JP Morgan’s (NYSE:JPM) quarterly “Guide to the Markets” always contains plenty of interesting information for stock-market participants. Released at the end of each quarter, the research document is packed full of interesting numbers and statistics on market themes and style performance. Here is a summary of some of the data contained in the September 30 report.

JP Morgan Guide To The Markets For Q4

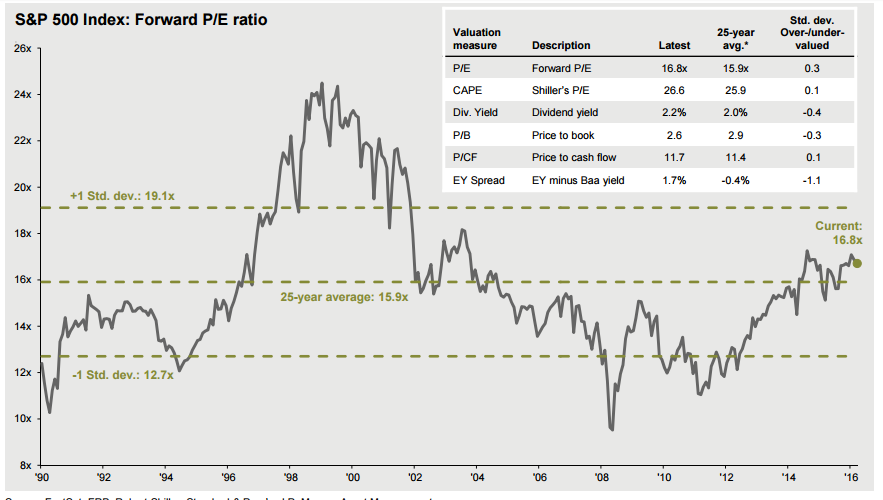

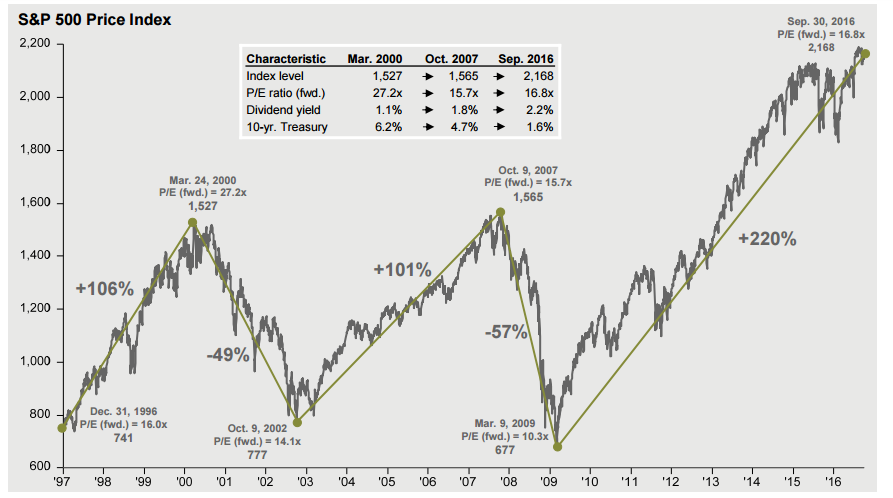

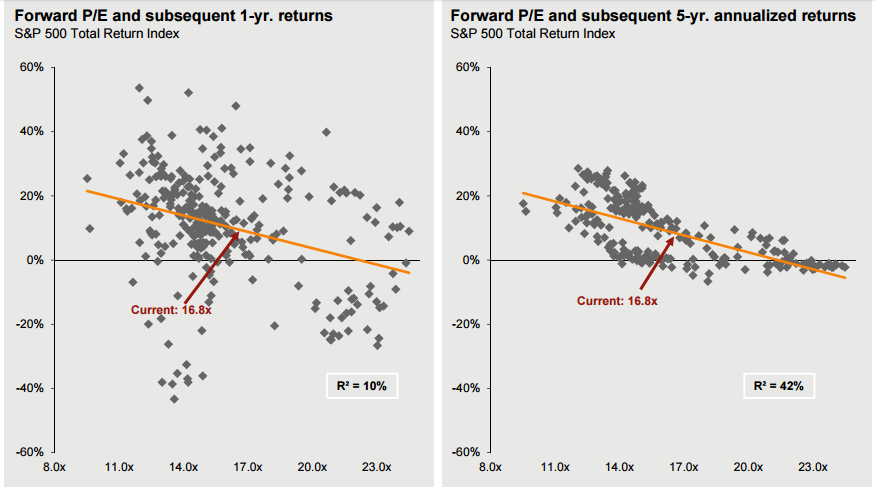

The leading chart of JP Morgan’s quarterly report is a breakdown of the current bull market. Between March 9, 2009 and the end of the third quarter of 2016, the S&P 500 has added 220%. From a low of 677 to a high of 2,168 the index has clocked the most impressive rally of the past two decades. Yet even after that rally, compared to the last two cycles the S&P 500 does not look to be overly expensive at current levels. Indeed, at the peak of the last bull market in October 2007 when the index traded at 1,565, the forward P/E ratio was 15.7 compared to today’s 16.8, although at the peak of the March 2000 bull market, the index was trading at a forward P/E of 27.2. The S&P 500’s current forward P/E ratio of 16.8 is overvalued by a standard deviation of 0.3 compared to the index’s 25-year average of 15.9.

Further, during both previous bull markets of the past two decades, the S&P 500’s average dividend yield ticked below 2% while today the index yields 2.2% -- an interesting phenomenon considering that today the 10-year Treasury rate is 1.6% compared to the March 2000 and October 2007 rates of 6.2% and 4.7%.

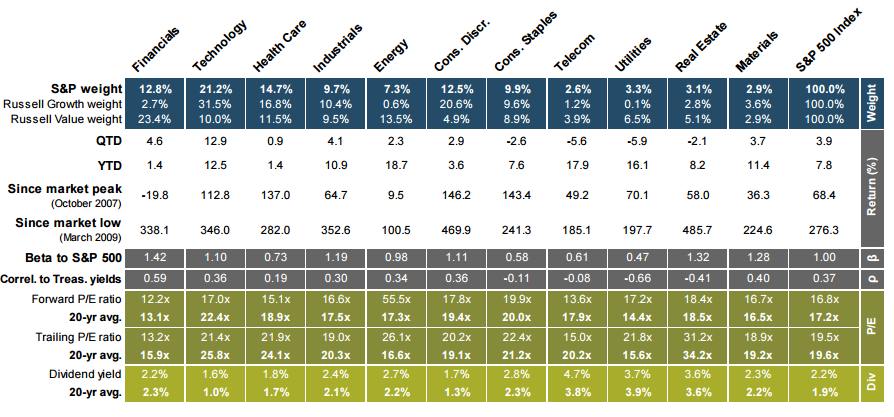

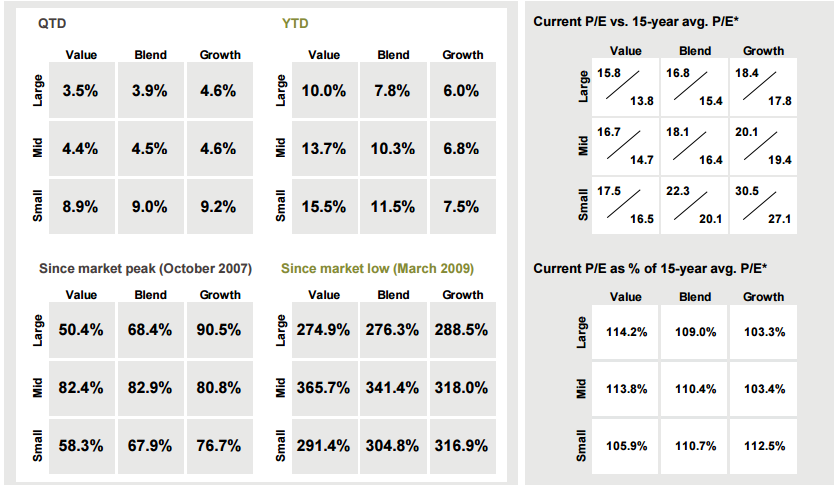

Value has seen a huge resurgence this year according to JP Morgan’s data. Year-to-date, small-cap value has returned 15.5%, mid-cap value has returned 13.7% and large-cap value has returned 10%. Meanwhile, small-cap growth has only returned 7.5%, mid-cap growth has returned 6.8% and large-cap growth has returned 6%.

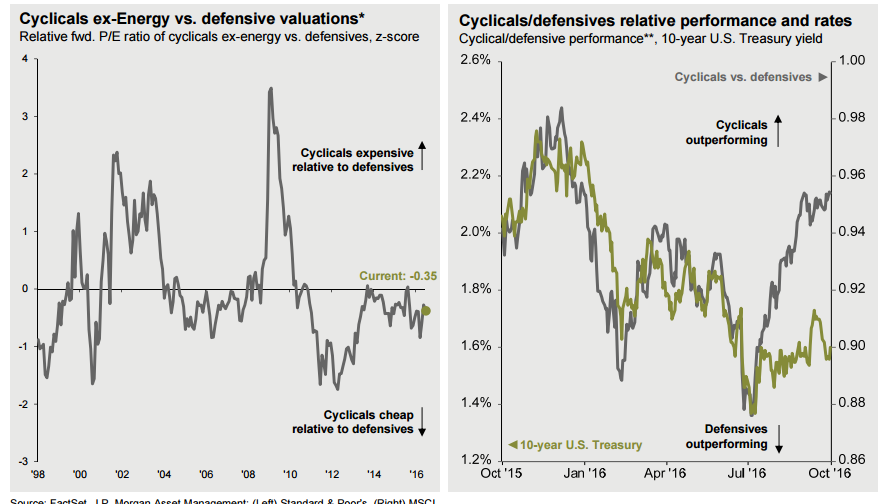

Cyclicals remain cheaper relative to defensives.

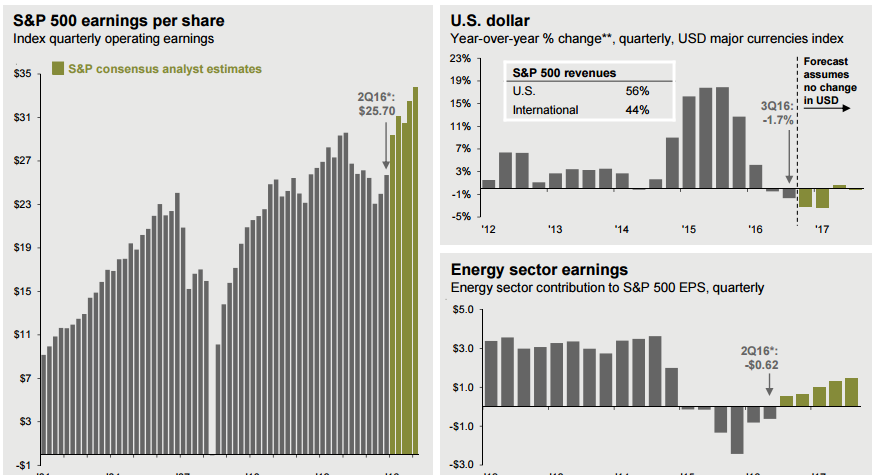

Quarterly Earnings: What To Expect

According to Wall Street consensus, S&P 500 quarterly earnings per share are expected to rise approximately 20% over the next few quarters.

And the market’s current valuations suggests steady returns going forward.