Parker-Hannifin Corporation’s (NYSE:PH) operating arm, Parker Aerospace, recently entered into a contract with Oxsensis Ltd to develop a sophisticated aerospace engine sensor technology. The solution will help to boost engine capability and performance.

The collaboration between these companies will develop static and dynamic pressure and temperature sensors for aerospace engine applications, supported by modern fiber optic sensor technologies. Both companies have extended their collaboration to apply the Oxsensis technology to Parker Aerospace instrumentation systems.

Over the past few years, the development of new technologies along with subsequent prototypes by both companies has been highly successful, having being built up on Parker’s system integration, engineering capability and aero-qualification, and Oxsensis optical sensor capabilities.

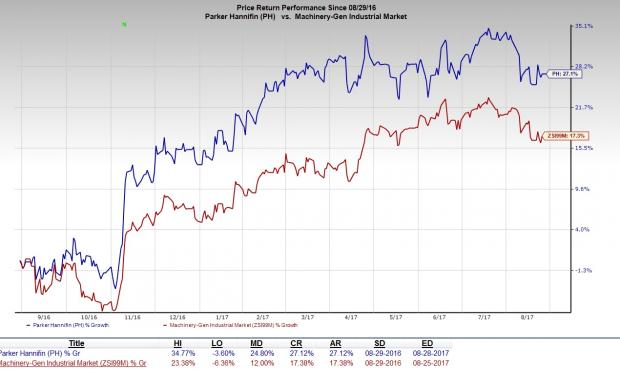

In one year, Parker-Hannifin’s shares have returned an admirable 27.1%, outperforming the industry’s average of 17.4%. Analysts have become increasingly bullish on the company over the past couple of months. Consequently, the Zacks Consensus Estimate for fiscal 2017 earnings has trended up from $8.90 to $9.05 in the last 60 days, thanks to nine upward estimate revisions versus none lower.

The Zacks Rank #3 (Hold) company benefits from its extensive distribution network, which has helped it in expanding the addressable market and reaching out to smaller OEMs. We believe that the company’s dominant foothold in the aftermarket business will boost its bottom line significantly in the upcoming quarters.

In addition, Parker-Hannifin remains bullish about its revamped “WIN Strategy,” which lays the detailed blueprint for long-term growth. The strategy will help it deliver an earnings per share compound annual growth rate of 8% and segment operating margins of 17%, over the next five years.

However, on the flip side, over the past few quarters, the company has been affected by an increase in prices for core materials like steel, aluminum, castings and nickel, among others. Such increase in prices can significantly weigh on the company’s profits and margins. The company also witnessed a substantial rise in the price of steel and aluminum of late and the trend is expected to continue.

Stocks to Consider

Some better-ranked stocks in the industry are Applied Industrial Technologies, Inc. (NYSE:AIT) , Barnes Group, Inc. (NYSE:B) and Sun Hydraulics Corporation (NASDAQ:SNHY) . While Sun Hydraulics sports a Zacks Rank #1 (Strong Buy), Applied Industrial Technologies and Barnes Group carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies came up with an average positive earnings surprise of 10.1% for the last four quarters, having beaten estimates every time over the last four quarters.

Barnes Group has an excellent earnings beat history, having surpassed estimates each time over the trailing four quarters. It has an average positive earnings surprise of 11.6%.

Sun Hydraulics came up with an average positive earnings surprise of 3.5% for the last four quarters, having beaten estimates twice in the last four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Original post