Street Calls of the Week

Stocks are currently the hottest topic in the news. Still correction or a bear market? Are we doomed or are we still good? What is this VIX anyway? Well, answering those: we are still good and you should not care about the VIX. Why are we still good? Most of the major indices, like for example SP500, DAX and FTSE, defended the crucial supports. Why VIX does not matter? Cause You cannot even trade it as a normal retail trader. What is more, focus on this one is just used as an excuse to explain that recent drop. No need to go deeper into that, quick look on the charts, and You can see that recent sell-off was predictable using just simple technical analysis (as we wrote on Investing last Monday!).

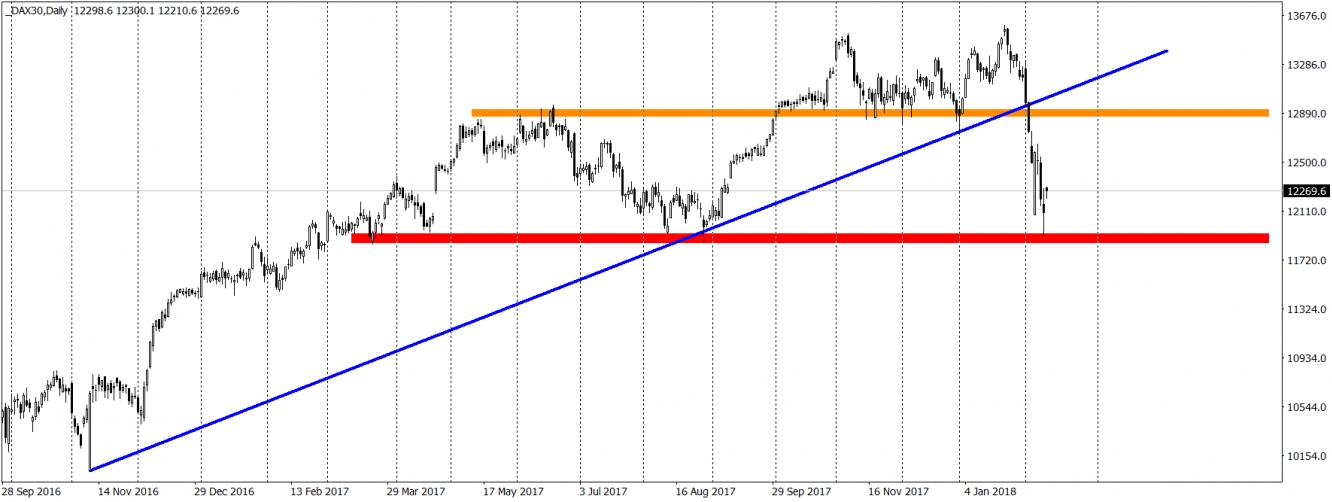

How is the DAX doing then? So far so good. Massive sell-off has been stopped, at least for now. Major indices are starting the new week on the front foot, all of them being above major supports. On Friday, Dax defended the area around the 11900 (red), which was a crucial support since the second half of March (confirmed later in August). Daily candle from Friday itself is not significant enough to create a strong buy signal though. It is a pin bar but hammer in this case would be much better. Monday begins higher, which opens a way for a short-term bullish correction. Positive approach stays here as long as we are above the red area. Price getting lower than that will be an invitation for a wild ride towards the bear market.

The target for the current correction is located on the old long-term support so the 12900 points area (orange). Chances that we will get there are relatively high.