Palo Alto Networks Inc. (NYSE:PANW) reported better-than-expected fourth-quarter fiscal 2017 results.

Palo Alto Networks reported adjusted earnings per share (excluding stock-based compensation, amortization and other one-time items) of 92 cents, surpassing the Zacks Consensus Estimate of 79 cents.

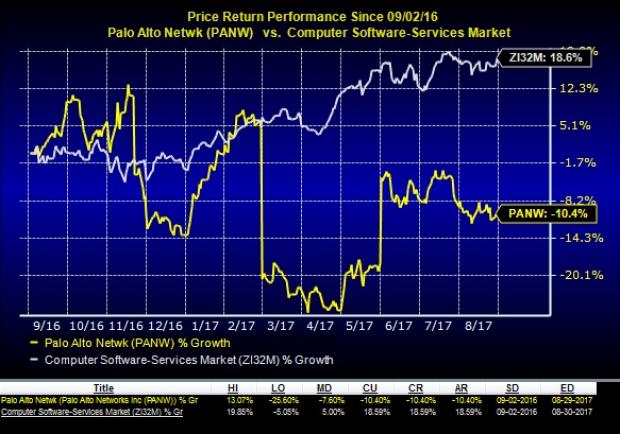

Despite strong results, the stock has declined around 10.4%, underperforming the industry’s gain of 18.6% in the last one year.

Quarter Details

Palo Alto Networks’ revenues of $509.1 million surged 27% year over year and outpaced the Zacks Consensus Estimate of $487 million. The quarterly revenues came above the guided range of $481-$491 million. The year-over-year increase was primarily due to new customer addition along with latest product launches. During the quarter, the company added around 3,000 new customers.

Product revenues increased 11.1% to $212.3 million. The company witnessed a 41.5% surge in subscription and support revenues ($296.8 million). SaaS-based subscription revenues climbed 46% from the year-ago period. Support revenues increased 37% year over year.

Billings jumped 17% year over year to $670.8 million during the quarter.

Geographically, on a year-over-year basis, revenues from the Americas increased 27%. The figures from Europe, the Middle East and Africa (EMEA) went up 28% while Asia-Pacific was up 27%.

Palo Alto Networks’ adjusted gross margin decreased 210 basis points (bps) on a year-over-year basis to 77.3% owing to higher cost of sales and launch of new products in the last quarter.

The company reported adjusted operating margins of 23.7% during the quarter. Adjusted operating expenses during the quarter were $273 million, or 53.6% of revenues. The company’s adjusted net income was $85.5 million compared with $60.3 million reported last year.

Palo Alto Networks exited the fourth quarter with cash, cash equivalents and short-term investments of approximately $1.375 billion compared with $1.372 billion in the previous quarter.

Receivables were $432.1 million compared with $364.1 million in the last quarter. Palo Alto Networks’ balance sheet does not have any long-term debt. The company reported cash flow from operations of $239.5 million during the quarter. Free cash flow came in at $190.3 million during the quarter. In the same period, the company repurchased 0.9 million shares worth $134.60 million.

Fiscal 2017 Highlights

For fiscal year 2017, total revenues increased 28% and came in at $1.8 billion. Total customer bases for fiscal 2017 grew to more than 42,500. Adjusted earnings per share came in at $2.71 per shares compared with $1.89 per share reported in fiscal year 2016.

Guidance

For first-quarter fiscal 2018, Palo Alto Networks expects revenues in a range of $482-$492 million, up 21-24% year over year. The Zacks Consensus Estimate is pegged at $485.3 million. Product revenue is expected to in the range of $170-$173 million, up 4-6%, while billings are projected to lie between the range of $580-$600 million, an increase of 12-16%. The company expects non-GAAP earnings per share within 67-69 cents. The Zacks Consensus Estimate is pegged at 69 cents.

For fiscal 2018, the company expects revenue to be in the range of $2.125-$2.165 billion, an increase of 21-23% year over year. The Zacks Consensus Estimate is pegged at $2.12 billion. Product revenue is expected to in the range of $735-$750 million, up 4-6%, while billings are projected to lie between the range of $2.64-$2.7 billion, an increase of 15-18%. The company expects non-GAAP earnings per share within $3.24-$3.34 (mid-point $3.29 per share). The Zacks Consensus Estimate is pegged at $3.25 per share.

Our Take

Palo Alto Networks allows firms, service providers and government bodies to impose tighter security measures through its network security platform. The company reported stellar fourth-quarter results and provided an encouraging first-quarter and fiscal 2018 outlook.

Revenue growth seems to be steady, aided by strength across all its geographical regions and business segments. Customer wins along with expansion of the company’s existing customer base are other positives. We believe that its product refreshes and acquisition synergies will boost revenues, going forward.

The company is keen on expanding cloud exposure. In line with this view, the company recently expanded ties with VMware, Inc. (NYSE:VMW) . Through the new collaboration, Palo Alto Networks will combine its security platform with VMware’s software platform, which provides private cloud-based service to make the cloud-computing environment more secure, simple, flexible, and efficient.

This deal will better equip organizations to handle private cloud technology and control business applications securely. As VMware remains one of the leading companies in the virtualization and cloud computing space, we believe Palo Alto Networks will gain significantly from this collaboration.

Nonetheless, a volatile spending environment and competition from Cisco Systems, Inc. (NASDAQ:CSCO) and Check Point Software Technologies Ltd. (NASDAQ:CHKP) remain concerns.

Currently, Palo Alto Networks carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

Check Point Software Technologies Ltd. (CHKP): Free Stock Analysis Report

Vmware, Inc. (VMW): Free Stock Analysis Report

Original post