To capitalize on the growing demand in Europe, Owens-Illinois, Inc. (NYSE:OI) plans to make a $60-million investment in a bid to expand its European glass operation. This is in sync with the company’s strategy to grow in premium segments while increasing capability and flexibility, as well as boost its environmental footprint.

Constellation Brands Inc (STZ): Free Stock Analysis Report

Owens-Illinois, Inc. (OI): Free Stock Analysis Report

iRobot Corporation (IRBT): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Original post

Owens-Illinois intends to build a new furnace at its Gironcourt, France plant. This expansion is slated to complete in early 2020, bringing the total furnace count at the plant to three.

Favorable European Markets A Key Catalyst

In 2018, the company’s revenues from Europe were $2.5 billion, up 5% year over year. It accounted for 37% of its total revenues. Segment operating profit for the region was $316 million in the year, a 20% year-over-year improvement. In fact, higher segment operating profit in Europe helped offset lower segment operating profit in the Americas and Asia Pacific.

The expansion at Gironcourt will mainly focus on the growing premium beer segment which is highly differentiated and uses unique bottle shapes to build strong, premium brand equity. Notably, Owens-Illinois has been outperforming the European beer market over the past five years, and this trend is expected to continue. In Europe, wine sales will be higher in 2019 due to the strong grape harvest in 2018.

Premium products in Europe are growing significantly faster than the overall market. Overall, the glass container market in Europe is healthy and continues to grow at about 1% per year. The company’s efforts to add capacity in Europe, supply-chain performance, focus on strengthening strategic relationships and footprint optimization poise it well for growing volumes and expanding margins in the region.

Continued Investment on Growth

This expansion-supporting organic growth comes on the heels of the company’s acquisition of nearly 50% interest in Empresas Comegua S.A. It is a leading manufacturer of glass containers, which operates two glass manufacturing facilities — one in Costa Rica and the other in Guatemala. Empresas caters to Owens-Illinois’ global strategic customers and various segments, including food, soft drinks, beer, spirits and pharmaceuticals. The buyout will help Owens-Illinois expand presence into new and growing glass markets in Central America, and boost its market presence in the Caribbean.

Other Growth Drivers

Owens-Illinois’ joint venture with Constellation Brands, Inc. (NYSE:STZ) has exceeded expectations so far — productivity has been higher than anticipated, capital costs were considerably lesser than initially expected and earnings have been growing every year. Continued focus on cost reduction will also aid results.

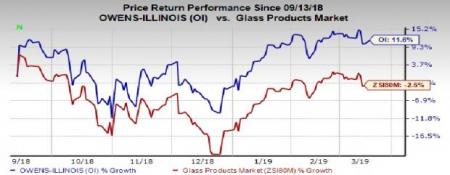

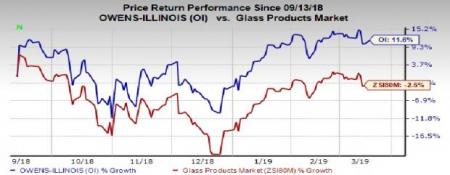

Shares of this Zacks Rank #3 (Hold) company have gained 11.6% over the past six months, against the industry’s decline of 2.5%.

Stocks to Consider

Some better-ranked stocks in the sector include iRobot Corporation (NASDAQ:IRBT) and Brady Corporation (NYSE:BRC) . While iRobot sports a Zacks Rank #1 (Strong Buy), Brady Corporation carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Brady has an estimated long-term earnings growth rate of 7.50%. The stock has gained 15% over the past six months.

Brady Corporation has an estimated long-term earnings growth rate of 20.50%. Its shares have gone up 4% in six months’ time.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

Constellation Brands Inc (STZ): Free Stock Analysis Report

Owens-Illinois, Inc. (OI): Free Stock Analysis Report

iRobot Corporation (IRBT): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Original post