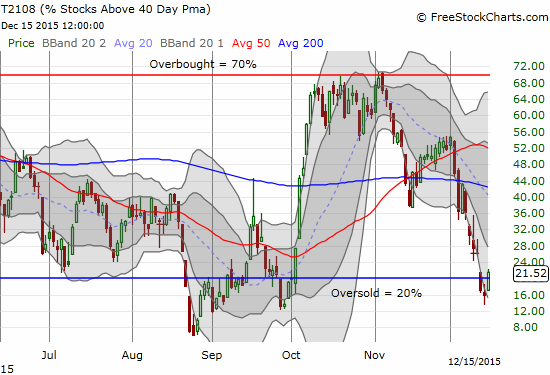

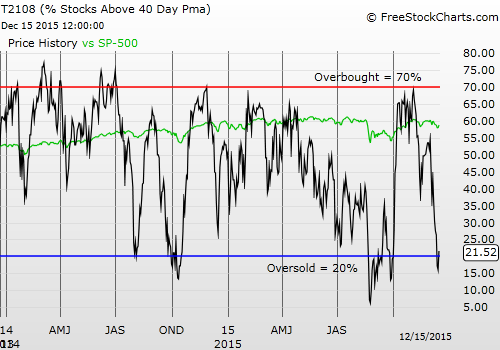

T2108 Status: 21.5% (ends 2 days at oversold)

T2107 Status: 24.7%

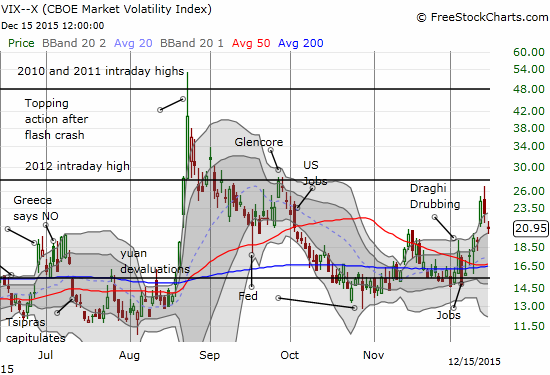

VIX Status: 21.0

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #1 over 20% (overperiod ended 2-day oversold period), Day #4 under 30%, Day #5 under 40%, Day #9 below 50%, Day #24 under 60%, Day #365 under 70%

Commentary

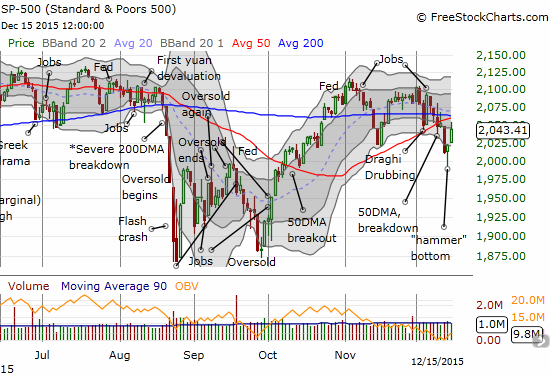

The market must have heard my complaining in the last T2108 Update about an unconvincing bounce. For today (December 15, 2015), the S&P 500 (N:SPY) delivered a strong upward push from BOTH the index and T2108 along with a plunge in the volatility index, the VIX. T2108 surged from 16.0 to 21.5%.

The S&P 500 (SPY) reverses all its losses from the oversold period with a 1.1% gain. The 50DMA holds as resistance as the index pulls back from its high of the day.

T2108 jumps out of oversold conditions but fails to reverse all its oversold losses.

The volatility index continues a sharp pre-Fed reversal and clings to a small gin from the oversold period.

Despite this strong showing, I remain wary. This bounce left some stragglers behind which keeps with the theme of of a market with exclusive participation. The S&P 500 managed to reverse all its losses from the oversold period, but T2108 fell well short. This means that there is a small group of stocks that lost so much during the oversold period, they were not able to ride enough of the market’s coattails to experience a recovery. The market exited oversold conditions with fewer stocks trading above their respective 40DMAs than when it entered.

The volatility index is also holding onto some of its gains from the oversold period. On top of all this, the S&P 500 pulled back from resistance at its 50-day moving average (DMA); in previous posts I expressed doubts that buyers could push through this resistance anytime soon.

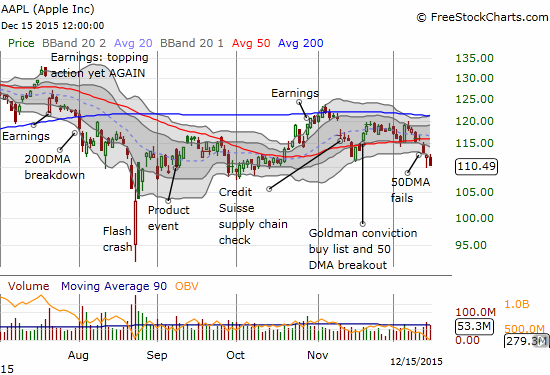

Apple (O:AAPL) is one of the more troubling laggards. I made a very wrong call expecting AAPL to fully participate in an oversold rally. AAPL experienced VERY poor relative performance with a decline of 1.8% on strong trading volume. This selling confirms a now very bearish breakdown from 50DMA support.

Someone forgot to let Apple (AAPL) know that the oversold period has ended. The selling confirmed the 50DMA breakdown.

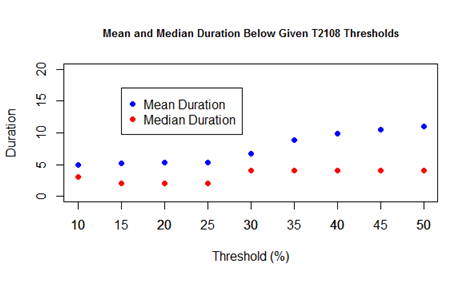

As a result of my skepticism, I used the rally to unload most of my trades from the oversold period and locked in profits. As a reminder, the typical oversold period lasts just one or two days. This brevity motivates me to trade oversold periods aggressively right from the start. As I mentioned earlier, I did not trade this oversold period as aggressively as is typical for me.

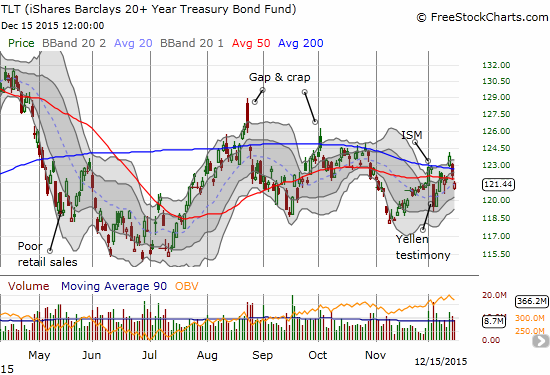

Mean and Median Duration Below Given T2108 Threshold

It helped that I did not want to expose these profits to the risk that the market reacts negatively to whatever the Fed has in store for us. In particular, I sold my call options on ProShares Ultra S&P500 (N:SSO). I kept my shares in ProShares Short VIX Short-Term Futures (N:SVXY) as a play on a post-Fed volatility implosion. I even sold my put options on iShares 20+ Year Treasury Bond (N:TLT) right after the open.

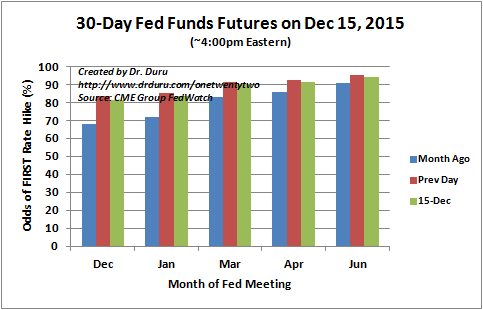

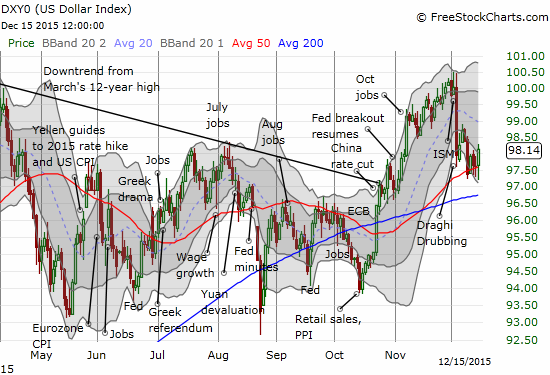

The Fed’s statement on monetary policy could completely alter the market’s technical position. Being able to react will be much more important than trying to predict both the Fed’s move and the market’s response(s). Here is a final look at the odds of a December rate hike, the dollar index's resulting positioning, and N:TLT showing that the market is still reluctant to sell off bonds just yet. It is as if the market is afraid that the Fed’s rate hike will initiate the kind of economic calamity that will force scared and panicked investors scrambling for the “safety” of U.S. government bonds.

The market ever so slightly drops the odds of a December rate hike the day before the Fed meeting. Still, at current levels, a rate hike is a near certainty.

The dollar index has comfortably churned above 50DMAA support for the past 5 trading days.

Interestingly, the market is not sending bond prices on a constant downtrend going into the Fed meeting.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

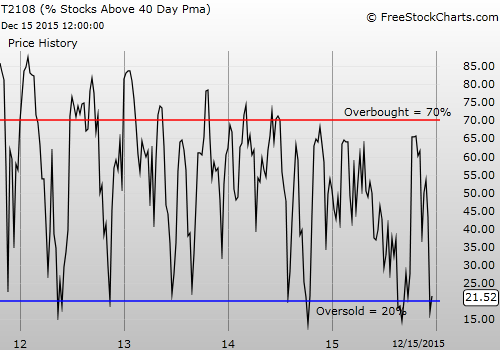

Weekly T2108

Be careful out there!

Full disclosure: long SVXY shares, long TLT call spread, long AAPL call options