Introduction

US stock markets have been increasing rapidly for some time, and with the S&P 500 price/earnings ratio now over 21, it is worth asking if there are other equity markets to consider for investments. As I have noted, trying to make money by picking stocks is almost always a losing proposition. So let's look at mutual and exchange-traded funds and identify attractive countries and regions.

What Countries?

I start by ruling out the Middle East and Europe. Despite progress against terrorists in the Middle East, the region remains extremely volatile. Europe is facing Brexit, problems in Spain and the yet-to-be resolved Greek crisis – a host of serious uncertainties.

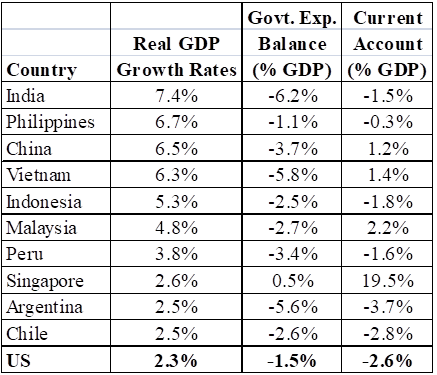

I next filtered out countries with low GDP growth rates. That left the countries listed in Table 2. The table also includes data on government surplus/deficits and current account balances. I eliminate India, Vietnam and Argentina for further consideration because of their large government deficits. Singapore and South Korea have surpluses. War worries reduce the attractiveness of South Korea. In this and following tables, I include the US as a reference point.

Source: IMF

Investment Vehicles

In what follows, ETFs and mutual funds are examined for countries and regions.

a. Country-Specific Exchange Traded Funds (ETFs)

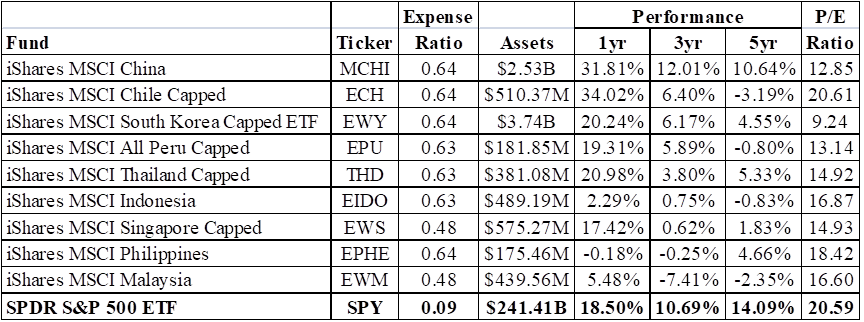

Table 2 provides data on ETFs for the nine countries remaining from Table 1 ranked by three year returns. I happen to use only iShare ETFs in this table for reasons of convenience. These ETFs closely reflect stock market performance in these countries. It appears that 2016 has been a very good year for most of the countries, and particularly China. 2016 has also been good for the US, as have the prior five years.

Source: Yahoo (NASDAQ:AABA) Finance

b. Regional ETFs

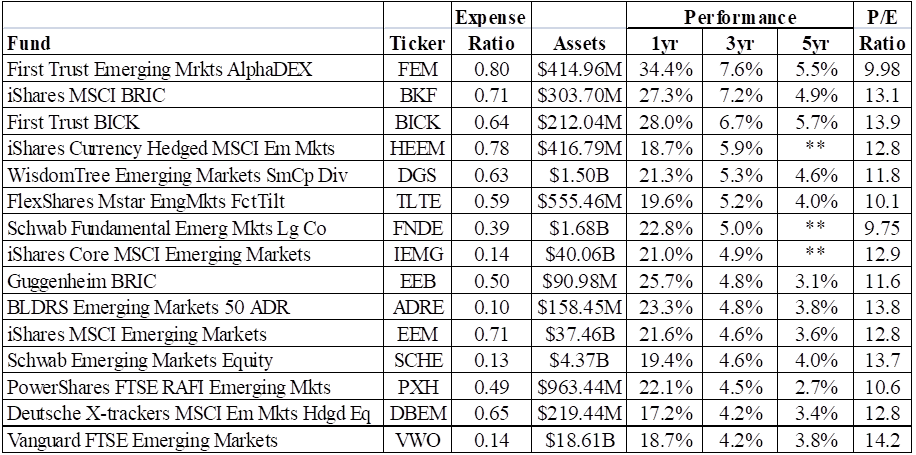

Most of the countries considered so far fall into the emerging market category. So Table 3 provides data on emerging market ETFs with three year returns greater than 4 percent. The results again reflect how good last year was for equity investments. And overall, these ETFs performed better than the country-specific ETFs listed in Table 2.

Sources: Yahoo Finance, ETF.com

Country And Emerging Market Mutual Funds

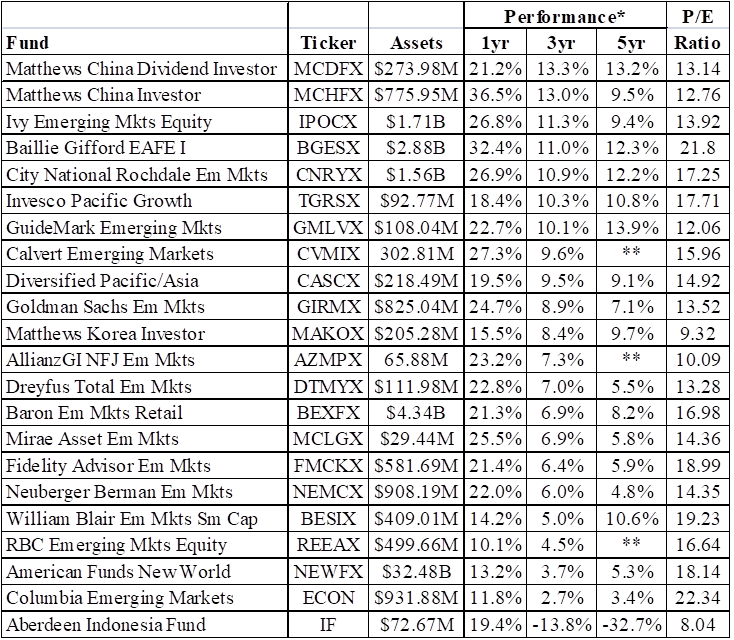

Table 4 combines some of the better performing country and emerging market mutual funds. Overall, their performance is better than the ETFs considered above. This is to be expected. Instead of reflecting indices, at least some of these mutual funds are actively managed. And when one focuses on a particular emerging-market’s stock exchange for a few years, you should start to see imperfections that can be capitalized on. Consider the two Matthews China funds. The manager of the Dividend Investor fund has been in place since 2012 and the China Investor has been its manager since 2010.

Sources: Yahoo Finance, Morningstar

* Load Adjusted

Conclusions

The US stock market is high, buoyed in part by hopes of a Trump tax cut. I view the odds of a meaningful tax stimulus occurring as less than 50%. In these circumstances, it is worth looking elsewhere for equity investments. The exercise above provides a starting point for finding alternate investments. And from it, I conclude mutual fund investments in China and other emerging-market countries should be considered.