Good morning, everyone. Welcome to Day Two of a week that is guaranteed to be action-packed. Hundreds of earnings reports, a Fed announcement with a press conference, a jobs report, Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN) and that’s just the scheduled stuff!

I must say, I am a bit surprised to wake up to green all over the screen, considering what a big deal the US/China trade talks are and how the Huawei indictment isn’t exactly great news for that process. Looking at the intraday data of the ES back to its lifetime high, we remain smack dab in the middle of no-man’s land. The bears have had the stuffing beaten out of them, and the bulls have kind of shot their wad. So we wait.

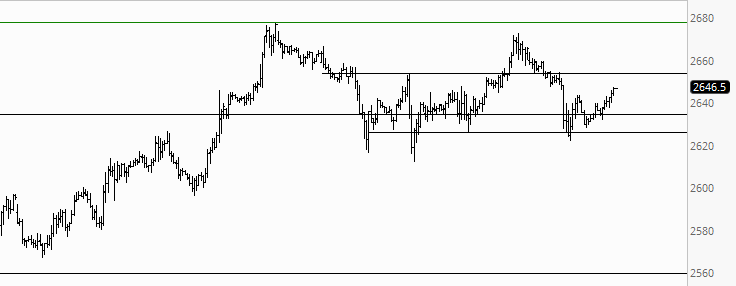

Looking closer, you can see the struggle going on. The 2626 level has been stubborn support, having repelled selling each time in the past few trading days. We’re in about a tight 54 point range, between 2626 and 2680. It’s going to take some big news to jolt us out of this quagmire (AAPL leaps to mind, but it could be anything).

Looking closer still, you can see how we’ve undone the NVIDIA (NASDAQ:NVDA) and Caterpillar (NYSE:CAT) damage from yesterday. We’re pretty much precisely where we were 24 hours ago. Thus, in this stalemate, I remain “participating but not aggressive” in my portfolio positioning. I have 45 short positions, all of them small, with a commitment level of about 148%. Give me some good strong breaks, and I’ll happily double that. Keep the market grinding higher, and I’ll beat a hasty retreat.