The VanEck Vectors Semiconductor (NYSE:SMH) is overdue for a short-term plunge, according to a historically reliable options indicator.

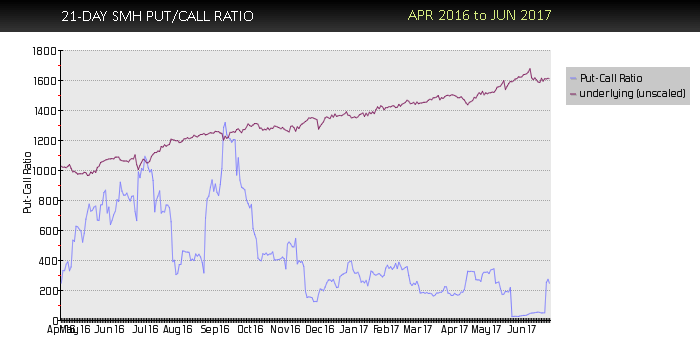

So say the options experts at McMillan Analysis Corp., who today published a note that their computer generated Put-Call Ratio Sell Signal has been visually confirmed by SMH’s chart (see below):

As you can see above, the put-call ratio recently plummeted to its yearly lows. In essence, this means that bullish options bets on a volume basis are dwarfing those on the bullish side more than at almost any point in history.

When the balance of bulls and bears skews too far in one direction like this, we tend to see a sharp turn the other way, and in SMH’s case, could mean a sharp pullback is coming in the short term.

Want to know more about put-call ratio? Here’s McMillan’s explanation:

Put-call ratios are useful, sentiment-based, indicators. The put-call ratio is simply the volume of all puts that traded on a given day divided by the volume of calls that traded on that day. The ratio can be calculated for an individual stock, index, or futures underlying contract, or can be aggregated – for example, we often refer to the equity-only put-call ratio, which is the sum of all equity put options divided by all equity call options on any given day. Once the ratios are calculated, a moving average is generally used to smooth them out. We prefer the 21-day moving average for that purpose, although it is certainly acceptable to use moving averages of other lengths.

Put-call ratio is by no means a foolproof indicator, but it is a historically reliable tool for traders to use to identify stocks and ETFs that are due for short-term corrections. It pays to closely monitor SMH’s share price over the next several sessions as a result.

The VanEck Vectors Semiconductor ETF was trading at $83.16 per share on Tuesday afternoon, down $2.18 (-2.55%). Year-to-date, SMH has gained 16.08%, versus a 8.17% rise in the benchmark S&P 500 index during the same period.

SMH currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #15 of 54 ETFs in the Technology Equities ETFs category.