Walt Disney Co (NYSE:DIS) is scheduled to report fiscal second-quarter earnings after the close tomorrow, May 9. The Dow stock has a history of relatively muted post-earnings price action, averaging a next-day move of just 2.2% over the past eight quarters. This time around, the options market is pricing in a bigger-than-usual swing of 6%, per Trade-Alert, and speculative players are positioning for a positive earnings reaction.

Over the past 10 days at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), options traders have bought to open 26,536 calls, compared to 8,278 puts. Plus, the resultant call/put volume ratio of 3.21 ranks in the 94th annual percentile, meaning long calls have been initiated over puts at a faster-than-usual clip.

The June 105 call has seen the biggest increase in open interest over this time frame, and data confirms a number of positions were bought to open. By targeting June options versus May options, the premium buyers may be hoping to take advantage of implied volatilities that aren't pricing in earnings expectations. Term structure data currently pegs implied volatility for weekly 5/11 Disney options at 48.99%, while monthly June implieds are 23.76%.

Today, though, the weekly 5/11 series is popular, accounting for five of Disney's 10 most active options. Buy-to-open activity is detected at the 103-strike call, in particular, and with a volume-weighted average price of $1.77, this makes breakeven for the call buyers at this Friday's close $104.77 (strike plus premium paid).

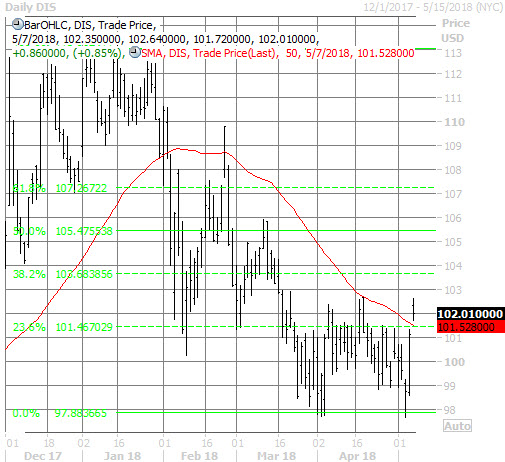

The last time DIS stock settled above this level on a weekly basis was late February -- when the shares got a lift from the success of "Black Panther." Since then, the security has lost 7.2%. Thanks to a record opening weekend for Disney's "Avengers: Infinity War," though, the equity bounced off recent lows near $98, and is now trading above the $101.50 mark -- a 23.6% Fibonacci retracement of its January through April retreat, and currently home to its 50-day moving average -- which had served as a speed bump since late March.