Investing.com’s stocks of the week

As Schaeffer's Senior V.P. of Research Todd Salamone pointed out in this week's Monday Morning Outlook, equity option buyers have soured on the market amid the latest post-rate-hike hangover for stocks. In reaction to the recent sell-off on Wall Street, "this group was buying equity put options relative to call options at a rate similar to that which marked the bottom of the February and March correction." With one options indicator that we track climbing to its highest level in over a year, we decided to take a look at what an influx of option bears could mean for the S&P 500 Index (SPX).

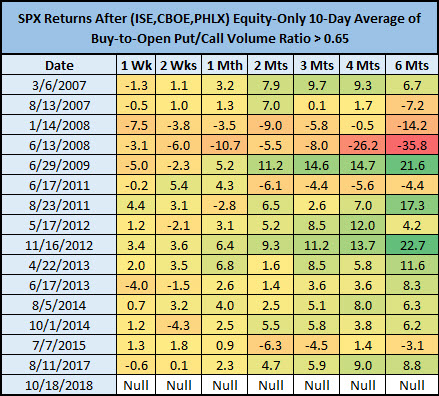

Specifically, the 10-day equity-only, buy-to-open put/call volume ratio on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) -- a real-time indicator for sentiment among options buyers -- topped 0.65 for the first time since August 2017. Prior to that, you'd have to go back to early July 2015 for a signal, looking at just one signal for every 30 days. Since 2007, this is just the 15th signal of its kind, per Schaeffer's Quantitative Analyst Chris Prybal.

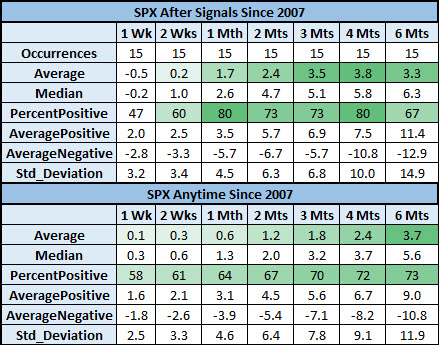

One week after previous signals, the S&P 500 has underperformed, averaging a loss of 0.5% and higher less than half the time. That's compared to an average anytime one-week gain of 0.1%, with a win rate of 58%, looking at SPX data since 2007. However, one month after signals, the index starts to outperform, averaging a gain of 1.7% and higher 80% of the time. That's nearly triple its average anytime one-month return of just 0.6%, with a positive rate of 64%.

In fact, the SPX's average post-signal returns two and three months out are also roughly double the norm, and the win rate of 73% is stronger than usual, too. Four months after a signal, the S&P was up 3.8% and was higher 80% of the time, compared to an average anytime return of 2.4% with a 72% win rate. Six months after signals, the index tends to be in line with the norm. It's worth noting, though, that the post-signal returns across the board would be even more bullish if not for the signals in late 2007 and 2008, when Wall Street was in the throes of the financial crisis.

While the S&P returns after extremes in equity put buying over call buying are encouraging, as Salamone cautioned, "extremes can become more extreme." As such, look for the 10-day equity-only, buy-to-open put/call volume ratio to roll over before calling a bottom for stocks. And in the meantime, consider playing this negative sentiment extreme by buying call options, which provide more leverage than buying stocks outright.