Skrill completion moves a step closer

Optimal Payments Plc (OTC:NVAFF) has raised proceeds of £452m from the rights issue. The Skrill acquisition is on track, with completion expected in early Q315, and we believe there is a strong likelihood of the stock joining the FTSE 250 later in Q3. On initial calculations, the combined group looks set to grow revenues to $800m and EBITDA margins to 30% by FY16 as cost synergies are realised. The stock is trading at a discount to peers based on our initial illustrative estimates for FY16.

Rights issue complete; acquisition on track

The rights issue is complete, with gross proceeds of £452m raised from the issue of 272.5m shares. The company continues to expect to complete the Skrill acquisition early in Q315, and immediately after this, will apply for a main market listing. We believe that if these events happen on schedule, Optimal will be eligible for entry into the FTSE 250 in September.

Combined group benefits from diversification and scale

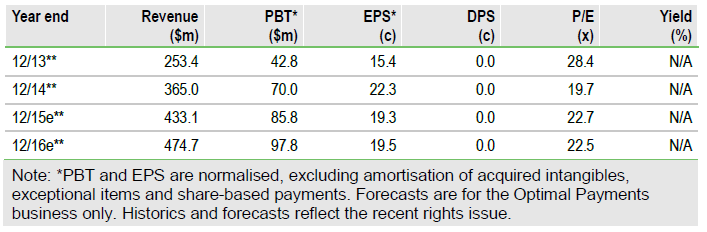

We have updated our published forecasts to reflect the completion of the rights issue and a change in the mix of revenues - estimates are for the Optimal Payments business only. We have produced illustrative estimates for the combined group that show that revenues could reach $800m by FY16 and EBITDA $244m (a 30.5% margin) once initial cost synergies are taken into account. The group will have a much lower dependence on Optimal’s largest customer and will have a more evenly balanced geographic exposure. While initial cost synergies are estimated at $40m, we would expect there to be further potential to reduce costs once the two companies have been integrated.

Valuation: Cost synergies drive value

The valuation metrics in the table above reflect only the Optimal Payments business. Based on our illustrative group estimates, Optimal is trading on an EV/EBITDA multiple of 15.9x FY15e and 9.3x FY16e. This is at a premium to peers in FY15 but drops to a discount in FY16 as the benefits of the initial cost synergies come through. On a P/E basis (19.3x FY15e, 12.5x FY16e), Optimal trades in line with peers in FY15e and at a material discount in FY16e. The combined business should be a strong cash generator, which should enable the company to pay down debt and consider further acquisitions.

To Read the Entire Report Please Click on the pdf File Below