- Technology sector rebounds

- Bitcoin heading towards all time high

- Gold climbs

Key Events

Contracts on the Dow, S&P, NASDAQ and Russell 2000 as well as global equities were all trading higher on Tuesday ahead of the Wall Street open, after Monday's tech rally saw the NASDAQ jump 0.84%. The move came amid optimism on corporate earnings which offset lingering pessimism over heightened inflation.

Treasuries fluctuated and the dollar declined.

Global Financial Affairs

Europe's STOXX 600 Index found its footing after yesterday's selloff, driven by a rally in the European technology sector which took its cue from yesterday's gains during the New York session. However, telecom equipment manufacturer Ericsson (ST:ERICb) dropped about 3%, though it has since recovered some of those losses, after the Swedish telecom infrastructure giant reported chip supply constraints which overshadowed an earnings beat.

As well, Swedish telecom operator Tele2 (ST:TEL2b) lost almost 5% of value, presumably on profit-taking after quarterly earnings met expectations.

Earlier, the same tech industry recovery helped Asian traders look past pessimism over China's slowing economy. Stocks in the region rebounded from yesterday's declines. Hong Kong's Hang Seng jumped 1.5%, outperforming Asian peers. On the other side of the performance spectrum, Australia's ASX 200 slipped into the red, as the metal & mining, resource and materials sector—which the country's economy is heavily dependent on—fell.

Rising bond yields have pressured Australian shares as investors feared the Reserve Bank would begin removing accommodation. However, rates dropped as investors shored up government bonds after the central bank said it remained committed to supporting monetary conditions to bolster the economy.

US Treasury yields on the 10-year note, which have been volatile recently due to patchy economic data, pared a decline while the dollar traded lower.

The USD drop follows a blown-out H&S top, which meets with the neckline of a massive double-bottom. That's why we consider this to be a momentary dip. We see it as part of a return move before the greenback makes new highs.

Gold moved higher, benefiting from the weaker dollar.

We now need to wait and see whether bulls or bears will win the upcoming battle between the smaller H&S bottom on the Daily Chart or the much larger H&S continuation pattern along with the downtrend line since the August record peak.

Bitcoin gave up an advance towards its all-time high, despite added hype around cryptocurrencies due to the impending start of trading later today of the first Bitcoin futures ETF, the ProShares Bitcoin Strategy Fund (BITO).

The digital token is developing a shooting star, which requires a close to be considered bearish. Also, the price broke free of its rising channel since the July bottom, suggesting a steeper climb toward the mid-April record.

Oil rebounded from a steep decline.

If prices return to session lows, they will complete an Evening Star.

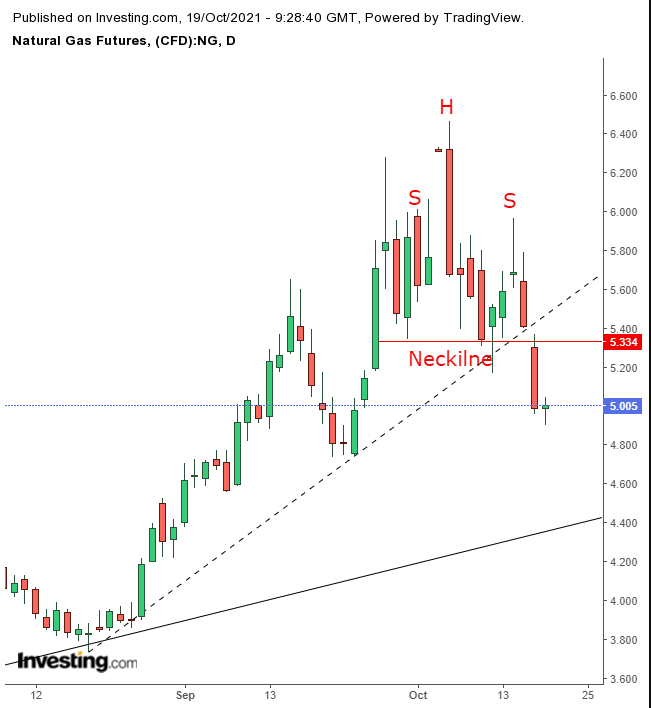

A natural gas shortage is spurring demand for products such as fuel oil and diesel for power generation.

The price completed a small H&S top.

Up Ahead

- The EIA crude oil inventory report is published on Wednesday

- On Wednesday, the Eurozone publishes CPI figures for September.

- US existing home sales numbers are released on Thursday.

Market Moves

Stocks

- The STOXX 600 rose 0.1% as of 8:42 a.m. London time

- Futures on the S&P 500 rose 0.2%

- Futures on the NASDAQ 100 rose 0.1%

- Futures on the Dow Jones Industrial Average rose 0.1%

- The MSCI Asia Pacific Index was little changed

- The MSCI Emerging Markets Index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.3% to $1.1647

- The Japanese yen rose 0.3% to 113.99 per dollar

- The offshore yuan rose 0.5% to 6.3970 per dollar

- The British pound rose 0.4% to $1.3778

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.58%

- Germany's 10-year yield was little changed at -0.15%

- Britain's 10-year yield fell two basis points to 1.12%

Commodities

- Brent crude rose 0.4% to $84.69 a barrel

- Spot gold rose 1% to $1,781.98 an ounce