Twenty-First Century Fox, Inc. (NASDAQ:FOXA) reported better-than-expected earnings for the fifth straight quarter, when it reported fourth-quarter fiscal 2017 results. The company’s adjusted earnings from continuing operations came in at 36 cents, beating the Zacks Consensus Estimate by a couple of cents. However, earnings declined 20% year over year as 7 cents of tax benefits were included in the prior-year adjusted earnings due to favorable tax ruling.

Including one-time items, earnings came in at 27 cents a share, compared with 30 cents reported in the prior-year quarter.

More importantly, the top line not only increased 1.5% year over year but also surpassed the Zacks Consensus Estimate after missing the same in the trailing two quarters. Revenues of $6,748 million came ahead of the consensus mark of $6,734 million on account of robust affiliate as well as advertising revenue at the Cable Network Programming segment, which mitigated lower content revenues at the Filmed Entertainment segment and dismal advertising revenues at the Television segment.

Following the results Twenty-first Century Fox’s shares inched up 1.5% in after-hours trading session on Aug 9. In the past one year, the stock has gained 6.7% compared with the industry’s increase of 2.9%.

Segment wise, Cable Network Programming revenues jumped 10.4% to $4,329 million on the back of robust affiliate revenues growth.

Filmed Entertainment revenues were down 11.5% to $1,803 million, while Television segment net revenues declined 3.7% to $1,003 million, both on a year-over-year basis.

The company’s total segment operating income before depreciation and amortization (OIBDA) came in at $1,450 million, flat year over year. Increase in OBIDA from Cable Network Programming was overshowed by decline in OIBDA from Television, Film Entertainment and Other, Corporate and Eliminations.

Detailed Discussion

OIBDA at Cable Network Programming climbed 19% to $1,441 million owing to 10% increase in revenues. The increase was partially offset by 7% increase in expenses on account of telecast of the International Cricket Council Champions Trophy in the reported quarter and also due to rise in programming and marketing costs at National Geographic.

OIBDA contribution from domestic rose 22% year over year due to increase in contribution form Fox News, the RSNs and FS1.

At the domestic cable channels, affiliate revenues grew 10% driven by sustained growth across FS1, FX Networks, Fox News Channel and RSNs. Domestic advertising revenues grew 6% year over year primarily due to higher ratings at Fox News.

OIBDA contribution from International cable channels were up 6% due to strong performance of FNG International. Affiliate revenues advanced 9% owing to increase in rates and subscribers. International advertising revenues rose 9% primarily due to high double digit advertising growth at STAR.

Filmed Entertainment’s OIBDA slumped to a loss of $22 million from $164 million contribution reported in the prior year-quarter due to decline in revenues at both film and studios.

Television segment’s OIBDA dipped 4.5% to $137 million on account of decline in segment’s revenues due to lower national and local advertising revenues. The segment expenses decreased 3% due to decrease in entertainment programming costs.

Other Financial Details

Twenty-First Century Fox, which shares space with The Walt Disney Company (NYSE:DIS) ended the quarter with cash and cash equivalents of $6,163 million. Total borrowings came in at $19,913 million and shareholders’ equity, excluding non-controlling interest of $1,216 million, was $15,722 million.

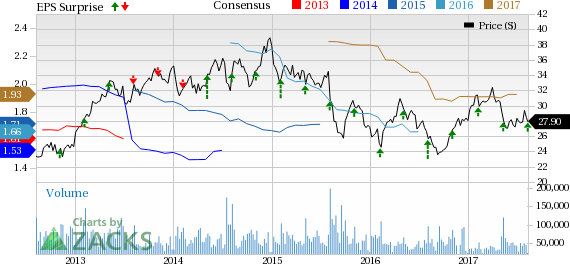

Twenty-First Century Fox, Inc. Price, Consensus and EPS Surprise

Other Developments

Rupert Murdoch’s Twenty-First Century Fox has made a “Possible Offer” to purchase remaining 61% stake in Europe’s leading pay-TV broadcaster Sky plc. The company already owns 39.1% stake in Sky. The buyout will strengthen its position in pay-TV network in Britain, Ireland, Austria, Germany and Italy. The deal has received go-ahead from European Commission.

As of 2016, Sky already has 21 million pay-TV subscribers and 30,000 employees. The deal will fortify Sky’s position in entertainment and sport, reinforce its adjusted earnings and free cash flow.

The acquisition has received clearance on public interest and plurality grounds in most of the markets in which Sky operates except the UK, including Austria, Germany, Italy and the Republic of Ireland.

However, if UK Secretary of State for Digital, Culture, Media and Sport refers the matter to the Competition and Markets Authority (CMA) then it may take around 24 weeks to complete the review process. Taking this in to consideration, the deal is expected to be sealed by Jun 30, 2018.

Zacks Rank & Other Stocks to Consider

Twenty-First Century Fox carries a Zacks Rank #3 (Hold). Some better-ranked stocks worth considering include Gray Television, Inc. (NYSE:GTN) and World Wrestling Entertainment, Inc. (NYSE:WWE) . Gray Television sports a Zacks Rank #1 (Strong Buy), while World Wrestling Entertainment carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

World Wrestling Entertainment has an impressive long-term earnings growth rate of 20%.

Gray Television shares have increased nearly 11% in the past three months.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Gray Television, Inc. (GTN): Free Stock Analysis Report

World Wrestling Entertainment, Inc. (WWE): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research