The S&P 500 is under modest pressure, and technology is to blame. Is the correction about to turn nasty from sideways? Still no signs of that, even as the investment-grade corporate bonds are being sold of as hard as long-term Treasuries. Yet, these corporate instruments have only now broken below their late October lows – unlike long-dated Treasuries, whose price action resembles a free-fall.

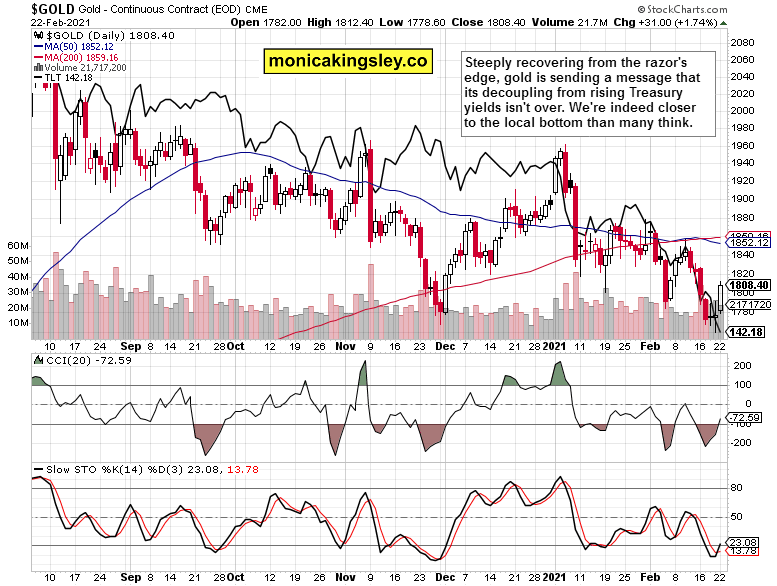

These government debt instruments are arguably the key asset class for every precious metals investor to watch. What used to be gentle decoupling signs over the latest weeks and months, got thoroughly tested last week. Yet, I stood firm in not calling gold down and out. The support zone at late November lows generated a rebound that was likely to materialize.

Silver naturally outperformed, both copper and oil had a strong day, and agri-foods are making new highs. The inflation dynamics described in Friday‘s article aptly called Why the Sky Is Not Falling in Precious Metals, continues unabated, and the pressure keeps building inside the metals and commodities.

Not even the U.S. dollar managed to benefit from the rising yields – the resumption of its bear market I called on Feb. 8, is one of the 2021 themes. Money keeps flowing from the Treasuries market, and there is plenty sitting on the sidelines (corporate and private) to still deploy and power stocks and precious metals higher. Also, those ready to withstand Bitcoin volatility stand to benefit – cryptos are behaving like a store of value, a hedge against currency debasement. I wrote in my very first 2021 analysis that the Bitcoin correction wouldn‘t get far.

Powell‘s testimony is about to bring volatility, but does it have the power to change underlying trends? Not really – while his latest high-profile assessments brought about a downswing, stocks recovered in spite of the GameStop (NYSE:GME) (contagion?) drama too. Should we see a replay of the above, new highs are coming – and they are, in both stocks and precious metals. We're in a commodities supercycle on top!

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

Gold, Silver And Treasuries

Gold price action indeed proved not to be as bearish. Finally, we're seeing a clear refusal to move down even as Treasury yields continue to plunge. How long will this new dynamics stick, where would it take the yellow metal? I treat it as a valuable first swallow.

The scissors between gold and silver keep widening, and the white metal again outperformed yesterday. That's exactly the dynamics of the new precious metals upleg that I'm expecting.

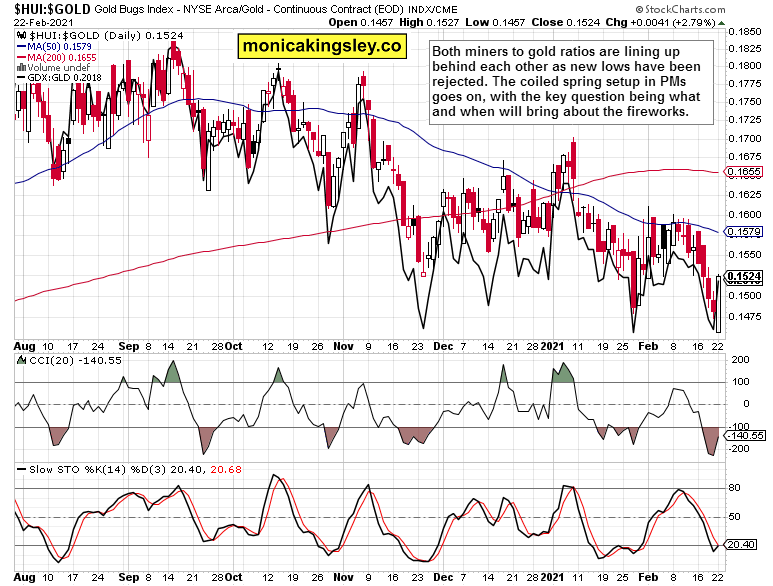

Both depicted miners to gold ratios show a clear pattern of post Nov resilience. GDX (NYSE:GDX):GLD (NYSE:GLD) is not breaking to new lows, while $HUI:$GOLD rejected them. Bobbing around, searching for a local bottom before launching higher? That‘s my leading scenario.

Summary

Gold and silver price action remain encouraging, and the same can be said about oil and many other commodities. Once the stimulus bill is passed, the positive fundamentals that are going to turn even more so, given the Fed‘s accommodative policies. Will these work to stave off the rising Treasury yields as well? If so, then gold‘s fundamentals got a crucial boost, which would soon be seen in the technicals too. As I wrote yesterday, the metals didn‘t get a knock-out blow – the medium- and long-term outlooks remain bright, and too many market players on the short side in the short run, means a high likelihood of a reversal – which is precisely what we saw.