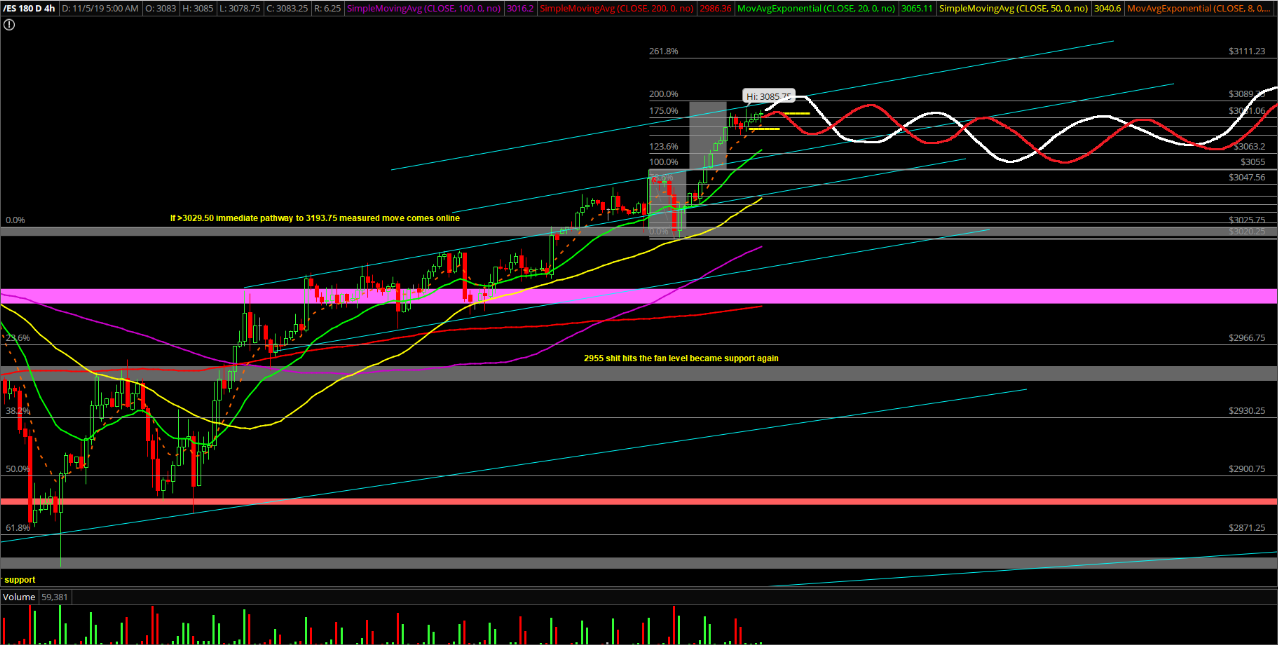

After Sunday night's grind up, Monday’s regular trading hours session was just a very tight consolidation overall range of 3083-3072.5 on the S&P 500, trapping and baiting traders as it gets ready for the next move. Price action could not gather enough strength yet to break above the 3085 key level and force a mini squeeze towards the 3100 major short-term level.

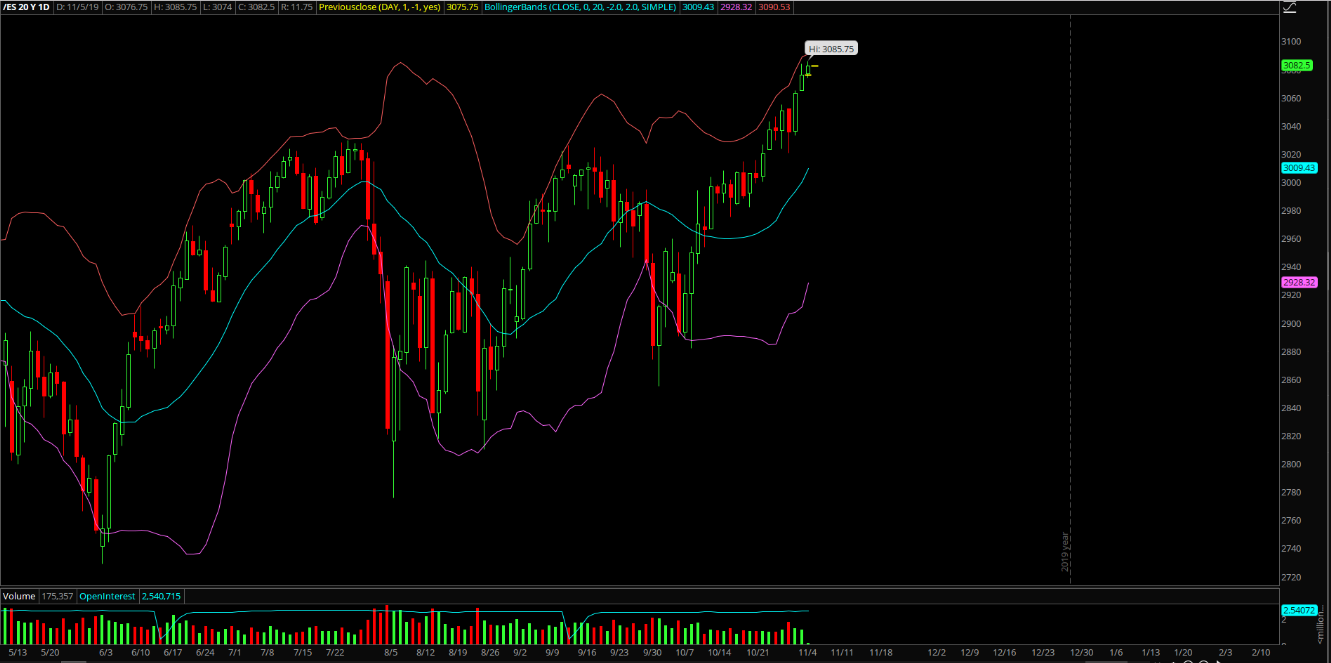

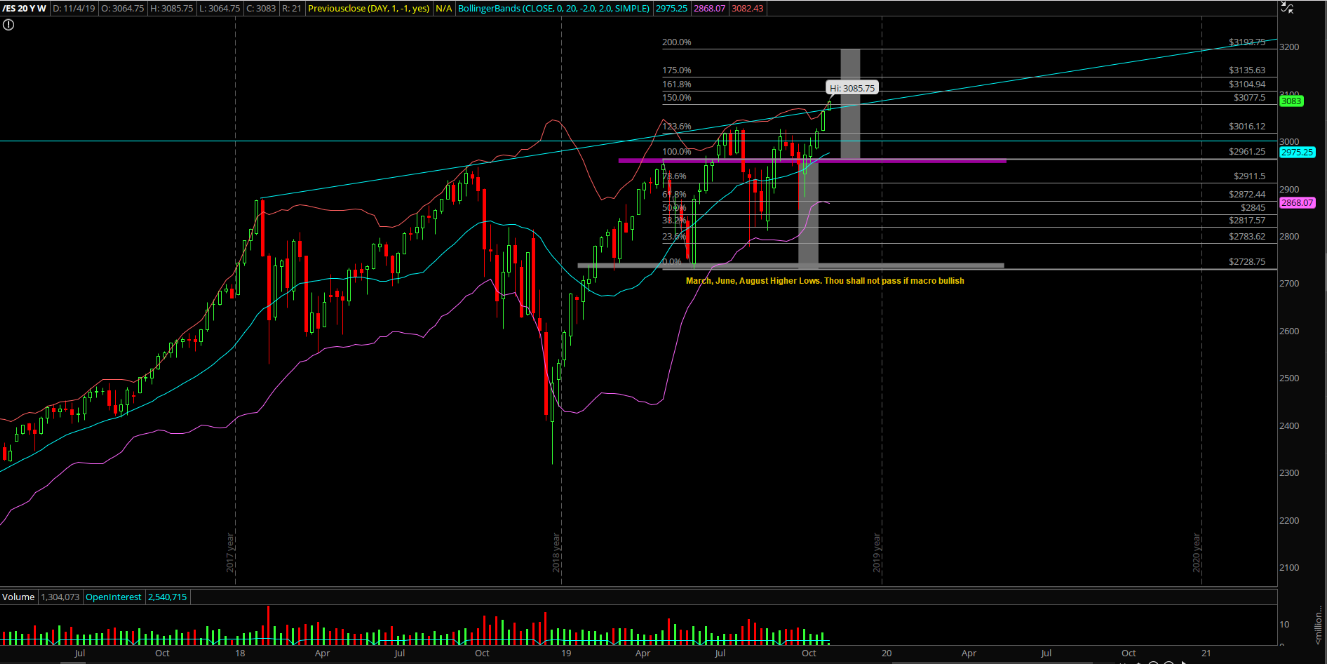

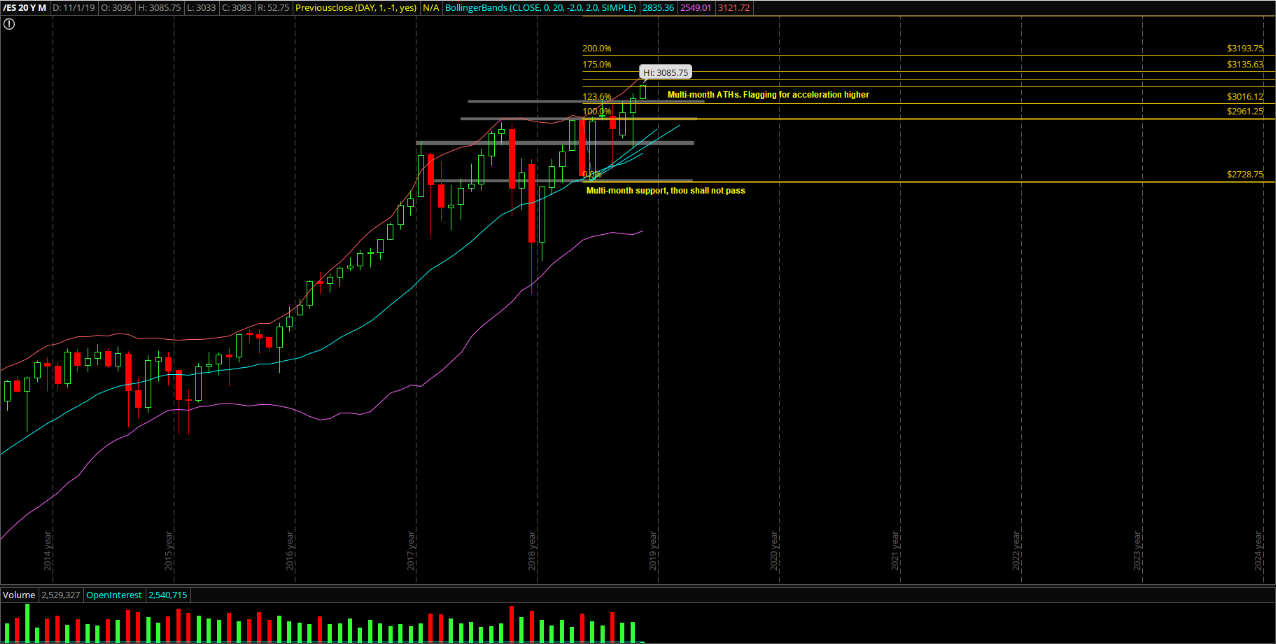

The main takeaway from this session is that the market is still showcasing the ongoing acceleration phase from last week’s breakout above 3029.5 (prior ATHs). However, the market is battling against the 3085/3100 resistance zone, and based on the current odds showcasing another temporary top setup before ramping higher. If it does not, then it opens up a rare scenario where 3193.75 target could be reached directly with a vertical squeeze to erase all doubts/odds. Know your timeframes because ultimately a temporary top/consolidation setup allows the market to backtest significant trending supports in order to reset the internals and ramp higher at a later date.

What’s Next?

Monday closed at 3075.75 on the Emini S&P 500 and nothing significant has changed from Sunday night's report. Our key points:

- Immediate trending supports have moved up to 3072 and 3065. All micro dips are considered buyable when above 3055 depending on your timeframes, but the risk exposure has increased greatly as price action battles against 3085/3100.

- Short-term, if below 3030 decisively would confirm more consolidation ahead and price may be just stabilizing before another attempt to ramp up higher (see daily 20EMA playing catch up).