I wanted to do dissect the expected S&P 500 2019 earnings and make the case for Financials from a fresh perspective.

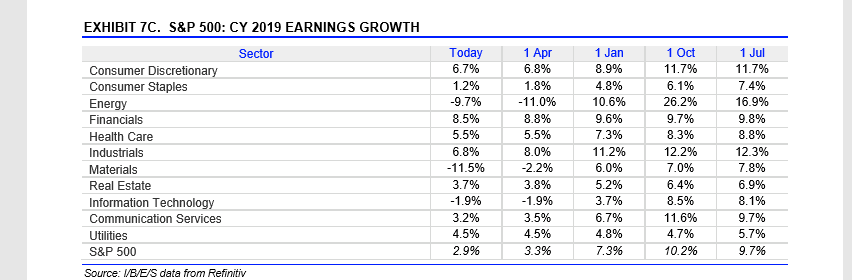

The I/B/E/S table by Refinitiv is from This Week in Earnings. It shows that of the 11 S&P 500 sectors, Financial’s are expected to show the strongest EPS growth this year.

Could that change this week with a number of Financials reporting? It could, but after Friday’s results, it’s not expected to change.

Let's dissect the data a bit further: which sectors had the biggest percentage declines in earnings estimates from October 1 ’18 or the point when the correction started?

- Cons Disc: fell 500 bp’s or 43%% from Oct 1;

- Cons Spls: fell 490 bp’s or 80% from Oct 1;

- Energy: fell 3590 bp’s (wow!) to -9.7% from +26% – the buyout of APC will put a bid under parts of Energy;

- Financials: fell 120 bp’s or 1.2% for a 12% decline in 6 months;

- Health Care: fell 280 bp’s or 2.8% for a 33% drop. Health Care always follows this pattern – actual sector growth should end up near 10%;

- Industrials: fell 540 bp’s or 5.4% for a 44% drop;

- Basic Materials: fell 1850 bp’s or 18.5% to – like Energy huge drop from big positive to big negative;

- Real Estate: fell 270 bp’s or 42%;

- Technology: fell 1040 bp’s or 10.4% from 8.5% to -1.6%;

- Communication Services: fell 840 bp’s or 8.4%;

- Utilities: fell just 20 bp’s from 4.7% to 4.5% or just 4%;

- SP 500: fell 730 bp’s or 7.3% from 10.2% to 2.9%;

(Source: IBES by Refinitiv, page 19 of This Week in Earnings. Calculations are my own)

Moral of the Story?

Financials show that the Street is expecting not only the highest rate of absolute earnings growth heading into the bulk of Q1 ’19 earnings, but that of all the sectors – except Utilities – Financials have shown the least degradation of expected earnings growth of all the S&P 500 sectors.

In other words, the expected 8.5% growth rate for Financials has held up despite heavy negative revisions for the rest of the S&P 500.

Have S&P 500 earnings been revised too low? Are Wall Street's expectations too negative? I do believe that’s the case, but that is one opinion.

Take all forecasts and opinions with a healthy dose of skepticism.

The numbers show that there is a good case for being overweight Financials in 2019. To be fair to readers, I've been overweight in the sector for several years. Too many positives for the sector, not the least of which is a bull market in stocks and credit this year, but the valuations are reasonable and the sentiment is poor.