I recently wrote a piece discussing a super inexpensive way to play for a huge move in silver (in either direction) over the next year or so (I also highlighted the fact that it was super inexpensive because it was something of a long shot). This piece is very similar except that the play is much shorter-term in nature.

Gold Miners

As I intimated in the silver article, I grow a little weary of all the “hype” surrounding gold, gold stocks, precious metals, and so on and so forth. The bottom line is that:

a) There is a time to be in metals and/or miners

b) There is a time to NOT be in metals and/or miners

c) Like anything else, its often hard tell which time is which

d) But there is ALWAYS a loud contingent shouting “Now is the time to be in metals and/or miners!”

So, a few key points before we get to, eh, the point:

*I am not claiming A or B above – consider me agnostic. But please DO NOT consider me part of D above.

So, what’s the point? The point is that there is absolutely nothing wrong with making small plays in speculative situations.

Remember this:

*If you never get into a situation where you can make a lot of money (relatively) fast, then you will never make a lot of money relatively fast.

*HOWEVER, at the same time you MUST avoid the temptation to make this your primary form of investment. Bottom line: invest wisely with the bulk of your capital, but don’t be afraid to “take a shot” with a small amount of your capital if you think an opportunity exists.

If You Think an Opportunity Exists in Gold Miners….

So again, I am not telling you that I think gold miners are going to rally and that I think you should take action. What I am saying is that if you think gold miners are going to rally there are ways to profit handsomely. To wit:

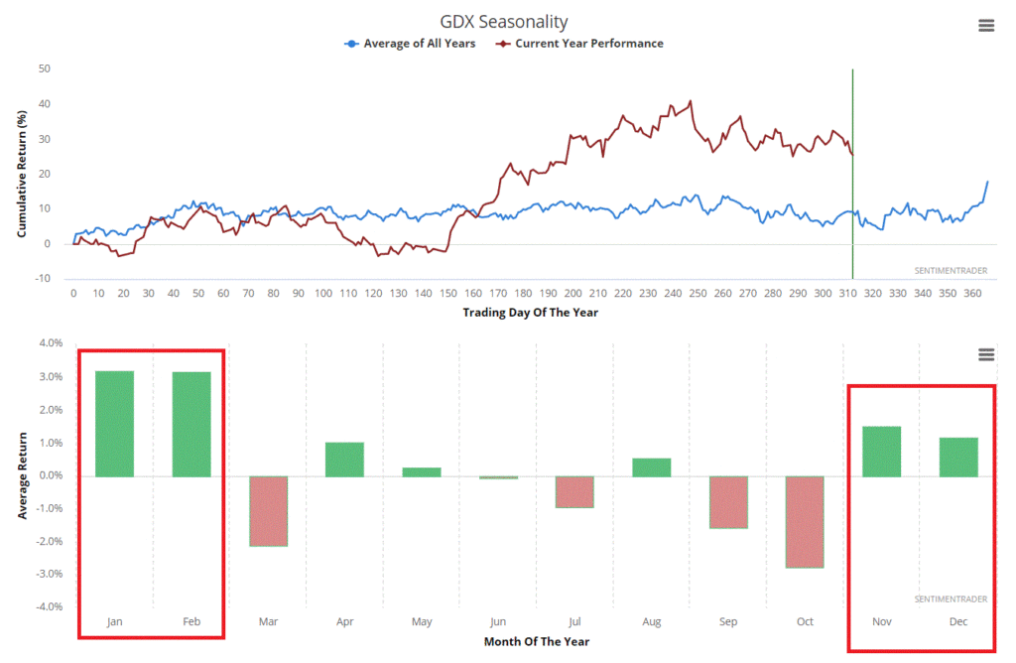

Figure 1 – VanEck Vectors Gold Miners ETF (NYSE:GDX) entering a potentially favorable seasonal period (Courtesy Sentimentrader.com)

Figure 1 displays the annual seasonal trend for ticker GDX (NYSE:GDX) as calculated by Sentimentrader.com. Note that Nov-Feb tends to be a bullish period.

Figure 2 displays the Elliott Wave count for ticker GDX (NYSE:GDX) as calculated by ProfitSource by HUBB software.

Figure 2 – GDX (NYSE:GDX) with potentially bullish Elliott Wave count forming (Courtesy ProfitSource by HUBB)

Does the fact that GDX (NYSE:GDX) is in a favorable seasonal period AND has a potentially bullish Elliott Wave count forming guarantee that GDX is headed higher between now and sometime early next year? Not at all.

In fact if GDX (NYSE:GDX) drops much below $26 a share chances are the Elliott Wave count will fall apart.

But here is the point: If you are going to bet on miner stocks, this information “suggests” that that may be the way to bet.

The Play

There are a lot of ways to play. The most straightforward is simply to buy shares of GLD (NYSE:GLD). 100 shares as I wrote would cost $2,623. However, I am going to highlight an alternative. It involves:

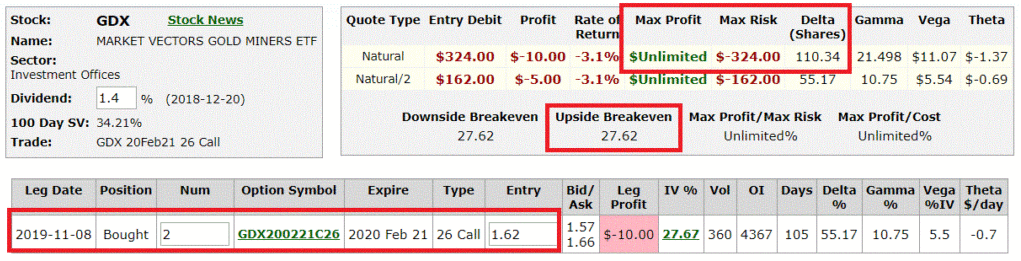

*Buying 2 GDX2020 26 calls @ $1.62

As you can see in Figure 3, this position costs $324 to enter (which is also the maximum risk on the position.

It also has a “delta” of 110 – this means that it will behave like a position of holding 110 shares of GDX (NYSE:GDX), i.e., the profit or loss in dollars will be similar to holding 100 shares of GDX, but at a cost of only $324.

Figure 3 – GDX (NYSE:GDX) Jan26 calls (Courtesy OptionsAnalysis.com)

Figure 4 – GDX (NYSE:GDX) 26 calls risk curves (Courtesy OptionsAnalysis.com)

As you can see in Figure 4, the equation is pretty simple:

*If GDX (NYSE:GDX) does in fact rise in price then this position can make a large percentage return

*If GDX (NYSE:GDX) does NOT rise in price the trader could easily lose the full $324 spent to enter the trade.

From a “positions management” point of view the key questions for a trader are:

*Will you cut bait if recent support is broken – or will you just size the position so as to risk the full $324?

*If price does go up will you “let it ride” until GDX (NYSE:GDX) hits the 1st target of $32.58? Or will you consider adjusting or selling half if GDX pops up in the short run?

Also remember that “speculation” is a different game mentally than “investing.” Investing takes a longer-term mindset, speculation deals with the “here and now”. To wit, this trade could completely fall apart between the time I click “Publish” and the time you read this post. All GDX (NYSE:GDX) has to do is keep heading south as it has been doing pretty much non stop since the 1st week of September.

The lesson here is this: A speculator needs to be able to absorb a loss – mentally and financially – and not let it affect his or her thinking on the next opportunity (HINT: This is much easier said than done).

Summary

Is buying a call option on a gold miner stock index a good idea or a bad idea? That’s not for me to say.

But it’s one idea.