If ES Actually Completes and Breaks Out Downwards From the Red Triangle, the Price Could Run a Long Long Way

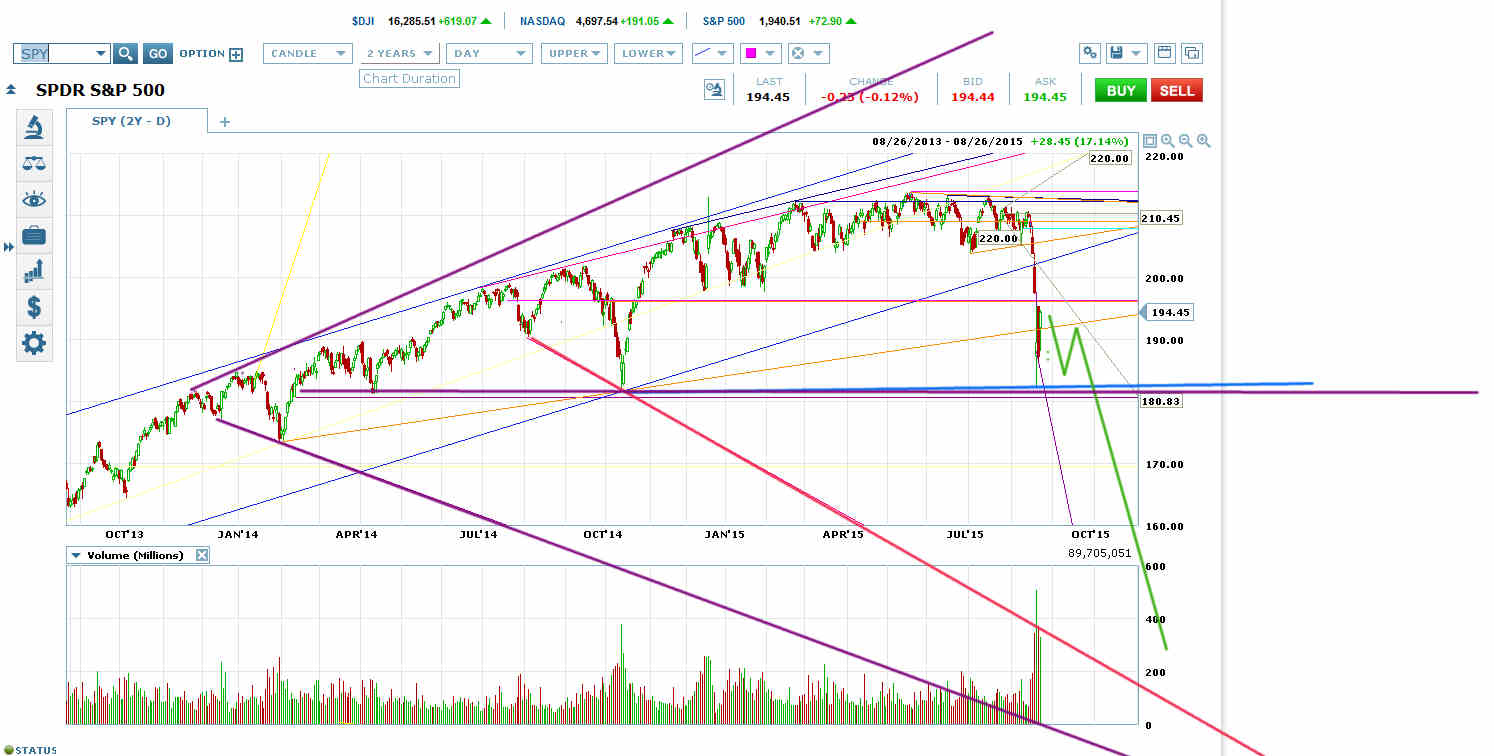

ES is starting to look like it’s serious about the potential triangle it’s forming (red on chart).

That’s dangerous because this triangle is in the right shoulder position of an enormous head and shoulders. A downward breakout from the triangle would imply that the H&S is breaking out as well.

The target of a breakout through the H&S neckline would be the bottoms of the red and purple megaphones on the chart below.

SPDR S&P 500 (NYSE:SPY)

An H&S Breakout would Target the Red and Purple Megaphone Bottoms

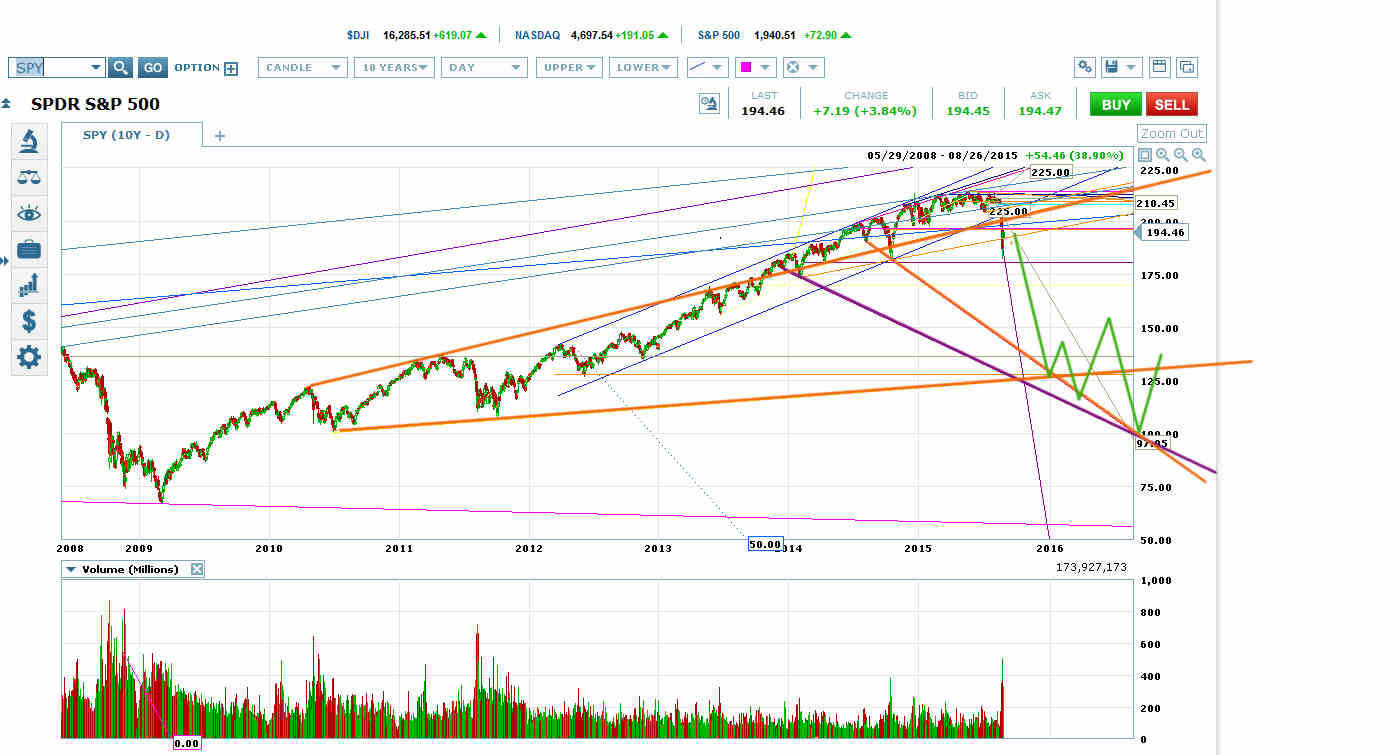

And the move to the megaphone bottoms would be a 5th wave collapse.

There is a confluence of the megaphone bottoms with the bottom of a long-term rising megaphone formation (orange on chart below) at roughly ES 1250.

Target would be the Confluence Area of the Purple, Red and Orange Megaphone Bottoms

Today’s new gray megaphone formed across VWAP of some larger megaphones down here near the Monday low. The gray megaphone frees up ES to collapse out of all these megaphones without the usual required VWAP retrace.

The red triangle could still break out upwards, but a breakout downwards at this point would definitely be a set-up to short, especially after this prolonged topping action and a multi-year Sornette bubble.