Jeremy Grantham is chairman of the board for the well-known asset management firm, Grantham, Mayo, & van Otterloo (GMO). Yet he is much more than that. He is also an accomplished “bubble-ologist.”

In a recent interview, Grantham said:

“Bubbles are unbelievably easy to see. Knowing when the bust will come is trickier.”

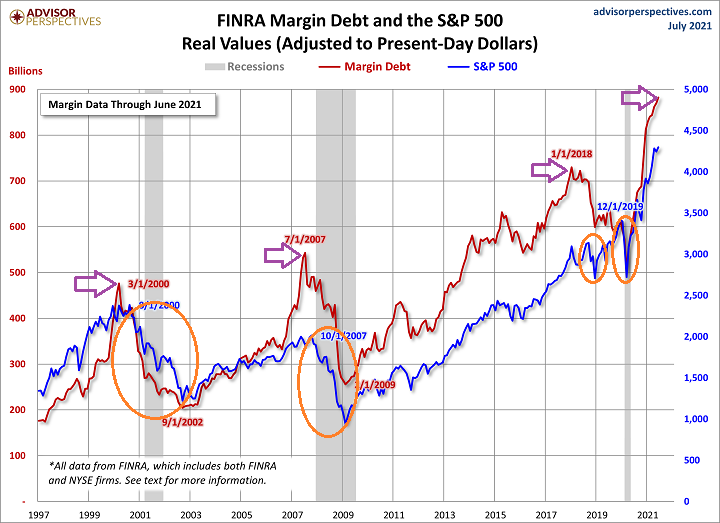

For instance, long periods of unbridled success tend to breed unchecked speculation. More and more investors engage in borrowing to leverage prospective gains with stock loans and leveraged instruments.

Historically, however, margin debt peaks often occur shortly before stock bubbles burst. Will this time be different?

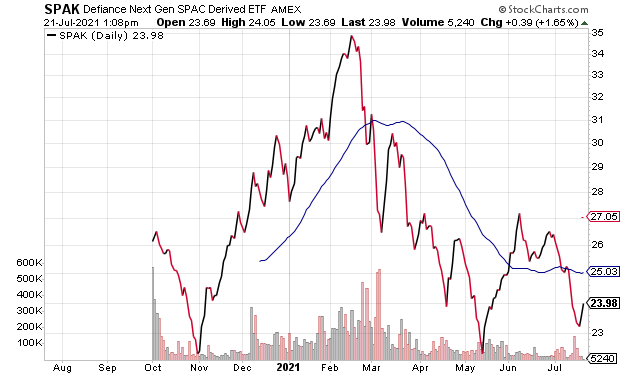

Many contend that the Federal Reserve has engaged in unique polices that will prevent potential bubbles from bursting. Ironically, these same folks do not deny that bubbles have cropped up in everything from special purpose acquisition companies (SPACs) to meme stocks to crypto.

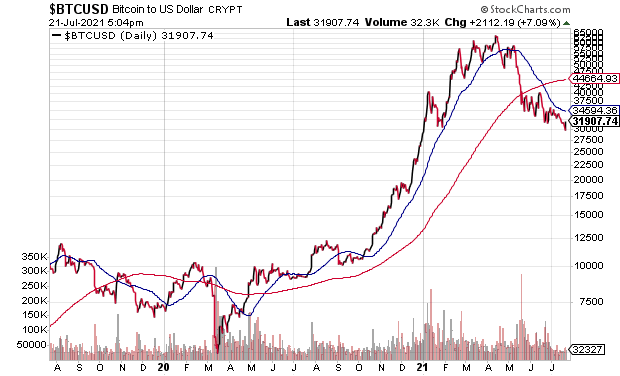

Some bubbles may have popped already. Bitcoin is down 50% from its peak. Meanwhile, SPACs (via SPAK) have also been demolished in recent months.

Nevertheless, it appears that the investment community at large believes that the Federal Reserve can contain any carnage from spreading to the broader marketplace. Of course, that may prove to be a dangerous belief system.

For one thing, the Fed’s endless quantitative easing (QE) is not a panacea for propping up asset prices. What QE does is replace low interest Treasury securities with zero-interest cash. In doing so, those who have zero-percent yielding cash feel compelled to earn something more than nothing on the money.

However, the compulsion will only exist for as long as investors are willing to pursue riskier securities. If investors shift from a speculative need to chase extremely overvalued assets to a preservation preference, zero-interest cash would become “king.”

It does not take much for snowballs to roll down a hill, pick up speed, and bring on an avalanche. Nobody wants to see their capital get eviscerated.

Actually, zero-interest cash has another purpose. One can acquire assets on the cheap when everyone else is licking their wounds.

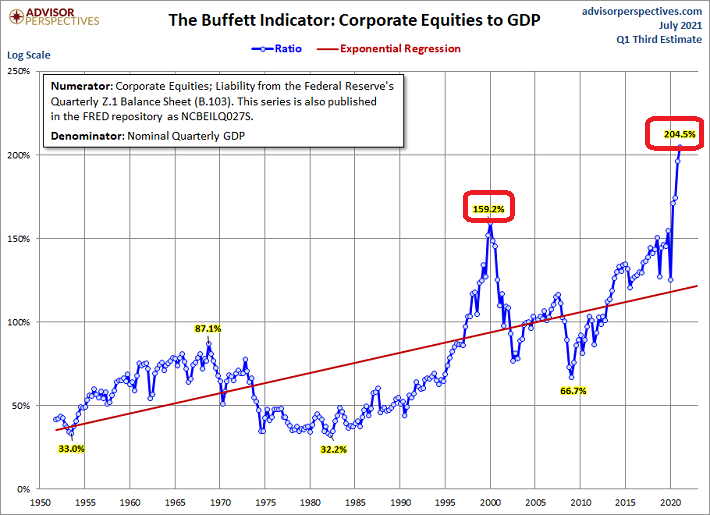

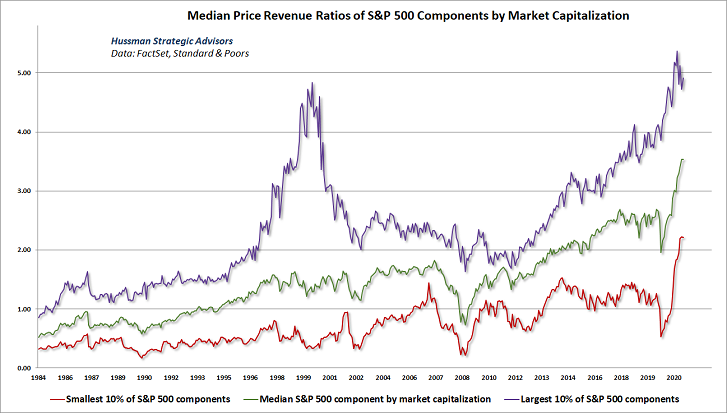

The way Grantham sees it, stocks are more irrationally priced than they were during the the 2000 stock bubble. Warren Buffett himself could not say that Grantham’s wrong.

Should you move a large portion of your assets to a cash position? That depends on how you choose to manage the risk of participation.

While the stock bubble certainly exists, and while it is rather monstrous, there are no rules about when a bursting will occur. Grantham may think it could happen in the fall of 2021, where stimulus may fade, the virus may pick up, or something unexpected may come to pass.

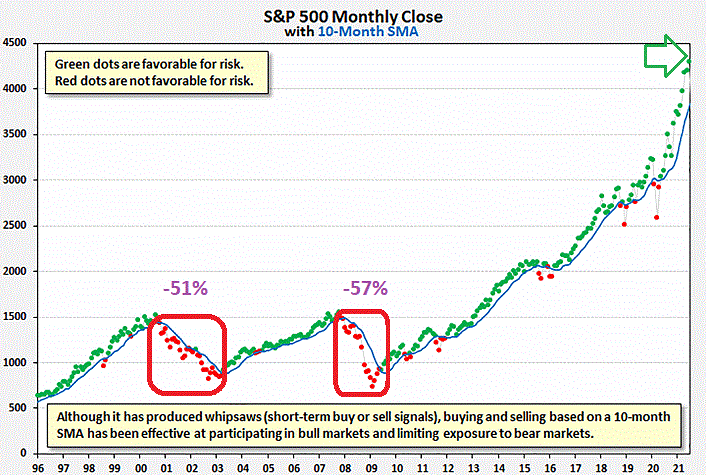

A trend-following approach may be preferable for other investors. For instance, as long as the monthly closing price for the market remains above its long-term moving average, maintaining target allocations should prove fruitful. (See the green dots below.)

What a trend-follower needs to pay attention to is a monthly close below the trendline. (See the red dots below.) That could very well be a sign that stock prices could be set for a painful period of depreciation, not unlike 2000’s tech wreck or 2008’s financial crisis.