The Federal Reserve is due to release its next formal policy statement April 27 at 2:00 pm ET

Fed’s Constant Assistance Is A Two-Sided Coin

The Fed stepping in to assist financial markets is not particularly new or surprising but with a dual mandate that includes keeping inflation in check, the central bank’s “bailouts” cannot go on indefinitely. The recent Fed-assisted rise in crude oil impacts inflation expectations, which brings to mind the Fed’s Jackson Hole keynote address by Stanley Fischer:

“Because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2% to begin tightening.”

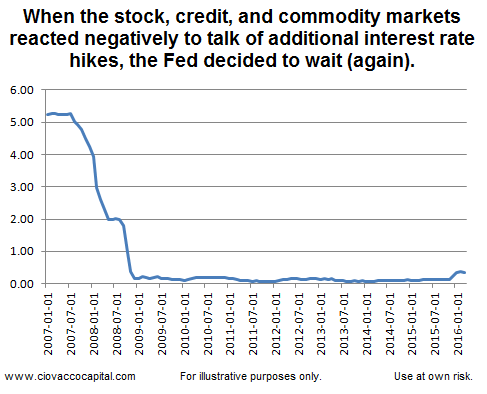

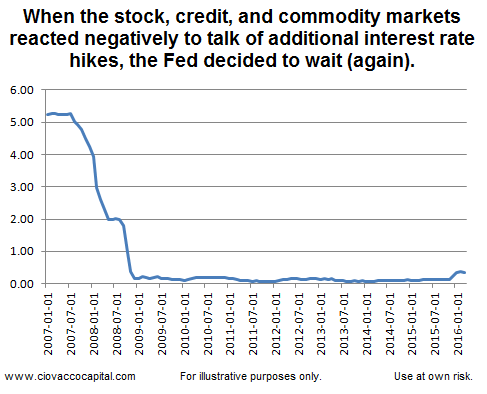

In 2016, thus far, the Fed has been content to keep rates hovering above zero. By reviewing how they decided to put off any additional rate hikes and the impact on inflation expectations, we can understand why the Fed’s market-friendly stance has limits, which may begin to adversely impact asset prices in the not too distant future.

Fed May Hike Rates Four Times In 2016

In what now seems almost comical, Federal Reserve Vice Chairman Stanley Fischer said on January 6, 2016 the Fed may raise rates four times in calendar year 2016. As a reference point, the S&P 500 opened at a level of 2,011 on January 6.

After Stocks Tanked, Fed Started To Amend Their Script

Between the “four rate hikes” proclamation day and January 20, the S&P 500 dropped from 2,011 to 1,812. By January 27, the Fed started to show some concern about plunging financial markets. From MarketWatch:

The Federal Reserve on Wednesday expressed less eagerness to hike interest rates, as the central bank showed concern over both the economy and the faltering stock market.

By February 1, Stanley “we plan to hike four times this year” Fischer had shifted to what was described as a “barely any interest rate hikes this year” stance. In twenty-six calendar days Fischer skipped all the way from four hikes to basically zero-to-one hike. From MarketWatch:

Federal Reserve Vice Chairman Stanley Fischer said Monday the U.S. central bank was worried the global market selloff could sap the strength of the U.S. economy, suggesting the market’s expectations of barely any interest rate hikes this year could turn out to be right.

A Simplified Look At The Bailout Mechanism

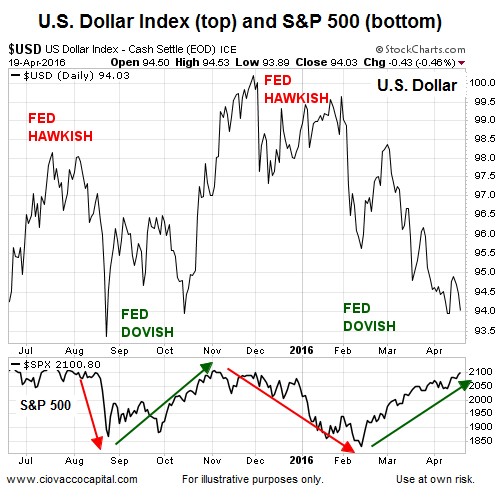

The economy, markets and monetary policy have an almost infinite number of moving parts. However, a few charts can sum up the Fed’s bailout process as well as the adverse impact on inflation expectations.

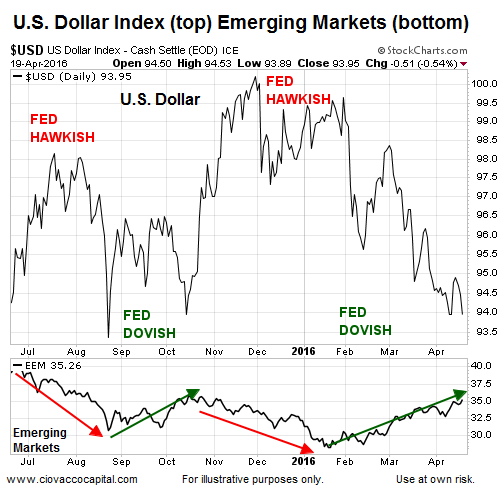

All things being equal, low interest rates tend to have a stimulative effect on the economy. Since monetary policy impacts the relative value of currencies, lower rates also tend to equate to a weaker U.S. dollar. Corporate earnings tend to benefit from a weaker U.S. dollar, which is pleasing to U.S. equity investors.

Rates And The U.S. Dollar

There are also a wide variety of ETFs that fall into a “weak-dollar-friendly” category, including oil (USO), energy (NYSE:XLE), materials (NYSE:XLB) and emerging markets (NYSE:EEM). While it is far from a direct correlation, the chart below shows stocks tend to perform better when the Fed talks about keeping rates lower longer (dovish) versus periods when the Fed hints at additional rate hikes (hawkish). The Fed’s tone, not surprisingly, is impacted significantly by movements in the stock market.

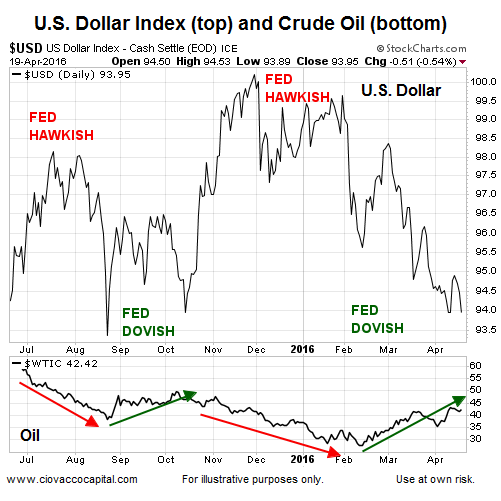

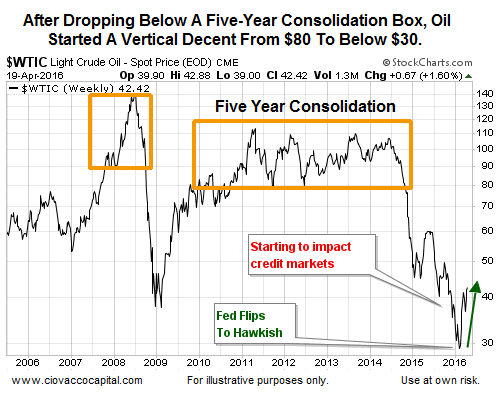

Oil Prefers Lower Rates

Since many credit agreements in the oil patch are tied to the price of crude oil, the recent waterfall plunge in oil prices started to have a negative impact on the credit markets, especially junk bonds (NYSE:JNK). Oil and wounded credit were undoubtedly a part of the Fed’s 26-day flip from “four hikes” to “barely any interest rate hikes this year”. Remember, oil falls into the weak-dollar-friendly category.

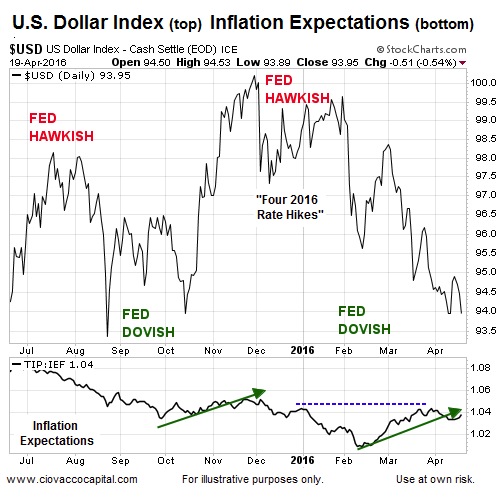

Bailouts Are Not All Fun And Games

We can use the ratio of Treasury inflation-protected securities (TIP) to intermediate Treasuries (IEF) as a way to monitor inflation expectations. With sharply rising oil prices come rising inflation expectations. Notice the dotted blue horizontal line shows the inflation expectation ratio has returned to the same level that prompted Mr. Fischer to proclaim four rate hikes may be needed in 2016. It is not likely the Fed allows inflation expectations to go unchecked forever. As shown via the charts below, a hawkish Fed can dampen inflation expectations. A hawkish Fed means a Fed that is talking about raising rates sooner and/or more frequently, which impacts the U.S. dollar, stocks, and crude oil as well.

Core CPI Rose 2.2%

The benchmark for U.S. inflation is the consumer price index. With crude oil tanking between mid-year 2014 and early 2016, CPI has benefited from a muted energy component; other components have not been so tame. From CNBC:

The so-called core CPI, which strips out food and energy costs, inched up 0.1%. That was smallest increase since August and followed a 0.3% increase in February. In the 12 months through March 2016, the core CPI rose 2.2% after gaining 2.3% in February. The Fed has a 2.0% inflation target.

Has Fed Waited To Hike Rates?

Anyone, including Stanley Fischer, who understands the lag between monetary policy and inflation knows at some point the Fed will have to raise rates due to rising inflation expectations. Fischer noted back in August 2015 the Fed “should not wait until inflation is back to 2.0% to begin tightening”. Crude oil has rallied strongly in recent weeks, meaning it will no longer be a silent member of CPI in 2016. The chart of the Federal Funds Rate below shows the Fed has raised rates a mere 0.25% after keeping them at zero for several years.

Oil Was Not The Fed’s Only Concern In Late January 2016

Clients and long-time followers know “the longer a market goes sideways, the bigger the move we can expect” once the range breaks. The chart of crude oil below provides a real-world example. The left side of the chart shows the financial crisis breakdown; the right side shows the more recent plunge.

Fed Received “We Need Help Calls”

Central banks often have dialogues with their global counterparts; sometimes the dialogue takes the form of a call for help. From Reuters:

Confronted with a plunge in its stock markets last year, China’s central bank swiftly reached out to the U.S. Federal Reserve, asking it to share its play book for dealing with Wall Street’s “Black Monday” crash of 1987.

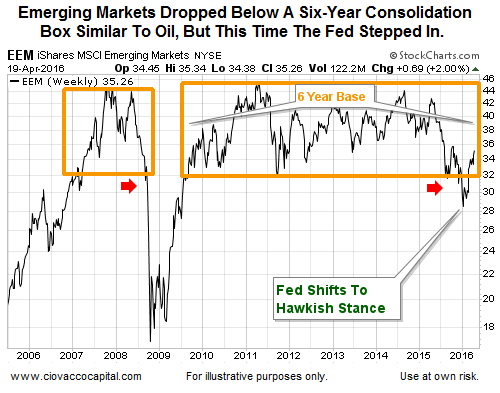

Compare the pre-plunge look of the crude-oil chart above and the early 2016 look of the emerging markets chart below. It is easy to understand why many experienced money managers had converted to a defensive stance in early 2016. After the Fed talked about multiple hikes in 2016 (which tends to push the U.S. dollar higher), the weak-dollar friendly ETF (NYSE:EEM) broke down from a six-year pattern of sideways action, which is a very, very vulnerable look as shown via the recent crash in crude oil.

Like crude oil, emerging markets benefited from the Fed’s about face on interest rates between early and late January 2016. If the Fed decides to take a more hawkish tone, it could throw a wet blanket over many of the current rallies in cyclical/weak-dollar friendly ETFs.

Yellen To Double-Down On Wealth Effect?

With earnings declining for several quarters, it is possible Janet Yellen has decided to double-down on the wealth-effect theory of economic stimulation. From The New York Times:

Ms. Yellen told the Economic Club of New York that the economy “had proven remarkably resilient,” and that the Fed expected better days ahead. She said the Fed still intended to pursue a careful, patient course toward higher interest rates as the economy improved. The cautious tone of her remarks, however, suggested no rate increase was likely at the Fed’s next meeting, in April, shifting the eyes of Fed watchers to its subsequent meeting in June. “I consider it appropriate for the committee to proceed cautiously in adjusting policy,” Ms. Yellen said. Stocks jumped and bond yields fell in the moments after the publication of Ms. Yellen’s remarks, part of a now-familiar pattern in which markets celebrate signs of economic softness and Fed restraint because that means interest rates will stay lower for longer.

Fed Statement Next Week

The Fed may break their recent pattern of being dovish when stocks are on the ropes and hawkish when stocks are hovering near their recent highs. However, the public remarks made on Monday, April 18, by the President of the Boston Fed remind us that it is unlikely the Fed can remain in stock/oil/emerging market friendly mode indefinitely. From Reuters:

The Federal Reserve is set to hike interest rates more rapidly than investors currently expect, a top Fed official said on Monday, again pushing back on what he said was investors’ too pessimistic view of the U.S. economy and monetary policy. It was the second time in as many weeks that Boston Fed President Eric Rosengren warned that futures markets, which see only one modest rate hike in each of the next few years, are off the mark. He said U.S. inflation was now “much closer” to the Fed’s goal.

Fed Can’t Postpone Hike Indefinitely

It is also possible the statements made in Jackson Hole last year, rising inflation expectations, and the chart of interest rates below cause the Fed to replace the dovish script with the hawkish script.

“Because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2 percent to begin tightening.”

Pop In CPI Could Spook Markets

We all know that hawkish Fed statements tend to put a drag on asset prices, but what many may not be familiar with is the market’s reaction to a well-above expectations inflation reading, which would force the Fed to raise rates at a faster than anticipated rate. The Fed is well aware of this possibility given they have done next to nothing to prepare for such an event.

Putting The Rally In A Different Light

If the Fed shifts to the hawkish camp, as shown in this week’s stock-market video, the current rally in risk assets may not be as impressive as it appears at first blush, which speaks to hawkish vulnerabilities. Nothing would surprise us given the recent actions of the Federal Reserve, including a decision to double-down on the wealth effect.