Very few traders know about this unique market phenomenon. Those who do could capture short term option returns – of up to 320%. How it works is simple: if a stock crosses one red line the setup is “armed” And, if it crosses the second red line? We get an explosive move.

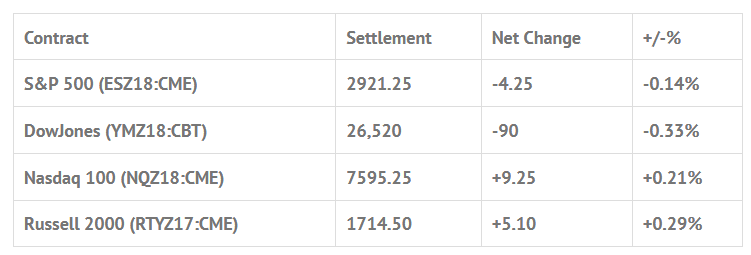

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.92%, Hang Seng +1.15%, Nikkei +0.39%

- In Europe 9 out of 13 markets are trading lower: CAC +0.31%, DAX -0.20%, FTSE +0.04%

- Fair Value: S&P +4.97, NASDAQ +27.31, Dow +22.17

- Total Volume: +1.03mil ESZ & 328 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, New Home Sales 10:00 AM ET, State Street Investor Confidence Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, FOMC Meeting Announcement 2:00 PM ET, FOMC Forecasts 2:00 PM ET, and Fed Chair Press Conference 2:30 PM ET.

S&P 500 Futures: #ES Closes Lower, But Not By Much

After trading higher for much of the overnight session, the S&P 500 futures opened yesterday at 2929.00, up +3.50 handles. The benchmark futures contract printed an early high at 2930.25 before a wave of early selling took it down to 2920.25 just after 10:00 AM CST, completing a 10 handle range, and then bounced up to a lower high of 2928.25 heading into 11:00. From there, the futures began to drift lower, making a new low at 2918.25 just after 12:30, and completing another 10 handle move.

The afternoon saw another choppy range of less than five handles, as the ES traveled to a mid afternoon high of 2923.00, then down to 2919.50. After that, the futures chopped higher into the MOC, as the MiM started showing $350 million to sell. The ES made a late day high of 2923.50 before printing 2920.50 at 3:00, and then settled at 2921.25, down -4.25 handles, or -0.15%.

In the end it was another choppy day of trade that seemed to lack leadership. While the futures did manage to trade above the 2934 level, it just could not hold the rallies. The ES has gone without a 1% move up or down for 64 trading sessions, dating back to late June. There was some type of rotation going on; buy the Nasdaq / sell the Dow and S&P. In terms of the ES’s overall tone, it didn’t act all that bad, but with tomorrow’s expected rate hike hanging over the markets it just never gained any steam. In terms of the days overall volume only 1.03 million contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.