Market Brief

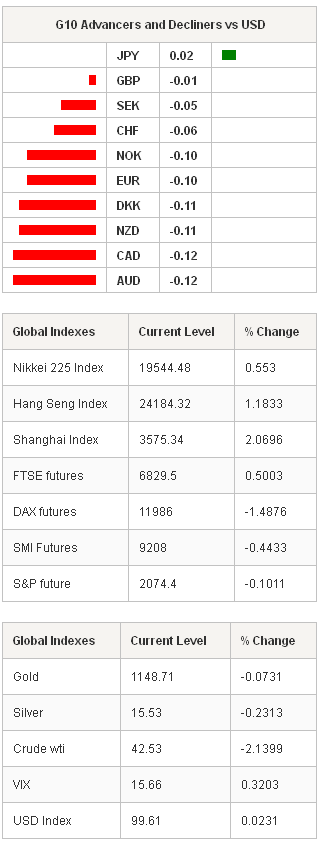

Today’s key event is the FOMC decision due at 18:00 GMT, limited price action should be seen across the FX markets globally. Traders make the final adjustments to their positioning, with USD broadly higher in Asia. This is because the Fed is expected to drop its call for “patience” at this month meeting, which will be perceived as a concrete step toward a rate normalization. While the hawkish Fed expectations are already priced in across the money and currency markets, there is greater chance of seeing a more significant reaction on the stock indices. After last week’s depressed market, the S&P 500 futures recovered timidly to $2,081 yesterday, Dow Jones futures gapped lower (after the unusual jump at yesterday’s trade), while NASDAQ has outperformed its US peers by advancing steadily to$ 4,384, still below the 21-dma.

WTI crude legged down to fresh low of $42.44 following the slide to fresh lows that has already started in New York yesterday. The fresh weakness in crude pushes the oil industry into deeper panic. Royal Dutch Shell A (NYSE:RDSa) announced to disassemble ¼ of its platforms in the North Sea, while 1/3 to ¼ of BP (LONDON:BP)’s UK fields are uneconomic said the CEO of the group. Fighting for its market share, the Saudi Arabia already prints deficit, while the US continues producing 9.4 million barrels per day, through a constant uptrend. The panic in oil prices keep oil producer currencies downbeat. USD/NOK extends gains to 8.3323, combined to Norway’s shrinking trade balance to 21 billion NOK from 27.1 billion a month ago. Norges Bank is expected to lower the deposit rates from 1.25% to 1.00% on March 19th meeting. The wider divergence between the Fed and the Norges Bank suggests steady advance toward 2000-2001 range of 8.50/9.50.

USD/CAD tests 1.2800+ offers, while USD/RUB trades ranged given the limited RUB transactions overseas.

There is nothing new on the EUR-complex. The EUR sentiment remains comfortably negative, both on hawkish Fed expectations and Greece seeking liquidity provision at EU summit. In Frankfurt, street protests against the ECB are in European headlines! Uncertainties should keep the EUR market anchored on the downside. EUR/USD sales are touted below 1.05, EUR/GBP faces solid offers at 0.7200/0.7250 (including option barriers, Fibonacci 23.6% on Dec’14 – Feb’15 sell-off and the 21-dma). EUR/JPY hovers around 128.52 (Fib 61.8% on 2012-2014 rally). Large option barriers are placed at 130+.

In Japan, the trade deficit narrowed well above expectations in February, from -1-179.1 billion (revised) to -424.6 billion yen. Exports to US rose 14.3%, to China slumped by a significant 17.3% confirming FinMin Aso’s warnings yesterday (on China being a downside risk to Japan recovery). USD/JPY remained ranged in Tokyo (121.26/41) alongside with the 10-year US yields narrowing just above 2.0%. The major focus is the FOMC decision today. Hawkish Fed carries potential for an easy cross above 122.03 (Mar 10th high). Option bets are supportive above 121.50 for today expiry. A post-FOMC close below 120.97 (Ichimoku conversion line) should however anchor the market below March highs.

The New Zealand’s current account deficit narrowed less than expected, the CA-to-GDP ratio fell to -3.3% from -2.6% in the 4Q. The weakness in dairy prices continues, with lower volumes and the GDT index down by another 8.8% at the latest Fonterra auction. NZD/USD remains downbeat, the negative bias keeps the 0.72 support in focus, and stops are eyed below.

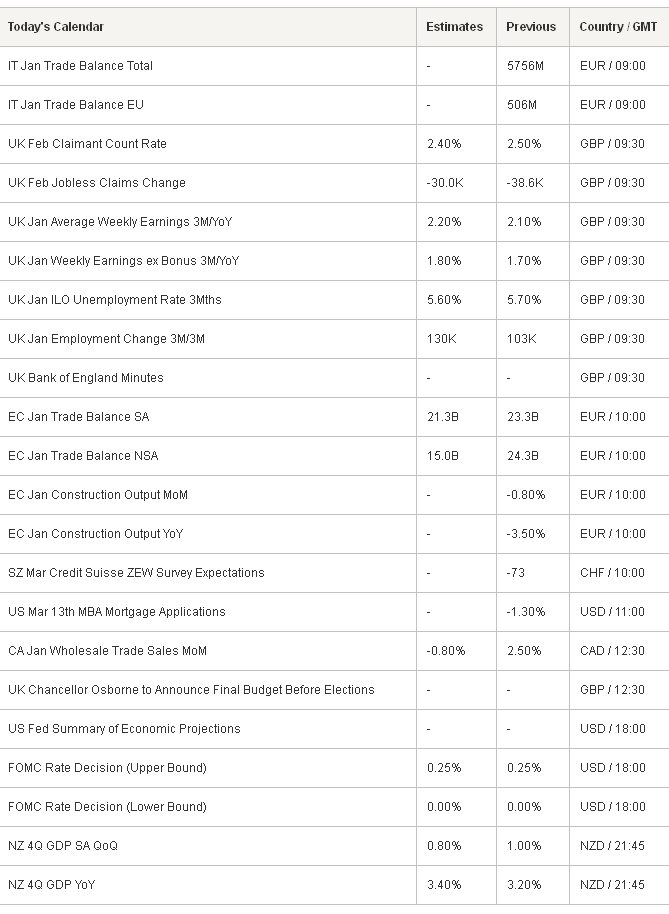

The economic calendar of the day: Italian January Trade Balance, UK January Unemployment rate and Weekly Earnings, UK February Jobless Claims Change and Claimant Count Rate, Euro-zone January Trade Balance and Construction Output m/m & y/y, Credit Suisse (SIX:CSGN)’s ZEW Survey on Expectations in Switzerland, US March 13th MBA Mortgage Applications, Canadian January Wholesale Trade sales m/m and later on New Zealand’s 4Q GDP q/q & y/y.

Currency Tech

EUR/USD

R 2: 1.0893

R 1: 1.0725

CURRENT: 1.0617

S 1: 1.0458

S 2: 1.0400

GBP/USD

R 2: 1.5137

R 1: 1.5027

CURRENT: 1.4755

S 1: 1.4700

S 2: 1.4547

USD/JPY

R 2: 124.14

R 1: 122.03

CURRENT: 121.33

S 1: 120.61

S 2: 119.38

USD/CHF

R 2: 1.0240

R 1: 1.0190

CURRENT: 1.0041

S 1: 0.9970

S 2: 0.9825