We often speak in these updates about how politics influences markets, but today I wanted to show how the opposite can also be true.

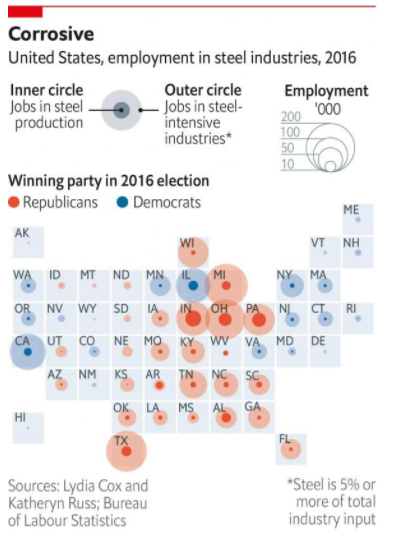

This map printed in The Economist this morning shows which US states have the most steel production and production related jobs...

Those familiar with the geographics of the US electoral college will immediately recognize that there is a high correlation between the steel producers and the "swing states" which most often determine the outcome of the American elections.

Wisconsin, Pensylvania, Ohio, Indiana, and Michigan (WI, PA, OH, IA, and MI) were critical states that ended up winning Trump the election in 2016.

These states are also known as the rust belt, primarily due to the vast deindustrialization that has taken place over the last few generations.

Economists looking at the bigger picture will never understand the use of Trump's new steel and aluminum tariffs because on the surface it doesn't make sense to risk so much for so few jobs.

But political scientists might have other ideas about what Trump is doing. By revitalizing the rust belt, Trump dramatically improves his chances in the 2020 elections, no matter how big the outcry from the deep blue states like New York and Californa.

Those hoping that he's just negotiating, mincing his words, or that he won't carry through on this might want to think again.

Today's Highlights

Pickled Europe

OPEC + Shale

Bitcoin Breakout

Please note: All data, figures & graphs are valid as of March 5th. All trading carries risk. Only risk capital you're prepared to lose.

Traditional Markets

The Political updates from Europe over the weekend haven't brought much clarity or stability to markets today.

As expected, the Italian elections have produced no clear winner and we could very well be weeks, if not months, away from any sort of resolution there.

In Germany, Angela Merkel has finally been reinstated for her fourth and likely final term as Chancellor. Even though they call it a Grand Coalition her grip on power is now wafer thin.

Dennis Austinat, our German Regional Manager, said:

Over the next two years, Merkel will need to walk on eggshells or else lose more of her base. Germany has become drastically more polarized in the last few years and it's getting near impossible to hold a middle ground coalition.

This morning, the DAX 30 reached it's lowest point in more than a year before seeing a recovery.

Of course, all of the global stock indexes are under some pressure at this time. Loud will be the cries of "buy the dip" today. Let's hope they don't get crushed by the politicians.

Oil Unification

We could get some big news from the WTI market today.

We've been discussing the tug of war between Eastern and Western oil producers for over a year now, but today they will finally sit at the same table.

For the longest time, OPEC and Russia have been pulling out all the stops to limit the production of crude oil in the East, while shale producers in the West have only been taking advantage of these efforts to ramp up their own output.

Nobody really knows what to expect from the meeting today but the headlines do indicate that it is a positive sign.

Looking at the markets though, at best we're off the lows...

You know what else is off the lows?....

Bitcoin

Over the weekend we saw a bullish sign for the world's favorite digital currency, Bitcoin.

As we can see, the upper trendline has now been broken and we've managed to sustain levels greater than $11,000 for four days straight.

Though this in itself is hardly a cause for celebration it is a rather positive update.

We would now look for a strong break above $12,000 to assume the uptrend has resumed. A difficult task indeed.

Invitation

Later today, I'd like to invite you to join us on YouTube. Our Founder and CEO Yoni Assia will be hosting a very special event with the Founder of Ripple and Steller Jed McCaleb.

The event will go live today at 16:30 GMT so come join us here

Let's have an amazing week ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.