Preview: US CPI

Key Statistics:

- Source: Bureau of Labor Statistics, US Department of Labor

- Release Period: October 2024

- Last Release Date: October 10, 2024,

- Actual: 2.4% vs Forecast: 2.3%. Previous: 2.5%

OCTOBER CPI FORECAST = 2.6%

Release Date: November 13, 2024, at 08:30 AM ET

- Purpose:

It measures changes in the price of goods and services purchased by consumers. Consumer prices account for most of the overall inflation. Inflation is important to the central bank to raise interest rates out of respect for their inflation containment mandate.

Key Highlights:

- US CPI expectation is 2.6% YoY headline inflation, 3.3% YoY “core” inflation.

- Core CPI seen rising at a similar pace in October vs September.

- Fed inflation fight remains a key driver, but Powell remains dovish.

- The yield on benchmark US 10-year notes jumped 12.2 basis points to 4.43%, just off the 4-month high of 4.479% hit last week.

- CPI release is followed by 4 Fed speakers on Wednesday from 8:30 am to 1:30 pm ET.

- US Stocks fall ahead of inflation theme back on the front seat after the US election.

- Asian stock market has a weak start on Wednesday. Nikkei 225 Index is down 1.08% to 38,949.62, as of 0217 GMT.

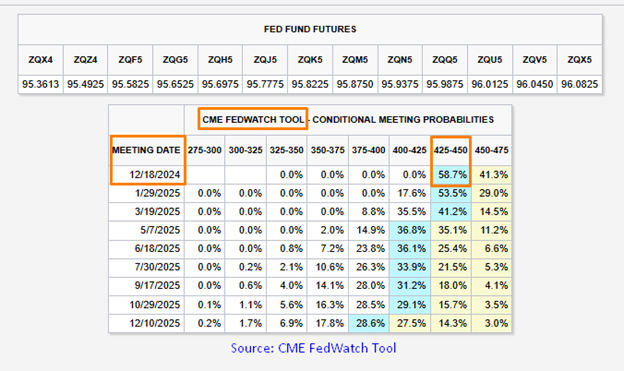

US Interest Rate Probabilities:

- US IR probabilities are showing about 59% of 25 bps cut on December 18, 2024.

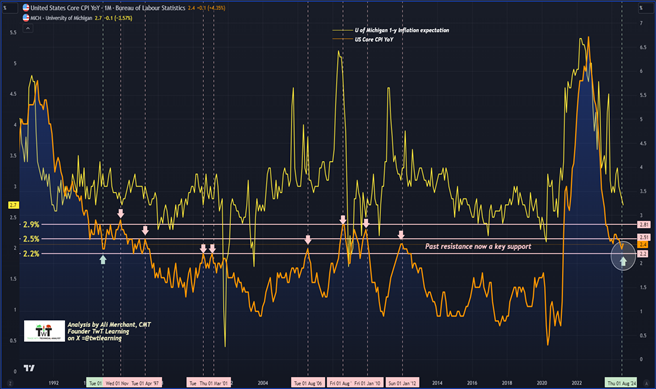

Technical Analysis Perspective:

- The US Core CPI 2.2% to 2.9% range has played a role in being magic levels since 1994.

- 2.3% was a key support/base in Dec 1994 for inflation to rise to 2.9% in Nov 1995.

- The magic levels have remained a key obstacle/resistance in November 1995, April 1997, August 2000, March 2001, August 2006, August 2008, January 2010, and January 2012 pushing inflation lower.

- It seems that August 2024 low at 2.3% is a high probability support for the upcoming few months.

- We will have more certainty about August CPI low after October release.

- If this turns out to be true, then Core CPI is likely to move higher at a gradual pace, eyeing 2.6 to 2.9%.

US Core CPI YoY Chart with University of Michigan 1-y Inflation Expectation

Conclusion:

Historically prices of Core CPI suggest that 2.3% to 2.4% print from prior falling inflation value has supported a rise to higher inflation in the upcoming months to 2.6% to 2.9%. Markets are focusing on inflation after a sweep US election victory by President Elect. Trump. It all depends on October inflation number.

Technical analysis is the study of higher probability vs lower probability setups. We are social and emotional human beings, sometimes our reaction to an event could be entirely opposite of the expectation.

A word of wisdom:

“The market can remain irrational longer than you can remain solvent” is a quote by economist John Maynard Keynes that emphasizes the unpredictable nature of financial markets. The quote means that investors should not bet against the market, even when they believe it is mispriced or irrational, because it's difficult to predict when the market will correct itself.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters (NYSE:TRI), Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”