Ocean Wilsons' (LON:OCN) first-half figures reported in August showed that its quoted Brazilian operating subsidiary, Wilson Sons (SA:WSON33), made progress despite a still difficult trading background, particularly for its offshore JV. The main container terminal and towage businesses are well invested and positioned to exploit a longer-term revival in the local economy. Confidence in this appears to be growing if strength in the currency and Bovespa equity index are taken as indicators.

H117 results and offshore JV update

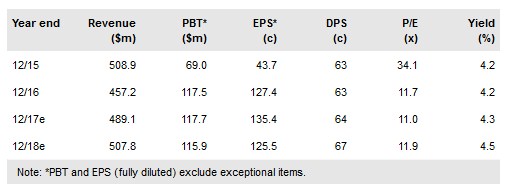

First-half revenues increased by 14.5% compared with the prior year period, largely reflecting strength in the Brazilian real (BRL). Within this, container terminals showed stronger growth while a sharp reduction in special operations income muted towage growth. Operating profit increased by 10% and a strong performance from the investment portfolio (+10% in the six months) helped boost the pre-tax profit increase to 31%. Reflecting the tough oil sector background Wilson Sons recently announced that its offshore joint venture (WSUT) is in negotiations with Petrobras that may lead to a temporary suspension of up to eight platform support vessel contracts and a reduction in average daily rates.

To read the entire report Please click on the pdf File Below: