The Japanese yen has posted slight gains on Monday, reversing direction from the Friday session, when USD/JPY posted sharp losses. USD/JPY is trading slightly above the 107 line.

On the release front, it’s a very quiet start to the week. In the US, there are no major releases on the schedule. Fed Chair Janet Yellen will address a conference in Philadelphia. The sole Japanese event is the 30-year bond auction. On Tuesday, Japan will release Current Account and Final GDP.

It was an outstanding week for the Japanese yen, which jumped 420 points against the US dollar. The currency markets wrapped up last week with strong volatility, courtesy of a dismal Nonfarm Payrolls report. The April number plunged to 38 thousand, stunning the markets.

Analysts could be forgiven for rubbing their eyes in disbelief at this figure, which was the lowest reading since August 2010. The estimate stood at 159 thousand, which was almost identical to the previous release.

The US dollar took a beating on Friday, and the yen took full advantage, gaining 230 points, climbing to 4-week highs against the greenback. This release could have significant ramifications, and could mean that a June rate hike by the Federal Reserve is no longer on the table.

Some of the plunge in the NFP release is attributable to a strike by workers at Verizon, a major communications company. Still, even without this component, the indicator would have posted a gain of only 72,000, well short of expectations.

In other US employment news, Average Hourly Earnings, which measures wage growth, posted a weak gain of 0.2%. The unemployment rate fell to 4.7%, but workforce participation dropped to 62.6%.

The markets are keeping a close eye on Japanese Final GDP, which will be released on Tuesday. Preliminary GDP was released last month, and surprised the markets with a gain of 0.4%, above the forecast of 0.1%. The estimate for Final GDP stands at 0.5%.

If GDP again beats the forecast, the yen could continue to gain ground and move closer to the 105 level, which has held in support since October 2014. A strong yen has hurt the Japanese export sector, and has resulted in warnings that Japan will intervene to combat what it terms “currency manipulations”.

The US is staunchly against such intervention, and the two countries publicly disagreed on this issue at the recent G-7 meeting in Tokyo. If the yen continues to rise, we’re likely to see further exchanges on the sensitive issue of currency intervention.

USD/JPY Fundamentals

Monday (June 6)

- 10:00 US Labor Market Conditions Index

- 12:30 US Fed Chair Janet Yellen Speaks

- 23:45 Japanese 30-year Bond Auction

Upcoming Key Events

Tuesday (June 7)

- 19:50 Japanese Current Account. Estimate 2.04T

- 19:50 Japanese Final GDP. Estimate 0.5%

*Key events are in bold

*All release times are EDT

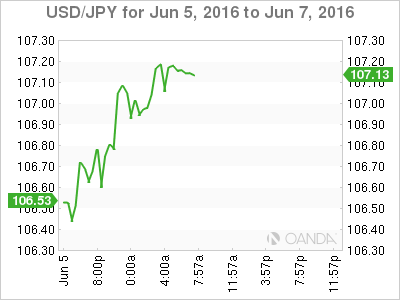

USD/JPY for Monday, June 6, 2016

USD/JPY June 6 at 6:35 EDT

Open: 106.67 Low: 106.48 High: 107.28 Close: 107.17

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 104.99 | 105.87 | 107.16 | 108.37 | 109.87 | 110.66 |

- USD/JPY has posted small gains in the Asian session and is flat in European trade

- 107.16 is fluid and could see more action during the day. It is currently a weak support line

- 108.37 has switched to resistance following sharp losses by USD/JPY in the Friday session

- Current range: 107.16 to 108.37

Further levels in both directions:

- Below: 107.16, 105.87 and 104.99

- Above: 108.37, 109.87 and 110.66

OANDA’s Open Positions Ratio

The USD/JPY ratio has showed sharp gains by long positions. This is consistent with sharp losses by USD/JPY on Friday. Long positions have a strong majority (70%), indicative of trader bias towards USD/JPY continuing to move to higher ground.