Upstream player Oasis Petroleum Inc. (NYSE:OAS) recently filed for the initial public offering (IPO) of its pipeline unit Oasis Midstream Partners LP. The company launched an IPO of 7,500,000 common units with an expected price range of $19-$21 per unit. Oasis Midstream intends to raise around $150 million at a price of $20.

The partnership would be listed under the NYSE under the ticker HESM. Morgan Stanley (NYSE:MS), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) Securities are the lead underwriters of the offering. The partnership is expected to grant underwriters a 30-day option to purchase up to an additional 1,125,000 common units.

About 27.3% of the ownership stake is being sold in the IPO and the figure is likely to reach 31.4% if the underwriters purchase the additional common units. Post the closure of the IPO, Oasis Petroleum and its affiliates will own either a 72.7% limited partner interest in Oasis Midstream or a 68.6% interest in case the underwriters exercise their full option to purchase the additional units.

Oasis Midstream, which was created in 2013, reported revenues of $140 million for the trailing 12 months ending Jun 30. The partnership’s operations are located exclusively in the Williston Basin area of North Dakota and Montana. The assets include a diversified portfolio of midstream assets which are strategically positioned to secure volumes from various producers. These assets mainly include crude oil /natural gas gathering and transportation system and water handling systems.

Oasis Petroleum has been undertaking initiatives to boost its acreage and midstream assets in the Williston Basin. Last year, the company acquired assets from Denver-based exploration player SM Energy Company (NYSE:SM) for $785 million. The company also brought its natural gas processing plant and other midstream assets into service.

Zacks Rank and Key Picks

Headquartered in Houston, Oasis Petroleum is engaged in the acquisition and development of oil and natural gas. The company owns a vast acreage in the Bakken and Three Forks formations. Oasis Petroleum presently carries a Zacks Rank #3(Hold).

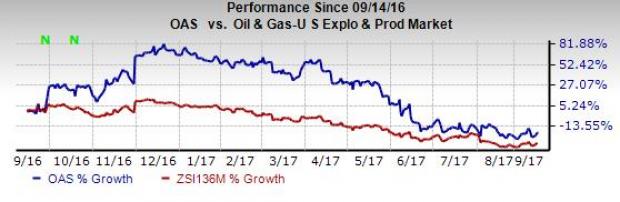

Oasis Petroleum has declined 18.3% in the last twelve months compared with 27.8% loss of its industry.

The company delivered a positive earnings surprise in each of the trailing four quarters, the average being 23.39%.

Some better-ranked players in the same industry are Range Resources Corporation (NYSE:RRC) and Lonestar Resources US, Inc. (NASDAQ:LONE) . Both these companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources delivered an average positive earnings surprise of 51.82% in the trailing four quarters.

Lonestar Resources is expected to deliver year-over-year growth of 60.20% and 79.67% in its revenues and sales, respectively in 2017.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Range Resources Corporation (RRC): Free Stock Analysis Report

SM Energy Company (SM): Free Stock Analysis Report

Oasis Petroleum Inc. (OAS): Free Stock Analysis Report

Lonestar Resources US Inc. (LONE): Free Stock Analysis Report

Original post

Zacks Investment Research