North American markets are feeling pretty good about themselves this morning as the final revision for US GDP was higher than even the most optimistic Wall Street prognosticators expected. The 5.0% growth rate for Q3 2014 was the best result in over a decade and prompted the Dow to rise above 18,000 for the first time ever. The USD is also performing well against all her rivals, but there was other news that came out today too which could end up taking more immediate precedence as the day moves along.

Despite the fever pitch felt through GDP, it was admittedly, figures for Q3, which we already knew were pretty good at 3.9% previous to this revision. Sure they were revised much higher than anyone expected, but the strength was already there. Therefore, price action for the rest of the day may be more dictated by figures that are a little more immediate like Durable Goods Orders and New Home Sales; both of which failed to live up to expectations this morning.

The trouble with going against the USD at this point in history is that almost all other major central banks are turning dovish while the Federal Reserve is looking patiently hawkish. So that pretty much rules out a lot of options like the EUR, AUD, and JPY (unless you’re feeling bold). However, over in New Zealand, they’ve actually been even more hawkish than the Fed, and their Trade Balance, released earlier this week, was in deficit, but much better than anticipated. Keeping that in mind, perhaps there is a fundamental reason for the NZD/USD to turn higher.

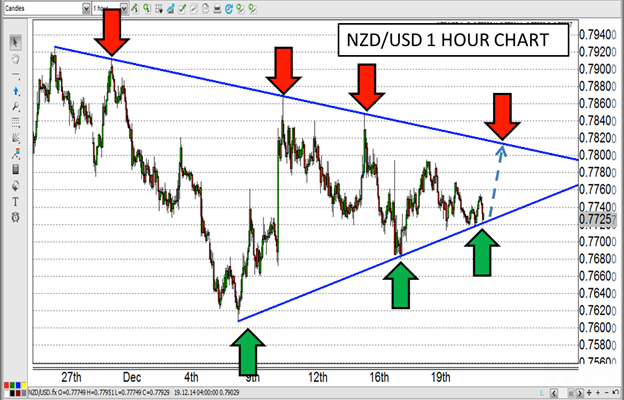

Of course, using only a fundamental reason to jump on this bandwagon could be a recipe for disaster, so we need to search for technical reasons as well. Luckily, we have them. The NZD/USD is currently embroiled in a triangle pattern that has suppressed it throughout December, and is at the bottom of that triangle (Figure 1). This bottom of the triangle also corresponds with the 61.8% Fibonacci retracement (not shown) from the December 18 low to December 19 high providing two levels of support. If this triangle continues to influence this pair, perhaps a rally just might be in store.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).