This morning we saw the Reserve Bank of New Zealand (the RBNZ), keep its benchmark interest rate on hold at 1.75%.

“Numerous uncertainties remain and policy may need to adjust accordingly.”

“Recent falls in the exchange rate were encouraging and would encourage the growth outlook if sustained.”

While all 26 economists that Reuters polled before the release expected no change, the kiwi took a bit of a beating, sending it through the NZD/USD daily support level that we have been watching since last year.

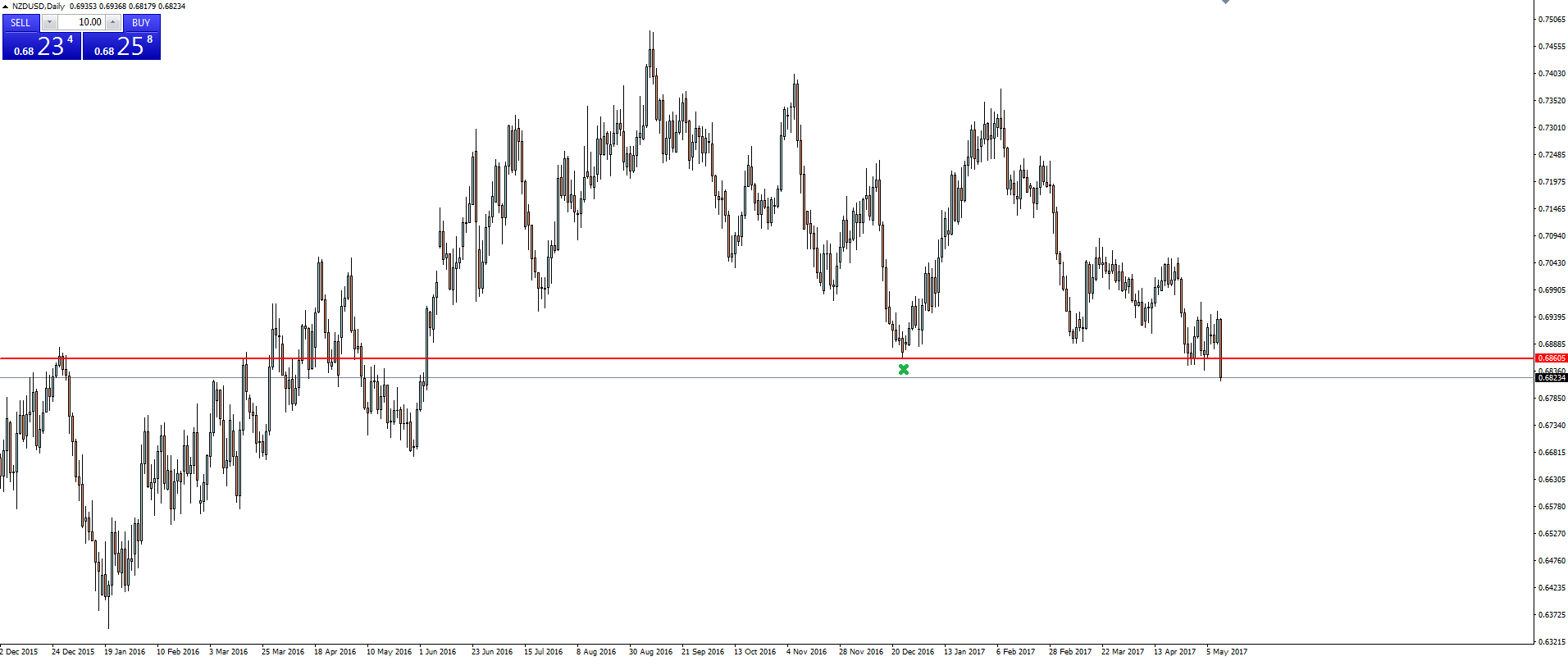

The NZD/USD daily chart shows this touch of support from back in December 2016:

NZD/USD Daily:

While price had been exploring below the level, its inability to make any sort of meaningful close saw it recently hold on. But after the RBNZ decision and statement, support finally broke.

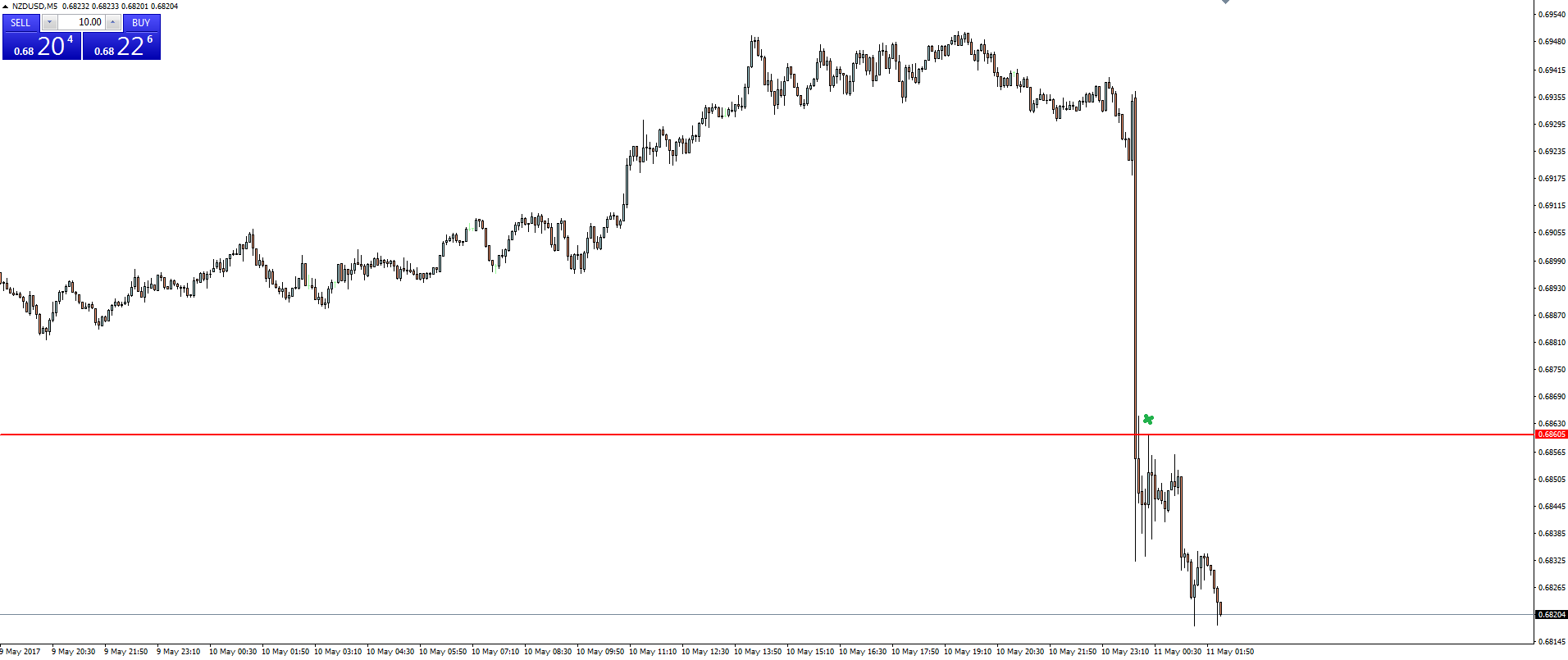

What I really wanted to highlight here on the NZD/USD 5 minute chart is the way that price pulled back and retested the higher time frame level that was created 5 months ago:

NZD/USD 5 Minute:

Come on, that’s pretty cool. And most importantly, was a nice entry level for a savvy forex day trader if you were at your charts this morning!

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.