The RBA and RBNZ meetings are on our doorstep (RBA up in less than 2 hours) and with either having the potential to cut rates, we could be in for a lively 24hrs for AUD and NZD.

The two main factors which have traders preparing for a rate cut tomorrow is RBNZ shifting to a dovish stance in March, before their CPI data missed the mark to send NZD crosses violently lower. There were several major changes in their March statement which warrant taking note of, but really it can be seen on the opening paragraph.

From the opening paragraph: February

… “We expect to keep the OCR at this level through 2019 and 2020. The direction of our next OCR move could be up or down”.

From the opening paragraph: March

… “Given the weaker global economic outlook and reduced momentum in domestic spending, the more likely direction of our next OCR move is down”.

They effectively shifted from neutral to dovish in that opening paragraph, before highlighting weaker global growth (in particular amongst some of our key trading partners….) and how this has placed upwards pressure on the NZ dollar. And a higher currency to an export nation such as New Zealand, generally warns easing to help lower their currency. Keeping in mind that inflation missed the mark after the March statement, we find it unlikely RBNZ will hold rates and, if they did – would likely see their currency soar higher against their wishes. And if RBA cut rates in a few hours, this surely adds further pressure for RBNZ to follow suit.

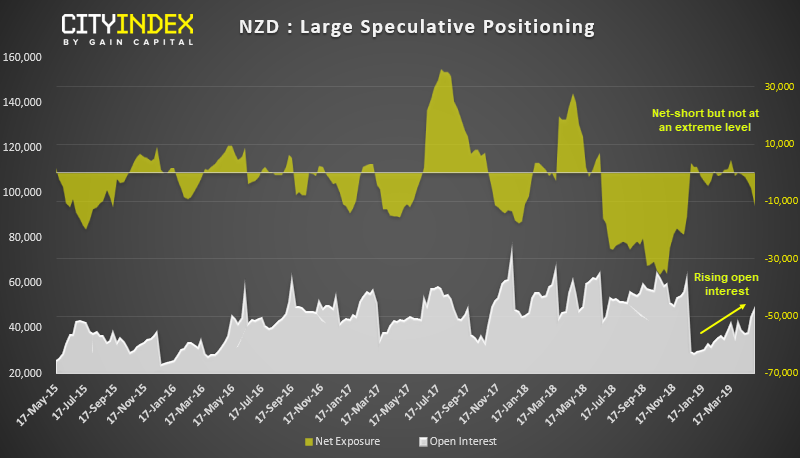

As for market positioning, we noted in Monday’s COT report that NZD traders had increased their bearish exposure at their fastest pace in 8 months leading into tomorrow’s cash rate meeting. Furthermore, this has been achieved on rising volumes (open interest) to add extra weight to the move yet, at the same time, net-short positioning does not appear to be at a sentiment extreme.

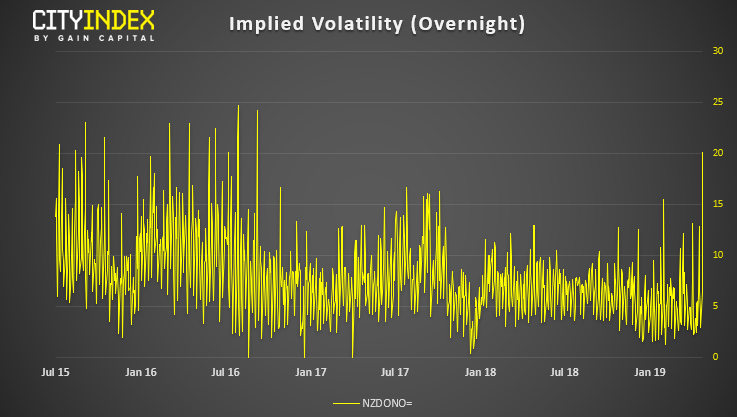

Overnight implied volatility for NZD has risen to its highest level since September 2016 but that shouldn’t come as too much as surprise given RBA and RBNZ are to hold cash rate decisions over the next 24 hours. And, with both RBA and RBNZ meeting having the potential to be live, we expect realised volatility to live up to expectations of its implied counterpart.

We continue to watch NZD/USD for it’s potential to break lower. A bearish trend structure has continued to evolve since breaking out of a large, multi-month coiling formation. A prominent swing at 0.6685 respected a 50% retracement level and the bias remains bearish whilst it holds as resistance. We’d need to see a break beneath 0.6580 before assuming trend continuation, where the lows around 0.6425-65 come into focus for the bear-camp.