Last week was relatively positive for the Kiwi dollar as a range of US economic data proved weaker than expected. The US NFP was highly negative, coming in at 142k (202k exp) whilst Average Hourly Earnings also fell to 0.0% m/m. The NZD subsequently rose higher and managed to finish the week around the 0.6450 level. However, the week ahead will prove critical for the venerable currency as it prepares to be largely dominated by the US unemployment rate and Non-Manufacturing PMI results.

The next few days will see the kiwi dollar focused upon the US labour market as the Unemployment Claims figures fall due. The market will be closely watching the results from this indicator, for some sort of signal as to the US Federal Reserve’s intent in the coming FOMC meeting.

Any further demonstrated weakness within US labour markets could doom any rate hikes for 2015. The pressure is already mounting for the central bank to hold off on any monetary policy changes given the weaker than expected NFP data. So any weakness in the US Unemployment Claims figures could benefit the NZD and cause a sharp appreciation against its namesake. In fact, the NZD is currently climbing ahead of the labour market result, as the market looks to take a risk off approach.

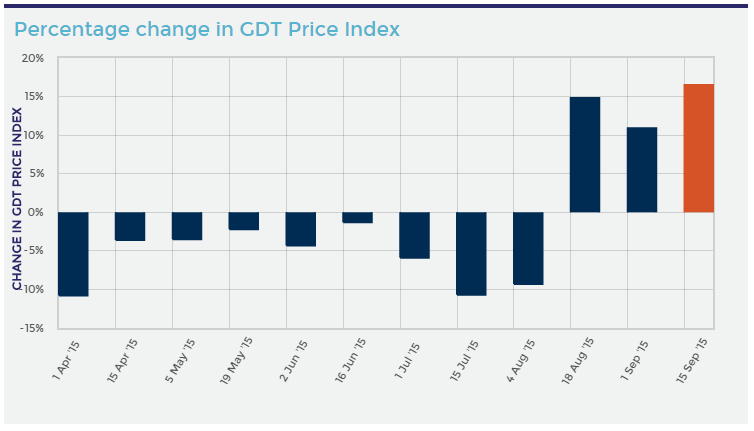

However, there is also some important NZ macroeconomic data due this week that has the potential to be missed considering the volatility that is likely to be present around the US unemployment Claims data. A Global Dairy Trade (GDT) auction result is due shortly and, given the importance of dairy to the New Zealand economy, should be watched closely.

Source: globaldairytrade.info

New Zealand’s largest dairy producer, Fonterra (ASX:FSF), has recently restricted supply in an attempt to alter the equilibrium price, which obviously limits the possibility of a negative result. Subsequently, it is likely that the GDT auction will provide another price increase, albeit a largely artificial one.

From a technical perspective, the pair continues to consolidate as it remains above the 64 cent handle. Also, the moving averages have started to turn with the 12 crossing the 30EMA whilst RSI continues to creep higher. Subsequently, the NZD is looking bullish, albeit in the short term, given the MA crossover and trending RSI oscillator. Support is found at 0.6285, 0.6237, and 0.5918. Resistance is found at 0.6521, 0.6679, and 0.6707.

Ultimately, the coming week is likely to be critical in determining the NZD’s short term trend given some of the encouraging signs. However, the medium term is still presenting some highly bearish signals, so buyers should be careful not to get their fingers burned.