One of the most followed gauges of the market is the (cumulative) NYSE's Advancing/Declining issues line (NYAD); it simple follows how many stocks are advancing vs decline (and unchanged). If more stocks are advancing the ratio increases, and vice versa if more stocks are declining. By adding each day's A/D number to the previous we'll get the cumulative number. This thus gives us a "look under the hood" in determining if a rally is sustained (many stocks are participating) or if it's running out of steam (fewer and fewer stocks are participating).

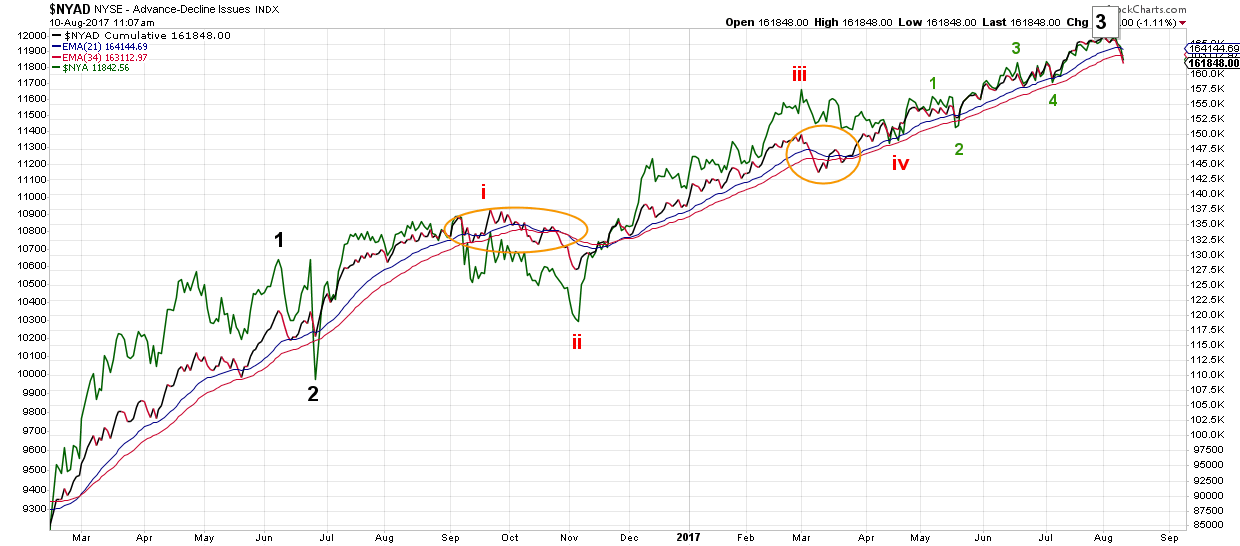

If we then add moving averages for trend-following we can determine if the NYAD is trending up (and so is the index) or if it is trending down. Below is a plot of the cumulative NYAD with two exponential moving averages (EMAs): the 21-day and 34-day. The NYSE index is in green with Elliot Wave labeling.

Today the cumulative NYAD dropped below both of the EMAs and therewith signals the market has entered a correction. In fact, the orange circles show the last two times, since the February 2016 low, when the NYAD dropped below both EMAs: both were longer and deeper corrections. It is thus logical to conclude the market is currently experiencing a similar longer and deeper correction. This is in line with my preferred view of the market where I've anticipated a larger top for quite some time: see here and here for example.

One of my market-breadth based buy/sell indicators already switched to sell last Friday (August 4) after several days of dismal breadth (negative) made it flip from buy/long to sell/short, which I alerted my premium members to in my weekend update; avoiding them a lot of the current pain many are experiencing now.

Together with the cumulative NYAD entering corrective mode, the weight of the evidence is therefore mounting for a larger correction, especially since the S&P 500 reversed on Tuesday at SPX2491, which is exactly from within the ideal target zone of SPX2488-2502 I forecasted in my earlier post. I will provide an update on this breadth-based buy/sell indicator next week.