NxStage Medical, Inc. (NASDAQ:NXTM) recently announced the regulatory approval of its System One platform by the FDA for solo home hemodialysis treatment. The company has also announced that it will provide patient training for this new indication later this year and in 2018.

System One has been a flagship platform of NxStage contributing significantly to the company’s top line. The latest development in the System One platform is exclusively formulated for both new and existing System One patients to reduce transportation costs, re-hospitalization rates and provide dialysis care on site. In fact, solo home hemodialysis eradicates the need of a care partner during the treatment procedure. Notably, the company got the first and only home nocturnal hemodialysis clearance way back in 2014.

Per management, globally, a number of patients failed to opt for home hemodialysis to date due to the absence of a care partner to help them during the process. The latest regulatory go-ahead is likely to lend NxStage a competitive edge and expand its patient base with solid access to the clinical benefits associated with home hemodialysis.

NxStage Partners Dialyze Direct for On-Site Dialysis

The latest regulatory progress closely follows another solid development in NxStage’s Dialysis platform. Earlier this month, the company announced that its subsidiary NxStage Kidney Care is partnering Dialyze Direct for supporting the needs of patients who need on-site skilled-nursing facilities (SNF) for dialysis treatment in Ohio. NxStage will now leverage on its System One platform and Dialyze Direct’s unique model for treating geriatric SNF patients with end stage renal disease (ESRD).

NxStage to Be Acquired

Earlier this month, German dialysis provider Fresenius Medical Care (FMS) signed an agreement to acquire all outstanding shares of NxStage for $30 a share. The transaction has been valued at $2 billion and is subject to close by 2018, on approval of NxStage stockholders and other customary conditions. We note that NxStage has been gaining prominence in the market of late with products like NxStage PureFlow SL Dialysis Preparation System, Nx2me Connected Health and NxStage System One.

Market Trends Buoy Optimism

Data from Markets And Markets reveal that the global hemodialysis and peritoneal dialysis market is expected to reach a worth of $83.89 billion by 2021, at a CAGR of 6.0%. NxStage’s continuous effort to bolster its Dialysis unit is likely to be benefitted by the bountiful prospects in the niche space. Furthermore, an increased rate of ESRD cases enhances probabilities of NxStage outperformance in the niche space in the near term.

Share Price Moves Up

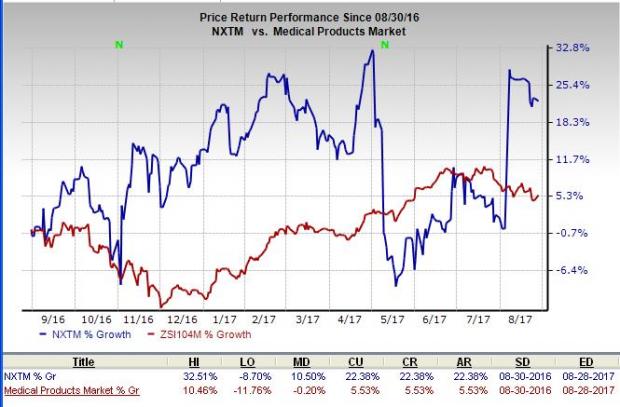

Over the past one year, NxStage has added 22.4%, comparing favorably with the S&P 500’s 11.9% over the same time frame. Furthermore, the current level was way higher than the broader industry’s gain of just 5.5% over the same time frame.

NxStage carries a Zacks Rank #3 (Hold).

Key Picks

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corp. (NYSE:EW) , IDEXX Laboratories, Inc. (NASDAQ:IDXX) and Cogentix Medical, Inc. (NASDAQ:CGNT) . Notably, Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while IDEXX Laboratories and Cogentix Medical have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences delivered an average earnings beat of 10.8% over the trailing four quarters. The company has a long-term expected earnings growth rate of 15.2%.

Cogentix Medical registered a positive earnings surprise of 200% in the last reported quarter. The stock represented a stellar return of 71.5% over the last one year.

IDEXX Laboratories delivered an average earnings beat of 9.3% over the trailing four quarters. It has a long-term expected earnings growth rate of 19.8%

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Cogentix Medical, Inc. (CGNT): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

NxStage Medical, Inc. (NXTM): Free Stock Analysis Report

Original post