NVR, Inc. (NYSE:NVR) , one of the nation’s largest homebuilding and mortgage-banking companies, reported second-quarter 2017 earnings of $35.19 per share, surpassing the Zacks Consensus Estimate of $28.63 by 22.9%. The reported figure also rose 60% from the year-ago profit level of $22.01 per share.

Total revenue (Homebuilding & Mortgage Banking fees) was $1.54 billion in the quarter and increased 11% year over year, driven by higher housing revenues and mortgage-banking fees.

Segment Details

Homebuilding: In the reported quarter, homebuilding revenues rose 11% year over year to $1.51 billion.

New orders climbed 8% to 4,678 homes, driven by demand growth in the housing markets served by NVR. Settlements increased 9% year over year to 3,917 units. Average sales price was $377,000, down 2% from a year ago due to a shift in new orders from higher priced markets to lower priced markets.

At the end of the reported quarter, average community count was 491, up 1.7% year over year.

The company’s backlog totaled 8,813 homes (as of Jun 30, 2017), up 9% year over year. Potential housing revenues from backlog increased 10% to $3.44 billion.

Margins

Homebuilding gross margin expanded 220 basis points (bps) to 19.5%, owing to a modest improvement in pricing along with moderating construction costs.

As a percentage of homebuilding revenues, selling, general and administrative expenses (SG&A) were 6.6%, down 70 bps year over year.

Homebuilding operating margin increased 300 bps year over year to 13%.

Mortgage Banking: In the quarter, Mortgage banking fees grew 20.5% year over year to $31.8 million. Mortgage closed loan production in the quarter totaled $1.04 billion, reflecting an increase of 11% year over year.

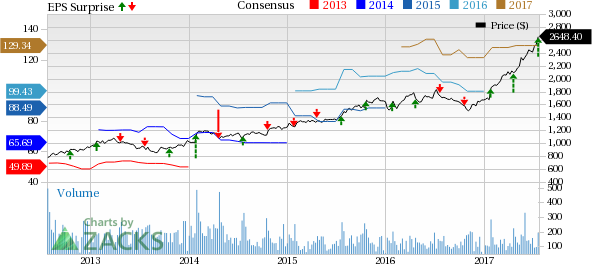

NVR, Inc. Price, Consensus and EPS Surprise

Financials

NVR’s cash and cash equivalents totaled $518.5 million as of Jun 30, 2017, compared with $395.4 million as of Dec 31, 2016.

Zacks Rank

NVR currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Upcoming Releases in the Construction Sector

Masco Corporation (NYSE:MAS) is slated to release its quarterly results on Jul 27. The Zacks Consensus Estimate for earnings is pegged at 60 cents, showing an increase of 29.8% year over year.

PulteGroup, Inc. (NYSE:PHM) is slated to release its quarterly results on Jul 25. The Zacks Consensus Estimate for earnings is 45 cents, highlighting an increase of 20.7% on a year-over-year basis.

Louisiana-Pacific Corp. (NYSE:LPX) is scheduled to release its quarterly numbers on Aug 1. The Zacks Consensus Estimate for earnings is pegged at 61 cents, reflecting an increase of 116.7% on a year-over-year basis.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Masco Corporation (MAS): Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX): Free Stock Analysis Report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Original post

Zacks Investment Research