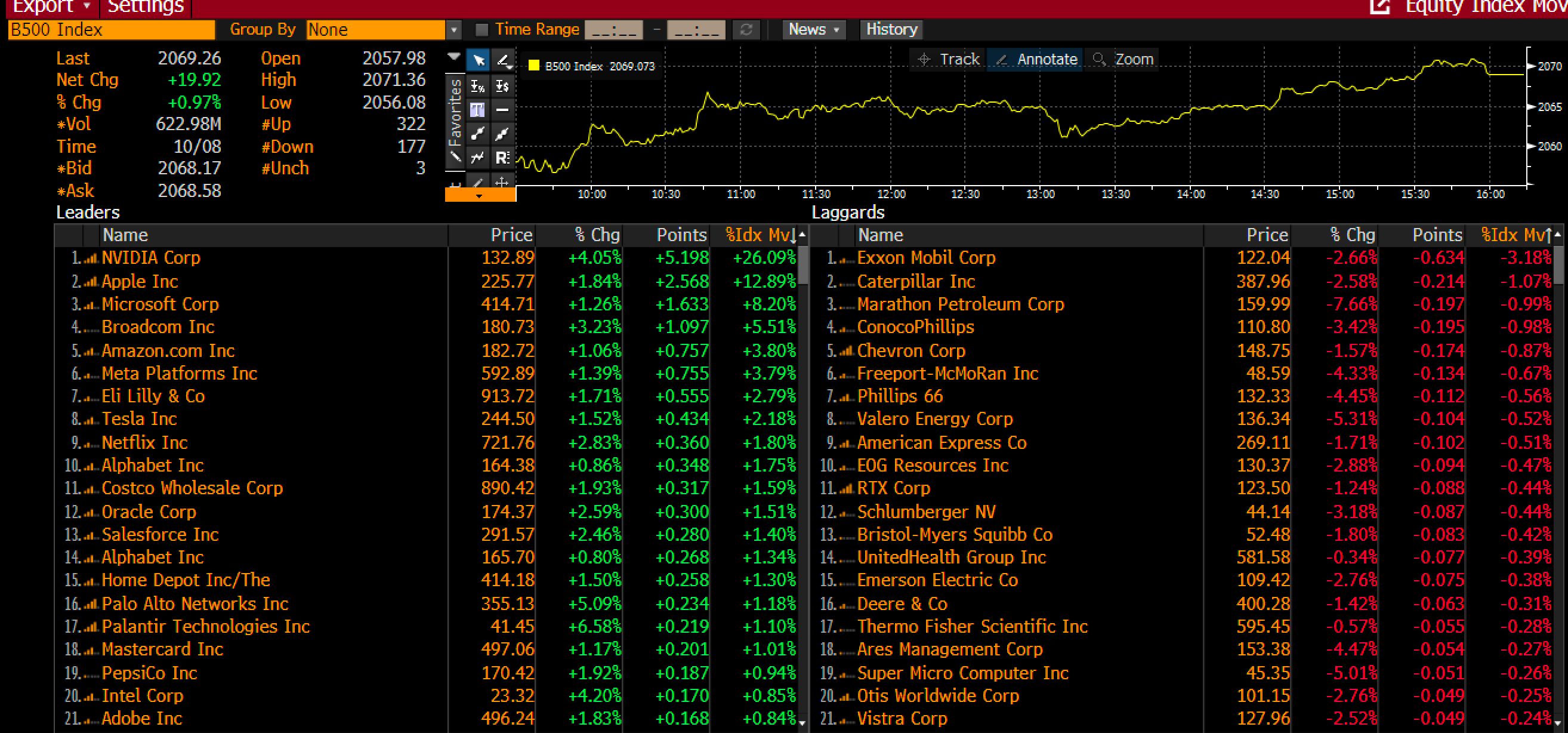

Stocks ended the day higher, recovering all of yesterday’s losses and closing up by about 1%. Nvidia (NASDAQ:NVDA) played a key role in driving the rally, climbing more than 4%.

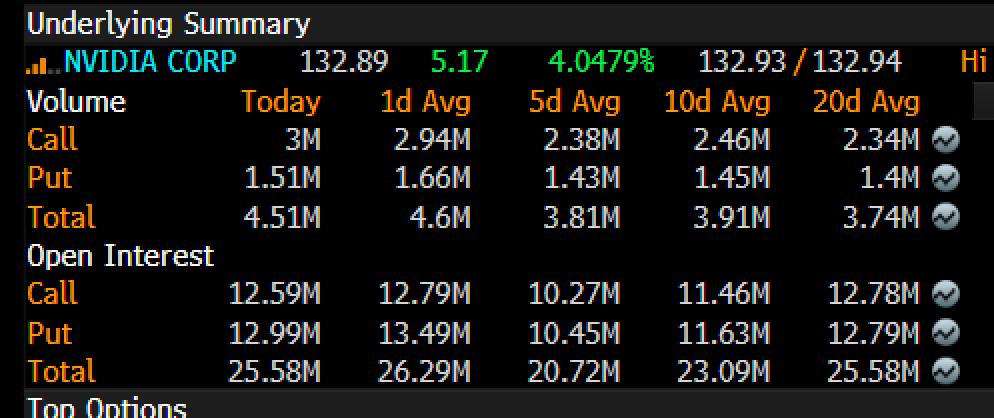

Over 3 million Nvidia call options were traded, well above the 20-day average of 2.3 million contracts.

(BLOOMBERG)

I point this out because, despite the surge in its price, Nvidia’s trading volume was relatively average yesterday. This suggests that much of the stock’s movement is driven by options trading rather than traditional share purchases.

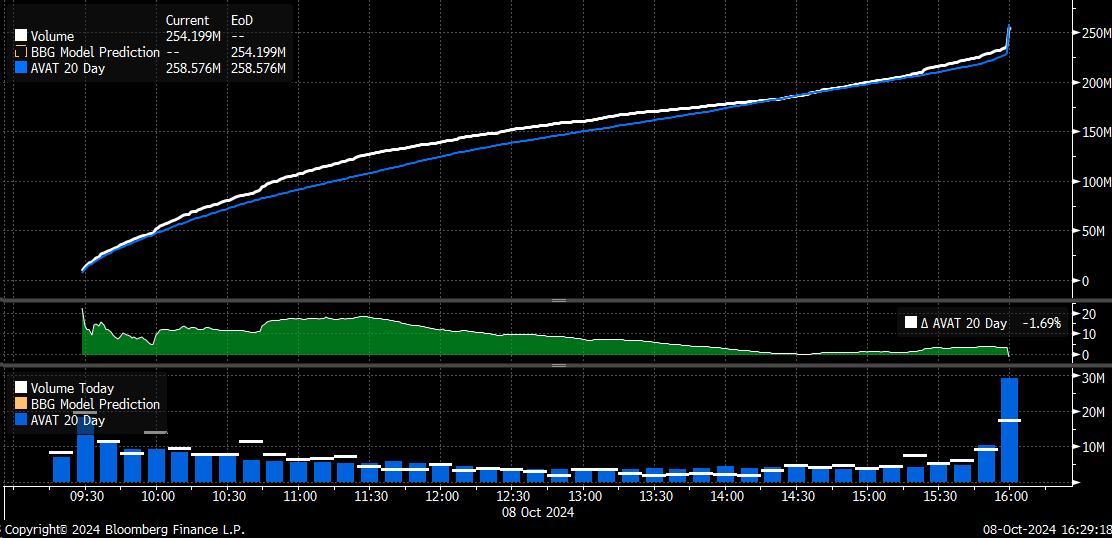

Additionally, we can see that by around 2 PM, the trading volume in Nvidia began to fade and drift below the 20-day moving average.

(BLOOMBERG)

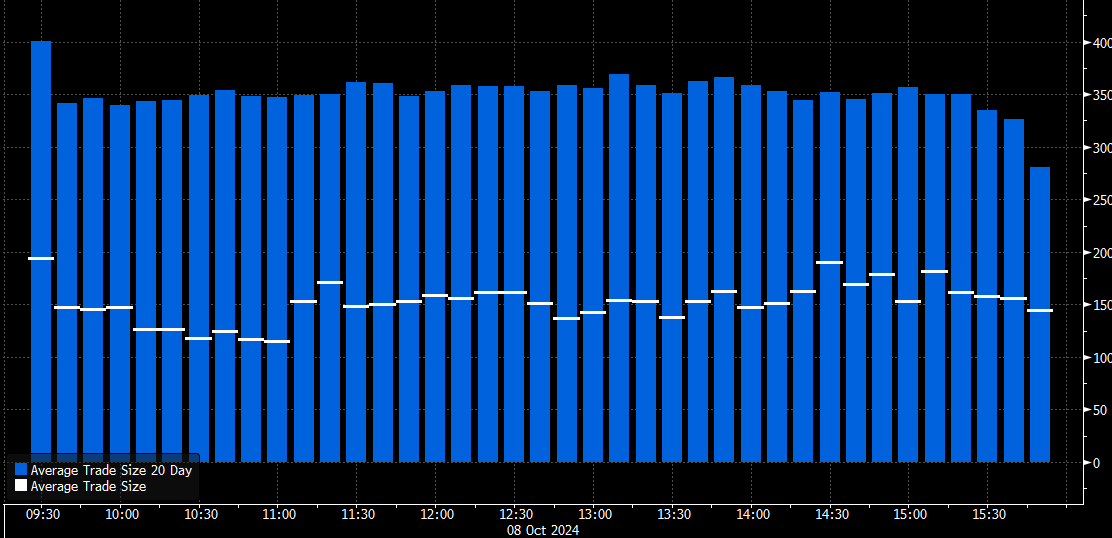

The average trade size was also half the 20-day moving average.

(BLOOMBERG)

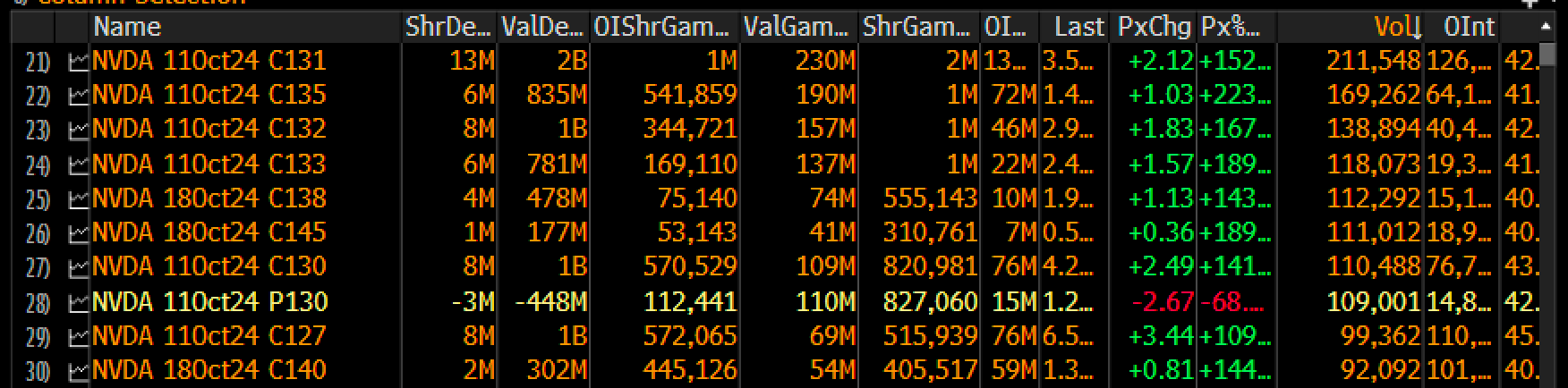

Meanwhile, most of yesterday’s call volume was for options expiring this week. This suggests the stock is driven by investors scrambling to gain short-term exposure rather than speculating on a sustained upside.

In a way, these investors are gambling on daily price fluctuations. The concern is that once this call volume fades, the stock price could revert to lower levels, potentially dragging the entire S&P 500 down.

(BLOOMBERG)

While the stock may appear to have technically ‘broken out,’ I guess once the call volume subsides, the stock will stall and revert to lower levels.

Nvidia accounted for almost 25% of the Bloomberg 500’s move yesterday, which is a proxy for the S&P 500.

(BLOOMBERG)

Meanwhile, the equal-weighted version of the S&P 500 was only up by 24 basis points yesterday, highlighting the divergence between it and the broader index on a day like yesterday.

S&P 500: Gap-Fill Ahead?

In the meantime, we continue to see these strange overnight S&P futures trading patterns, resulting in frequent gaps after sharp rallies or sell-offs in the final hour of trading.

Yesterday was another example—after the day before yesterday’s sell-off, we gapped higher. The pattern has been that these gaps tend to get filled relatively quickly.

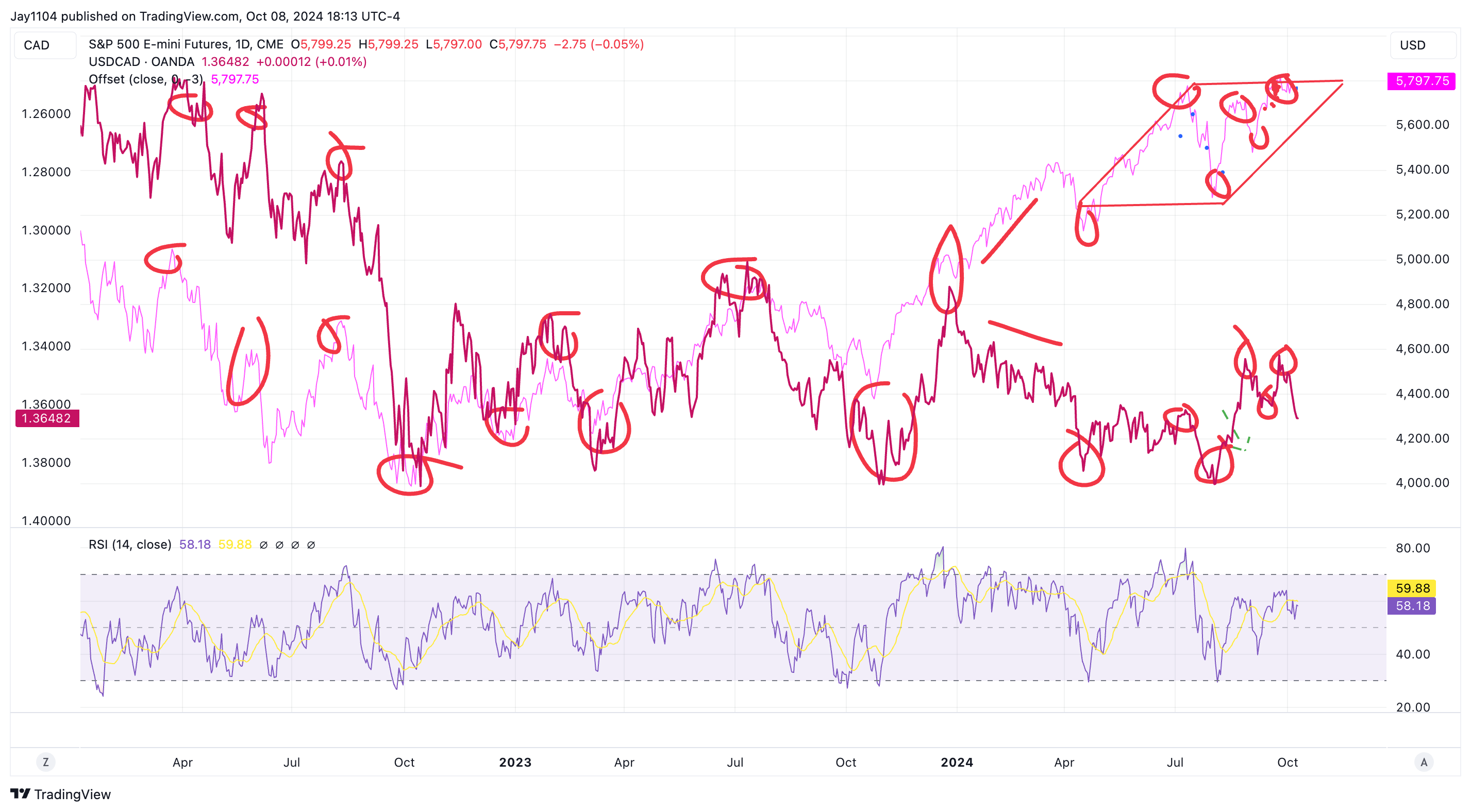

USD/CAD - S&P 500 Correlation

An interesting development is that the USD/CAD has weakened over the past few days. If you invert the USDCAD chart and shift the S&P 500 back by three days, you’ll see a strong correlation between the two.

When the USD/CAD tops, the SPX tends to bottom, and when the USD/CAD bottoms, the SPX tops. The one notable exception to this pattern was around January 2024.

Finally, it is worth pointing out that, based on my model, reserve balances have not bounced back to levels before quarter end, which is why I think liquidity in the market has been so bad recently.

(BLOOMBERG)