Technology has always been pivotal in global economic development. Businesses and government institutions capitalize on it to enhance productivity and generate higher returns. If there’s one thing that doesn’t stop here, it will be evolution.

Today, artificial intelligence (AI) is at its pinnacle as it revolutionizes the business sector and the capital market. As of 2022, the AI industry is valued at $454.12B.

Given all this, investors are becoming more attracted to AI stocks. Whenever you hear it, one of the most adept companies leading this trend is Nvidia (NASDAQ:NVDA). This tech giant plays an integral role in making technology a reality to a great extent.

However, buying Nvidia today can be challenging for many, especially newbies. NVDA is already a giant with an elevated valuation and a market capitalization of $3.1T. It can be pricey at $123.99 because it is traded at a PE Ratio of 73.83x.

Meanwhile, its price/sales ratio is 39x, which means you have to pay $39 for every $1 of the company's revenue. Additionally, it only has a dividend yield of 0.02%, so for every $1 you pay, you only receive $0.002 or 0.20 cents. This makes it logical for investors to doubt its capacity to sustain its growth pace.

With that, you may be wondering about its potential alternatives. Thankfully, there are plenty of AI stocks you can choose from. Although current returns are not as high as NVDA’s, their potential to increase in the long run is enticing.

In this article, we will cover some alternatives for Nvidia and why you should buy them.

Why Buy AI Stocks

AI is poised to transform investing behaviors and business processes worldwide. Although many skeptics continue to scrutinize its potential, its advantages remain evident. As such, it continues to capture more demand, allowing it to expand across other industries.

With this increased viability, AI stocks have more appealing growth prospects today. These are the reasons you should buy AI stocks today.

The AI industry will keep expanding

With a market size of over $400B, the AI industry has already made significant progress. Yet, its journey does not end here. AI continues to evolve as it becomes more crucial in businesses and financial markets. It becomes a staple for optimizing workflows and realizing economies of scale by removing redundancies.

Through AI, businesses may enjoy higher revenues and earnings as it may increase productivity and efficiency.

AI may see an influx of customers as we expect more businesses and individuals to use it in the long run. With a CAGR of 19%, we project its market size to expand to $2.6T by 2032. Given this, AI stocks may become more viable, driven by higher revenues and larger operating capacity. These may support the price uptrend, allowing investors to enjoy higher returns.

AI stocks in North America may reap the most benefits, comprising nearly 40% of the global market share. Asia-Pacific companies may follow the trend with a CAGR of 20%. Hence, we can expect a bullish trend and sustained dividend payments.

Higher returns for AI stocks

Concerning historical returns, NVDA is already a winner, with a 28,000% price increase over the past decade and a nearly 200% increase in the past year, making it a viable stock no matter our economic conditions.

Unsurprisingly, AI stocks are often considered inflation hedges along with cryptocurrencies and TIPS. Thankfully, many overlooked AI stocks have had impeccable returns over the years.

For instance, Meta Platforms (NASDAQ:META) had risen 727.97% over the past decade. But among the alternatives in the table below, Advanced Micro Devices (NASDAQ:AMD) had the best returns in ten years. It increased by over 3,000%.

Other alternatives, such as Arista Networks (NYSE:ANET), ServiceNow (NYSE:NOW), and Alphabet (NASDAQ:GOOG), also had huge returns. The industry increased by 1700% on average, so buying AI stocks has always been profitable.

Even better, they outperformed the S&P 500 (SPX), which has only increased by 181% in ten years. If we annualize their returns, AI stocks rose by at least 24% yearly or twice the returns of the S&P 500 average.

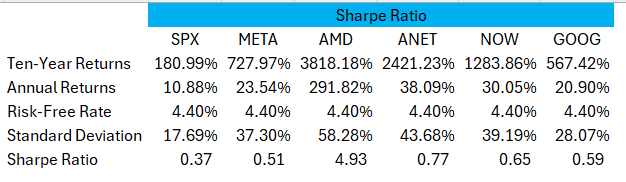

Meanwhile, their standard deviation or volatility has been noticeable. It is at least twice the volatility of SPX. We can attribute it to their sharp price increase over the years. Their market appeal and expansion have driven the massive increase in their prices. We can use the Sharpe Ratio, Treynor Ratio, and Jensen’s Alpha to confirm this.

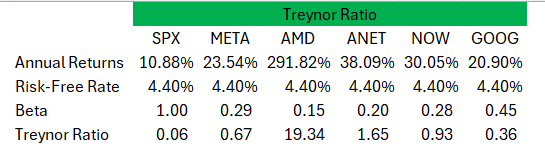

Using the Sharpe ratio, we can see that AI stock price returns outweigh volatility. Their ratios are also much higher than those of SPX. The same can be seen using the Treynor Ratio.

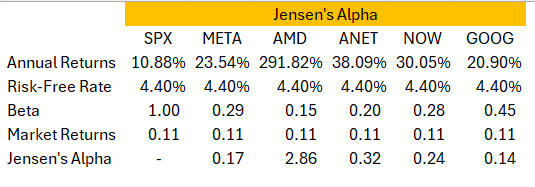

The last test, Jensen’s Alpha, can be the best measure since it shows the direction of the price trend and the degree of the price variation versus market returns. Since we compare the S&P 500 to itself, it automatically has a Jensen’s Alpha of 0.00. Meanwhile, the remaining stocks have a higher alpha, which shows that they outperformed the market.

Additionally, AMD has noticeable ratios. The values are far higher than those of its peers. Hence, it has had the best performance over the past decade.

Aside from price returns, we can also appreciate their dividend yields, particularly META's 0.40% and GOOG's 0.11%. These are much higher than NVDA's, proving they are cheaper than this AI giant.

Increased AI adoption in banking and finance

Banking and finance is a fundamental part of the global economy. They control cash flows across businesses and even capital markets. As such, they must maintain solid and efficient technology to manage multiple and cross-border transactions.

AI, combined with blockchain technology, may transform banking products and services. For instance, it can automate transactions and store them while maintaining the anonymity of every client.

Even better, they can help expedite the verification and approval of loan applications. AI and blockchain can automate the processes involved here, be it mortgage, business, or private loans for college. They can automatically generate smart contracts and verify information, eliminating the need for a third party.

With that, other industries will also consider using these technologies, allowing AI to enter new niches.

AI adoption in investing

Online stock investing has reshaped financial markets by enhancing trade execution and influencing investor behaviors. Even inexperienced investors and students can enter and conquer the market with AI. These apps offer data-driven analysis and recommendations to make well-informed decisions.

While risks may not be eliminated, biases are limited since AI focuses on actual market and economic data. In the long run, other financial markets will adhere to this trend as they adopt new technologies. This can open more opportunities for AI to penetrate more industries.

Economic recovery

After four years, the economy has started to stabilize. The decreasing inflation and normalizing consumption allow the Fed to maintain rate hike pauses. If the trend goes on, rate cuts may follow. This may be beneficial for consumption, investing, and borrowing. In turn, business expansion and innovation may follow.

The rebounding economy may drive AI stock price increases. AI stocks will also enjoy positive spillovers as the stock market heats up amid increased capital inflows. The increased demand may also support them as more businesses regain footing and adapt to the digital revolution.

Top 5 AI Stocks To Consider

Nvidia continues to reign in the world of AI, but many alternatives are emerging and showing their potential to compete with this giant. They’re also much cheaper today, so finding an entry point can be more accessible. The list includes the stocks we analyzed earlier, which we believe will not face oversaturation.

1. Advanced Micro Devices, Inc. (AMD)

- Stock Price: $159.47

- Market Capitalization: $255B

- Advanced Micro Devices, Inc. (AMD) is the first stock in our pecking order.

This stock creates many GPUs, CPUs, and embedded chips. Like many companies, it also had its fair share of challenges that pushed it to the brink of bankruptcy about a decade ago. But its resilience proved it could bounce back and exceed expectations years later. Thanks to its then-new CEO, Lisa Su, it was able to dominate its GPU and gaming front segments and capture large clients, such as Sony (NYSE:SONY) Playstation and Microsoft’s Xbox.

When the AI wave started, its AI chip offerings boosted the data center segment revenue by 80% YoY. At the end of FY23, its revenue was already 240% higher than pre-pandemic levels.

During 1Q24, sales reached $5.47B, a 2% YoY increase. While this seemed insignificant, AMD had improved efficiency with a 6% YoY decrease in operating costs. So, it had a gross profit margin of 40% versus 34% last year, showing economies of scale. We can confirm this in its FCF/Sales Ratio, which went from 5% to 7%. As such, it could turn more of its revenues into free cash.

AMD has solid fundamentals, given its stable cash levels of $6B, equivalent to 35% of its current assets. This amount is also enough to pay all its borrowings and accounts payable simultaneously. As such, AMD can expand further and make dividend payouts without leveraging debt and share issuance.

Moreover, the stock price is near Nvidia's, making it the cheapest on this list. We can confirm it using its Price/Book Value or PB Ratio of 4.59x. Indeed, it is reasonable relative to its intrinsic value.

We can also check its historical price and book value to show how it has changed. This can also help us assess whether the price is fairly valued. We did it by averaging the daily price for every year.

After finding the values and ratios for every year, we got a target price of $200.14, showing that the recent price remains cheap and undervalued relative to previous prices. It is also inexpensive relative to the book value. With that, the stock price has a 26% upside potential. So, the current price is a good entry point for buying.

2. Meta Platforms, Inc. (META)

- Stock Price: $519.56

- Market Capitalization: $1.30T

Meta Platforms, Inc. is known for its unmatched cutting-edge consumer-facing product development prowess. It was further fortified after launching its Meta AI assistant in 1Q24. Since then, the business has seen millions of people adopt or try this solution. The Llama 3 language model features image and video generation, language understanding, and animations.

In addition, the company remains a staple on the internet with its social media platforms, Facebook and Instagram. These are mainly used for interaction among billions of users. Also, they serve as digital marketing platforms that earn through subscriptions and advertising fees. Given its current trajectory, it may remain dominant on the internet.

These things are highlighted in its solid topline growth. Revenues have consistently increased over the years. As of 1Q24, its sales reached $36.46B, a 27% YoY increase. Given its well-managed costs and expenses, it maintains its efficiency. Hence, its operating margin is 39% versus 29% in 1Q23.

Like AMD, META is a highly liquid company. Its cash amounts to $58B, or 77% of the current assets and 26% of the total assets. This can also cover all its borrowings and current liabilities, allowing it to sustain its dividend payments.

The only drawback is that the stock price appears expensive at $519.56. This can be daunting for those who will not bother to do stock valuation. However, the price is reasonable if we check it with important metrics. It has a PE Ratio of 29.84x, much lower than NVDA and AMD. The ratio is the second-lowest among the stocks on this list. As more businesses and individuals adopt AI and join social media platforms, the stock price uptrend may be supported.

3. ServiceNow, Inc. (NOW)

- Stock Price: $774.13

- Market Capitalization: $155T

ServiceNow, Inc. (NOW) can also be daunting as investors must pay $774.13 for every share. Yet, it is one of those companies with the most substantial growth prospects and business model.

With its engagement in workflow automation for digital businesses, NOW is poised to capture more clients. E-commerce is expanding, while hybrid work setup has become more prevalent. These trends will increase the demand for cloud-based solutions to ensure productivity. They are crucial for businesses without brick-and-mortar establishments, which has increased since the pandemic. We expect more SMBs to enter the market in FY25 as the global economy regains its footing.

AI solution providers like ServiceNow may enjoy more demand as the business sector rebounds. It may see higher revenues and income, which can put upward pressure on the stock price.

For instance, its 1Q24 sales rose by 24% year over year, while costs and expenses remained relatively stable. Thus, its income margins also expanded.

NOW remains well-capitalized and highly liquid, as its healthy Balance Sheet shows. Its cash of $5.1B comprises 29% of the total assets and is more than twice the amount of its borrowings.

4. Alphabet, Inc. (GOOG)

- Stock Price: $186.86

- Market Capitalization: $2.28T

There are five reasons you should consider buying Alphabet, Inc. (GOOG).

First, it is relatively cheaper than all the stocks on this list. At $186.86, it is traded at a PE Ratio of only 28.54x. It also has the second-lowest PB Ratio of only 7.83x. If we assess it using the PB Ratio, we will derive a target price of $224.52, 20% higher than the current price. GOOG is undervalued.

Second, it continues to lead AI research with its transformer method, which paved the way for ChatGPT’s success.

Third, it is an internet staple, particularly for YouTube and Google (NASDAQ:GOOGL) Search.

Fourth, it offers a wide range of products and services, allowing it to capture various niches. Unsurprisingly, it remains the second-largest technology business by revenue, which continues to increase.

It maintains double-digit revenue growth. In 1Q24, its revenue increased 15% YoY to $80.47B. Given its manageable costs and expenses, it remains a great model for efficiency. So, its operating margin increased from 28% to 33%.

Fifth, it is a high-moat stock or a business free from competition due to its strategic network effects and solid brand recognition. However, Alphabet does not let its guard down as it remains liquid with over $100B in cash. Hence, it can pay borrowings on time, finance expansion, and sustain dividends.

5. Arista Networks, Inc. (ANET)

- Stock Price: $347.95

- Market Capitalization: $104B

Arista Networks, Inc. (ANET) is relatively newer than the other companies on our list. But it has already proven itself to be a worthy candidate. With its cloud networking solutions, it remains integral in ensuring business continuity and workflow efficiency all the time. It is more critical today as remote work and revenge travel take over.

Its sturdy market positioning is evident in its impressive core operations. It maintains double-digit revenue growth, which reached 16% during the first quarter. Also, it continues to enhance its productivity to generate higher returns, as evidenced by its operating leverage of 39%, up from 37% last year.

Both fixed and variable costs are increasing as the company expands. However, the latter’s change is relatively flatter, which shows that ANET is realizing economies of scale. As such, it enjoys an operating margin of 42%, up from 35% in the previous year.

Its high liquidity can help it capitalize on economic recovery and increased business openings. Its cash of $5.01B is equivalent to 50% of the total assets and can cover all liabilities at a single payment. So, sustaining its expansion in the long run is possible. Hence, it can generate more revenue and earnings, further increasing the stock price.

Key Takeaways

AI continues to revolutionize business operations and investing platforms. As it becomes a staple to enhance efficiency and accuracy, it can capture more demand. As the economy rebounds, more businesses and investors may enter, providing more opportunities for AI solution providers. Hence, AI stocks are excellent buys.