In a bid to expand its advanced materials science range, NuVasive, Inc. (NASDAQ:NUVA) recently announced the Vertera Spine buyout. However, the terms of the acquisition agreement have been kept under wraps.

NuVasive, a pioneer in applying procedurally-integrated solutions for minimally disruptive spine surgeries, aims to market and distribute Vetera Spine’s FDA-approved COHERE Cervical and COALESCETM Lumbar Interbody fusion devices in the United States. This deal will also lend the company a three-dimensional porous interbody technology across both polyetheretherketone (PEEK) and titanium materials. Notably, the company has introduced a few new features in its Modulus XLIF built on a fully-porous titanium implant created in a three-dimensional manufacturing process and designed to match the porosity and stiffness of bone.

We encouragingly note that the company’s U.S. Spinal Hardware business, comprising implants and fixation products, MAGEC-EOS spinal bracing and lengthening system and the PRECICE limb lengthening system, registered 3% growth in the last reported quarter. NuVasive is leaving no stone unturned to gain traction in the fast growing spine market. In this regard, the company has been steadily focusing on product development. Moreover, the company claims to have an active corporate development pipeline that includes a number of strategic investments, acquisitions and partnership opportunities. Notably, during the first quarter of 2017, the company launched the first two interbody devices, MLX and TLX, used in lumbar fusion procedures.

Per a report from BECKER’s SPINE REVIEW, the global minimally-invasive spine surgery market is expected to witness a CAGR of 7.6% between 2017 and 2021. Also, per a report by Technavio, the global spinal implants market is expected to witness a CAGR of roughly 6% in the 2016-2020 period.

Thus, given the current market potential, we believe that the company is on the right track to gain traction.

We believe an ageing population, unhealthy lifestyle and rising awareness and expenditure in healthcare will continue to drive growth in the minimally-invasive spine surgery market. However, this market is dominated by many well-established players like Stryker Corporation (NYSE:SYK) and Zimmer Biomet Holdings, Inc. (NYSE:ZBH) . Notably, Stryker provides a range of products with ES2 Spinal systems, MANTIS implants, LITe Decompression tubes and many more under its minimally invasive spine surgical solutions portfolio. Moreover, Zimmer Biomet’s range of thoracolumbar products forms a comprehensive portfolio for minimally-invasive spine surgery.

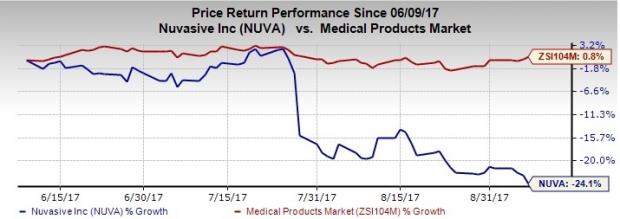

Over the past three months, NuVasive has underperformed the broader industry. In this period, the company has lost 24.1%, as compared to the 0.8% gain of the broader industry. We expect the company to make a comeback with the latest developments.

Zacks Rank & Key Pick

NuVasive carries a Zacks Rank #3 (Hold). A better-ranked medical stock is Edwards Lifesciences Corporation (NYSE:EW) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has rallied roughly 20.7% over the last six months.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Stryker Corporation (SYK): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

NuVasive, Inc. (NUVA): Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH): Free Stock Analysis Report

Original post