Nutrien Ltd (NYSE:NTR) is the largest producer of potash and the second largest producer of nitrogen fertilizer in the world. The company is also the largest agricultural retailer in North America with 1,400 locations, selling their products and other products.

Based in Canada and formed from the merger of PotashCorp and Agrium in 2018, Nutrien has many competitive advantages. As one of the lowest-cost producers with great scale and direct retail distribution, they have carved out a narrow moat for themselves in the industry.

Trading at a reasonable 17x forward P/E ratio during a period of low fertilizer prices, I consider them relatively attractive at the current time.

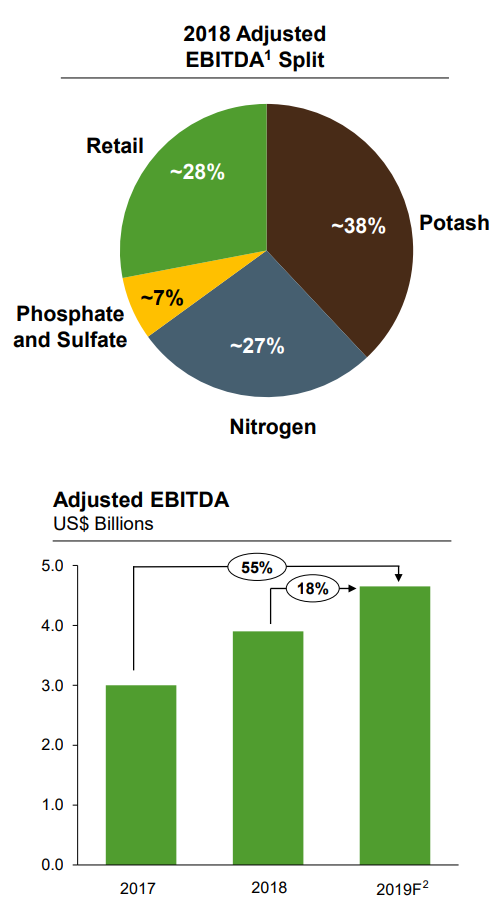

Their earnings are growing and relatively diversified:

Chart Source: Nutrien Bank of America Merril Lynch February 2019 Presentation

Because the company is newly-formed from their recent merger, one of the greatest opportunities is to save money by exploiting synergies (aka minimizing redundancies) and divesting non-core assets. The company expects to save hundreds of millions of dollars as the two companies fully become one entity and is using that money for growth, targeted acquisitions, buybacks, and dividends.

Chart Source: Nutrien Bank of America Merril Lynch February 2019 Presentation

Nutrien’s Opportunity

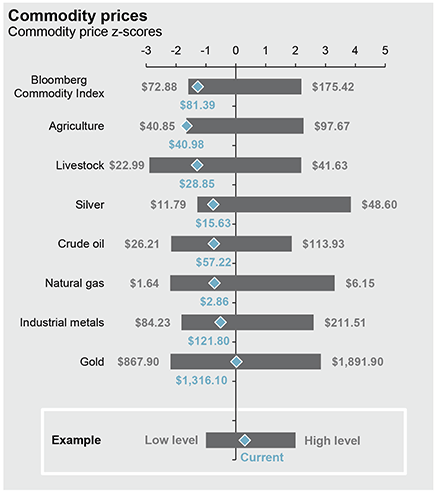

Right now, commodities, in general, are cheap, and agricultural commodities are the cheapest:

Chart Source: J.P. Morgan Guide to the Markets 1Q2019

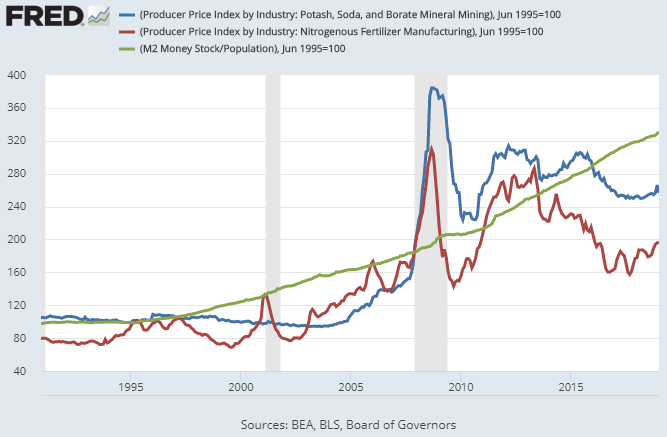

Fertilizer prices (blue and red lines) are near decade lows, and have lagged the growth pace of broad money supply per capita (green line), which I often use as a back-of-the-envelope valuation comparison for commodities:

Chart Source: St. Louis Fed

Furthermore, Nutrien has a rather low bar to step over. It pays a 3.2% dividend yield and buys back considerable amounts of its own stock, which boosts earnings per share and dividends per share. This allows it to potentially give good calculated returns whether or not it has significant top-line growth as long as fertilizer prices don’t go too low.

Key Risks

Commodity producers are inherently risky because they can control their costs to some extent but can’t really control the price of their own product. A commodity is by definition not unique, so the price is purely determined by supply and demand.

The more consolidated an industry is, the more power suppliers have to keep supply in check and prices high. But this is inherently a fragile state of affairs and most commodity producers don’t have much of a moat. A few key players like Nutrien, however, have such scale and low cost of production that they can be considered to have a narrow moat.

Additionally, Nutrien’s large retailer business provides the company with diversification. In addition to selling fertilizer, they sell seeds and specialty products. The agricultural retail industry is highly fragmented, and as Nutrien acquires and consolidates parts of the industry, they may enjoy more favorable buying power from product producers.

Nutrien has about $9 billion in debt, or less than $7 billion in net debt when cash is backed out. This is neither particularly high or low; the company uses substantial leverage but at a level in line with this sort of asset-heavy industry.

One of the most useful aspects of Nutrien is that their risks are very different than most other companies. The majority of businesses are tied to the economic cycle; they have good returns during economic expansions but face severe risks during economic recessions. Fertilizer is not a very economically-sensitive commodity, because people need to eat either way. Fertilizers follow their own unique supply and demand cycle, which gives Nutrien somewhat less correlation to a broad index like the S&P 500 than many other companies in other industries have.

Final Thoughts and Fair Value

I’m a buyer of Nutrien anywhere under $50. A 3% dividend yield, 3-5% buyback yield, and 3% topline growth can potentially give 9-11% annual returns.

After this recent run-up in price, it may be worth waiting for a dip. It’s a good stock to put on your watch list to see if you can snag it at a discount.

It should be stated that commodity producers shouldn’t make up a large percentage of most portfolios. They can have explosive upward potential during commodity supercycles, but overall it is a very rough business and it’s hard to generate consistently good returns on invested capital (ROIC).

Nutrien is as its best when it is held as a small portion of a portfolio. Investors can take advantage of its limited correlation with other stocks to diversify their portfolios, especially late in the business cycle when many other stocks are highly-valued.

Disclosure: Author is long NTR.