Novo Nordisk (CO:NOVOb) A/S (NYSE:NVO) announced that the Canadian regulatory authority has approved its basal insulin, Tresiba, for the once-daily treatment of adults with diabetes mellitus to improve glycemic control. Notably, Tresiba is expected to be launched in the Canadian market in October.

Tresiba is already marketed in many countries including the United States and EU. Sales of Tresiba increased 149% in local currencies in the first half of 2017.

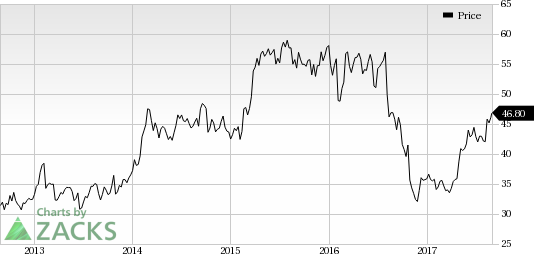

Consequently, Novo Nordisk’s shares have outperformed the industry year to date. The stock has rallied 29.9% compared with the industry’s gain of 11.3% in the same time frame.

Earlier this week, Novo Nordisk announced that the FDA has approved the label expansion of Victoza. The diabetes drug is now approved as a treatment to reduce the risk of major adverse cardiovascular (CV) events including heart attack, stroke and CV death, in adults with type II diabetes and established CV disease.

The FDA’s approval was based on data from the pivotal LEADER study on CV outcomes, which evaluated the drug in more than 9,300 people with type II diabetes at high risk of major CV events. Markedly, the data from the study demonstrated that Victoza significantly reduced the risk of CV death. The drug lowered the risk of non-fatal heart attack or non-fatal stroke by 13% compared with placebo and showed an absolute risk reduction of 1.9%.

We believe the Canadian approval for Tresiba and the label expansion for Victoza should improve the diabetes revenues of the Danish phama giant going forward.

Zacks Rank & Stocks to Consider

Novo Nordisk currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in health care sector include Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) , Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Aduro BioTech, Inc. (NASDAQ:ADRO) . While Alexion and Regeneron sport a Zacks Rank #1 (Strong Buy), Aduro holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates have moved up from $5.57 to $5.61 for 2017 and from $6.90 to $6.92 for 2018 over the last 30 days. The company delivered positive earnings surprises in each of the trailing four quarters, with an average beat of 11.12%. The share price of the company has increased 13.7% year to date.

Regeneron’s earnings per share estimates have increased from $12.84 to $14.78 for 2017 and from $15.32 to $16.21 for 2018 over the last 30 days. The company pulled off positive earnings surprises in two of the trailing four quarters, with an average beat of 10.11%. The share price of the company has increased 30.5% year to date.

Aduro’s loss estimates per share have narrowed from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 for 2018 over last 30 days. The company came up with positive earnings surprises in two of the trailing four quarters, with an average beat of 2.53%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars. But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month. Learn the secret >>

Novo Nordisk A/S (NVO): Free Stock Analysis Report

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research