Novartis AG (NYSE:NVS) announced positive primary data from the phase III study, CANTOS, on pipeline candidate canakinumab (ACZ885).

The study evaluated quarterly injections of canakinumab in patients with a prior heart attack and inflammatory atherosclerosis as measured by high-sensitivity C-reactive protein. Results from the study showed that canakinumab reduced the risk of major adverse cardiovascular events (MACE) by 15%.

The study met the primary endpoint in cardiovascular risk reduction with the 150mg dose of canakinumab — the 300mg dose showed similar benefits but the 50mg dose was less efficacious. The results were presented at the European Society of Cardiology (ESC) Congress and published in The New England Journal of Medicine.

The company plans to submit data from the CANTOS study alongside initiating phase III studies in lung cancer.

We remind investors that canakinumab was first approved in 2009 for cryopyrin-associated periodic syndromes as Ilaris. In 2016, the FDA approved the label expansion of the drug to treat three rare and distinct types of periodic fever syndromes — tumor necrosis factor-receptor associated periodic syndrome, hyperimmunoglobulin D syndrome / mevalonate kinase deficiency and familial Mediterranean fever.

Meanwhile, a review of blinded, pre-planned oncology safety analyses revealed a 77% reduction in lung cancer and 67% reduction in lung cancer cases in patients treated with 300mg of canakinumab.

The successful development and commercialization of canakinumab is expected to boost Novartis’ cardiovascular portfolio significantly. The company currently has Entresto in its portfolio which has been given a Class I recommendation in the United States and EU for the treatment of heart failure with reduced ejection fraction (HFrEF).

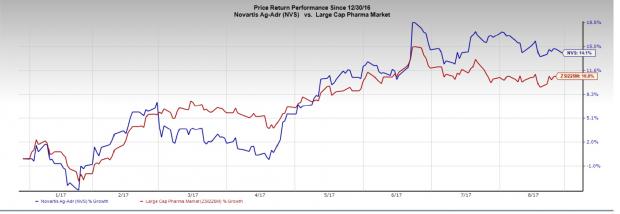

Novartis stock has rallied 14.1% in the year so far compared with the industry’s 10.8% gain.

Going forward, we expect that the approval of new drugs and label expansion of existing ones will bode well for Novartis even though stiff generic competition for key drugs like Gleevec continues to act as a major deterrent.

The European Commission recently approved Novartis’ breast cancer drug Kisqali (ribociclib) which is expected to boost its oncology portfolio even though competition is stiff with the likes of Roche Holding (SIX:ROG) AG (OTC:RHHBY) .

Zacks Rank and Key Picks

Novartis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector include Gilead Sciences, Inc. (NASDAQ:GILD) and Aduro Biotech, Inc. (NASDAQ:ADRO) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gilead’s earnings per share estimates increased from $8.31 to $8.75 for 2017 over the last 30 days. The company delivered positive earnings surprises in three of the trailing four quarters, with an average beat of 6.38%.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research