Street Calls of the Week

If you are bear, you probably couldn’t have drawn up a better outcome yesterday. The S&P 500 gapped higher and traded up all day, pushing to the 3,425, and filling the gap. The bulls tried two times to break the S&P 500 higher but failed. It resulted in a bone-crushing 80 bps point drop in the final 35 minutes of trading.

More importantly, I think this sets up a drop to 3,340, and at the very least, a retest of Tuesday’s lows. It was not the type of close you want to see as a bull.

Also, today we will get the ECB monetary policy announcement, which may or may not help stocks overall.

The outcome for the QQQs was not much better; on two occasions, they tried to break the ETF higher but failed. It sets up a potential drop back to $270 today.

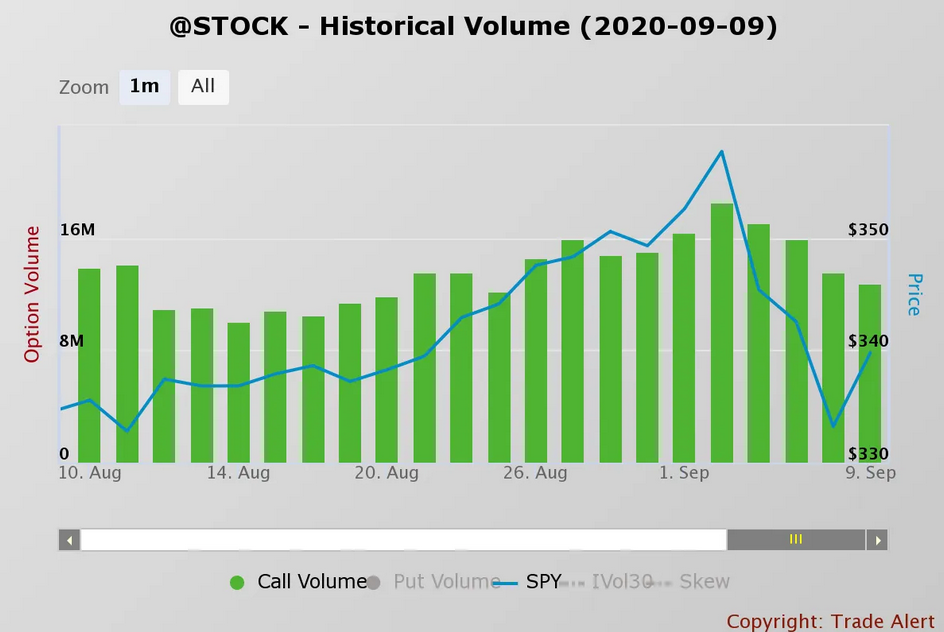

We are just not seeing the call volume return to the market like we saw in previous weeks; it has been steadily declining in recent days.

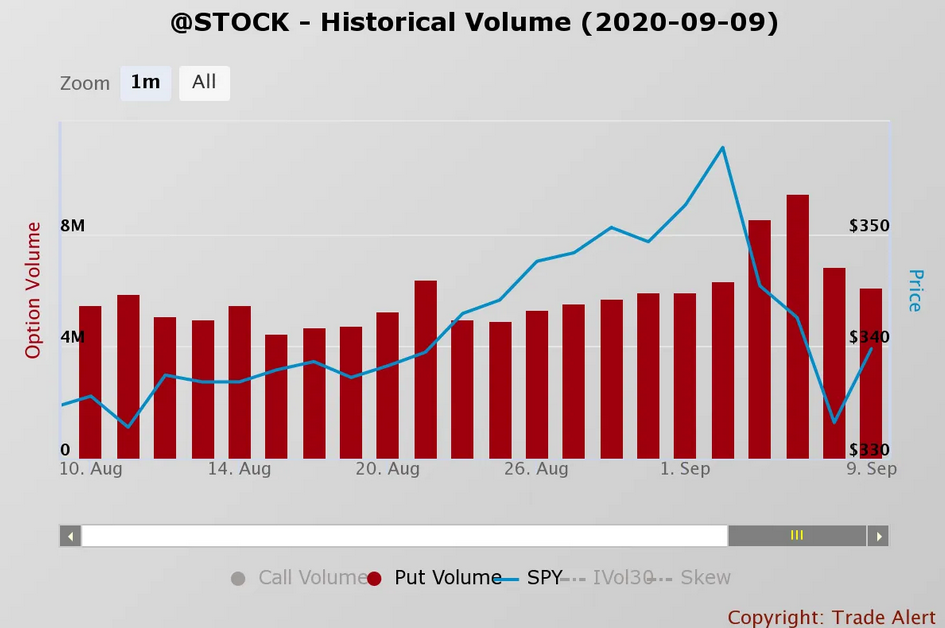

Meanwhile, put volume fell some today but remains elevated compared to prior weeks.

Tesla

Tesla (NASDAQ:TSLA) had an intense day rising by 10%, and managed to climb right back to resistance around $370. That’s the significant level if it can’t get above that level today, then yesterday is for not, with a drop back to $330 on the way.

Starbucks

Starbucks (NASDAQ:SBUX) has a descending triangle pattern to it, and a big gap to fill around $78.50.

Roku

Roku (NASDAQ:ROKU) had a lovely day, but I don’t think it sticks, probably falls back to $150.