A wild week for stocks as the tech dump lasted more than a day.

We’ve stabilized but charts are showing more downside to come for the NASDAQ in particular.

The metals did poorly and continued to slide lower with the sole exception of palladium, who continue to beast higher.

All in all, it seems a great time to take a little trip and get away from the action in order to avoid getting chopped up overtrading.

Waiting for high probability setups is key rather than trying to catch the proverbial falling knife.

I much rather have all my cash ready to deploy when easy money is sitting there rather than get chopped up cash-wise, which always does a number on my mental game as well.

Be a winner, have patience.

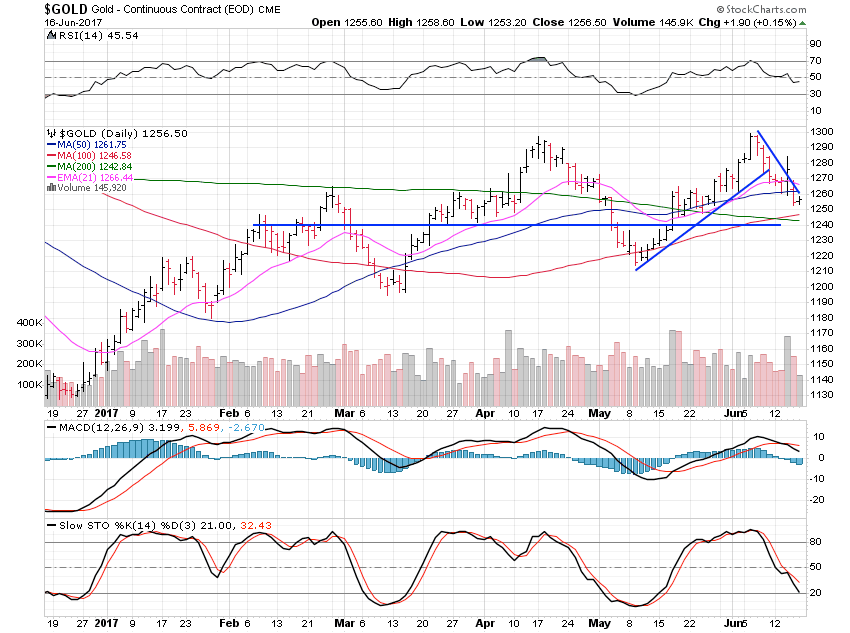

Gold lost just 1.17% but is clearly in a downtrend now until the downtrend line is broken.

I’m looking at $1,240 as the area where we should see a turn but time will tell.

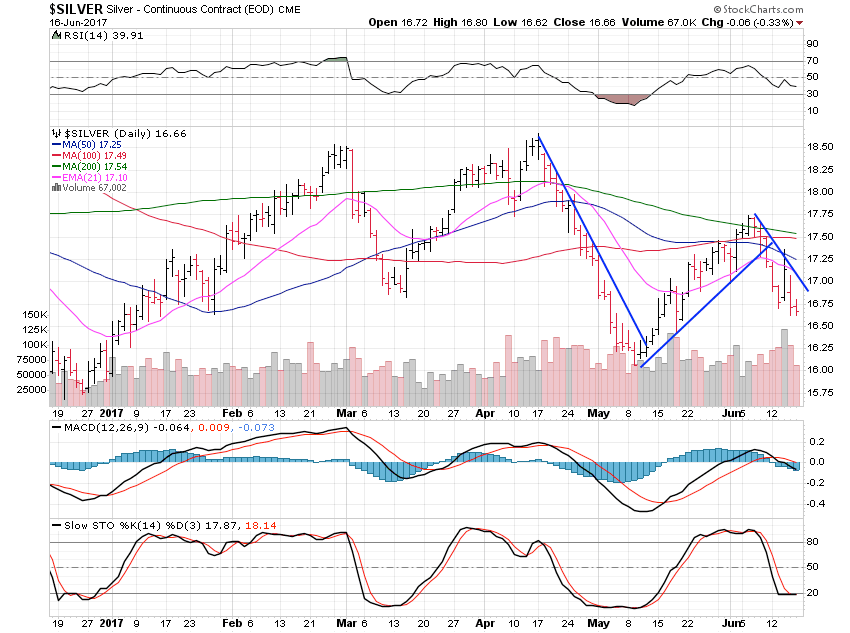

Silver slid 3.26% and is also firmly entrenched in a downtrend.

Let’s see where we end up making the turn and breaking the solid downtrend line in the next week or two.

Not great action at all but if we see a higher low shortly it would be a good sign.

Platinum dropped 1.44% and looks set for at least another $20 on the downside.

Below this $930 pivot area says weakness while above would indicate strength.

Not at all great action but it is what it is and it may be mini vacation time to stay whole.

Trust me, it’s much cheaper to go have some fun than get chopped up in markets.

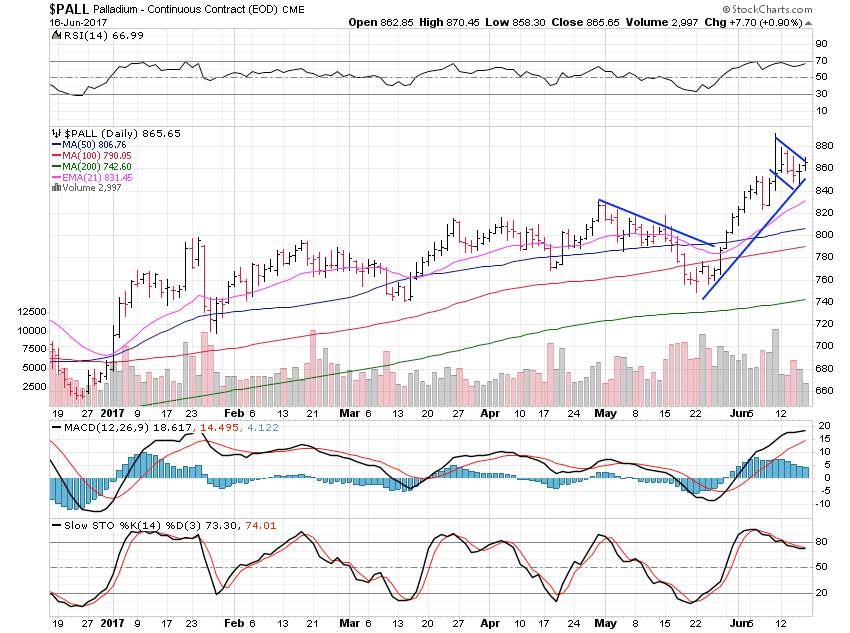

Palladium once again was a winner and gained 1.10%

As long as the uptrend line stays intact, palladium will move higher.

This little bull flag indicates another pop higher very soon.

All-time highs at $913 is very close so it only makes sense to expect a nice long rest after we likely break above, then move back below $913.

So, caution is warranted in this market everywhere and a little vacation is always nice to refresh the mind and body while we wait for better setups to form.