Nordstrom Inc (NYSE:JWN) (ticker: JWN) is a luxury retail chain that also offers off-price Nordstrom Rack locations.

The company is in a bit of a rough patch at the moment, and Nordstrom stock has dropped like a rock in recent months:

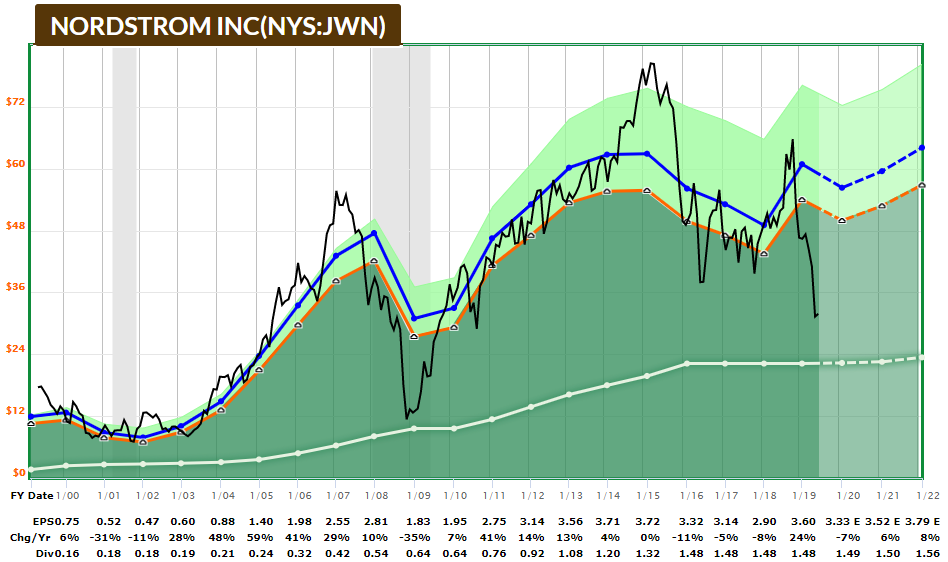

Chart Source: F.A.S.T Graphs

The Bad News:

On the surface, Nordstrom sounds like a lot of other brick-and-mortar retailers these days.

The company is in the midst of closing under-performing stores, its stock price is currently the same as it was in 2005 (ouch!), and its dividend payout has been flat since 2016.

The principle issue is that although sales are strong, the company has had declining profit margins. Over the past five years alone, the company’s gross margin decreased from over 38% to under 36%, and their operating margin literally halved from 10.8% to just 4.8%. This doesn’t bode well at all.

The Nordstrom family offered to buy the company and take it private in early 2018 at a price of $50/share. The board rejected this offer for being way too low, since the public stock price was already in the high $40’s at the time and there wasn’t much of a premium offered.

By late 2018, the stock price was happily up to $66/share. In the mere 8 month since then, the stock price is down to under $32/share.

Nordstrom reported very poor results in May for the first quarter of 2019, which has been responsible for much of this recent sell-off. Almost all reported items were bad; sales slumped and margins on those sales declined. If there was one silver lining, it was that online sales for the company increased by 7% for the quarter.

The Good News

Unlike many retailers that have been struggling, shrinking, and liquidating, Nordstrom has been able to grow its revenue over the past decade, which shows the resilience of the brand in a very competitive environment. Over the past five years, they have increased revenue from $12.5 billion to $15.7 billion.

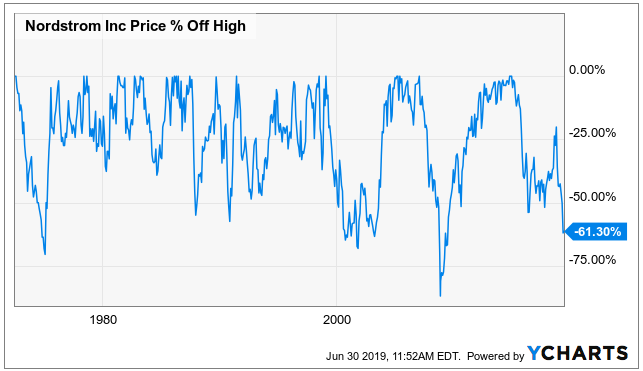

Nordstrom has been around for well over a century, and has historically been somewhat of a blue chip stock. The company has often had big draw downs of 50% per more, and those were historically strong buying opportunities.

Nordstrom is already 61% off of its high point, which is the biggest drop since the global financial crisis and its fourth largest stock price drop in history.

At this price, the P/E is below 10 and the dividend yield is over 4.6%, which may present somewhat of a floor to the stock as long as company fundamentals don’t deteriorate further. While the company could turn into a value trap, history suggests that Nordstrom is usually a buy at these levels.

The company’s balance sheet is solid with BBB+ credit ratings and a debt/income ratio of about 4x. They are making use of leverage but not to excess.

Going forward, Nordstrom earns almost a third of its sales from online channels, and this will likely keep growing. The fact that the company is closing stores can help its margins, and it makes sense for the company to focus on profitable locations and online penetration.

For investors that want decent yields, high-dividend stocks like Nordstrom along with some safe closed-end funds can offer much higher yields than the S&P 500, or treasury bonds, without taking on too much risk. The key is to stay diversified and watch payout ratios closely. Right now, Nordstrom only pays out about half of its earnings as dividends, so unless earnings take a dive, the dividend appears safe for now.

I’ve been ignoring the retail space for a while, but at this new low price, I’m interested. People are happy to buy clothes and shoes when they go on sale, but rarely want to buy stocks on sale.

Final Thoughts

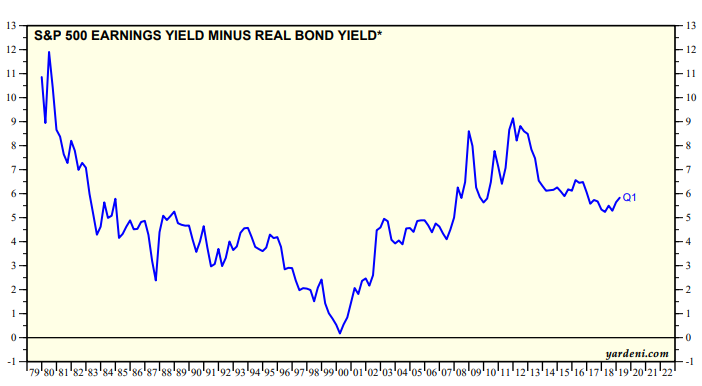

The equity risk premium in the United States continues to be substantial, meaning that average S&P 500 earnings yields are considerably above real bond yields.

In other words, although we are likely late in the market cycle, there is a solid case to buy stocks rather than to only own bonds when looking at the two asset classes from long-term point of view.

Chart Source: Yardeni Research

By many metrics, stocks are expensive. Stock market capitalization as a percentage of GDP, CAPE ratio, dividend yield, all point to stock market overvaluation. Many areas of the market are likely overvalued, including many software companies and hot IPOs.

A large portion of high-quality dividend stocks, however, still represent a good alternative to government bonds that yield next to nothing, and are relatively cheap when that comparison is made. For this reason, I continue to be 70% in equities despite the fact that I’m cautious about many of their prices.

Companies with solid fundamentals, strong dividend yields, and resilient balance sheets still make sense as investments these days. If Nordstrom can turn its recent slump around for a better quarter or two, its stock could pop in price.

While I wouldn’t make Nordstrom a large core position in a portfolio, I consider it a buy as a small position at these prices. Retail has always been volatile, but Nordstrom is one of the stronger players in the space, and now that the stock is in the low $30’s, the valuation is compelling.