- US employment data in focus today, most signs point to a solid report

- ECB raises rates and strikes hawkish tone, but euro trades lower

- Cable hits one-year high, gold near new record, Apple (NASDAQ:AAPL) beats earnings

NFP seems solid, can USD capitalize?

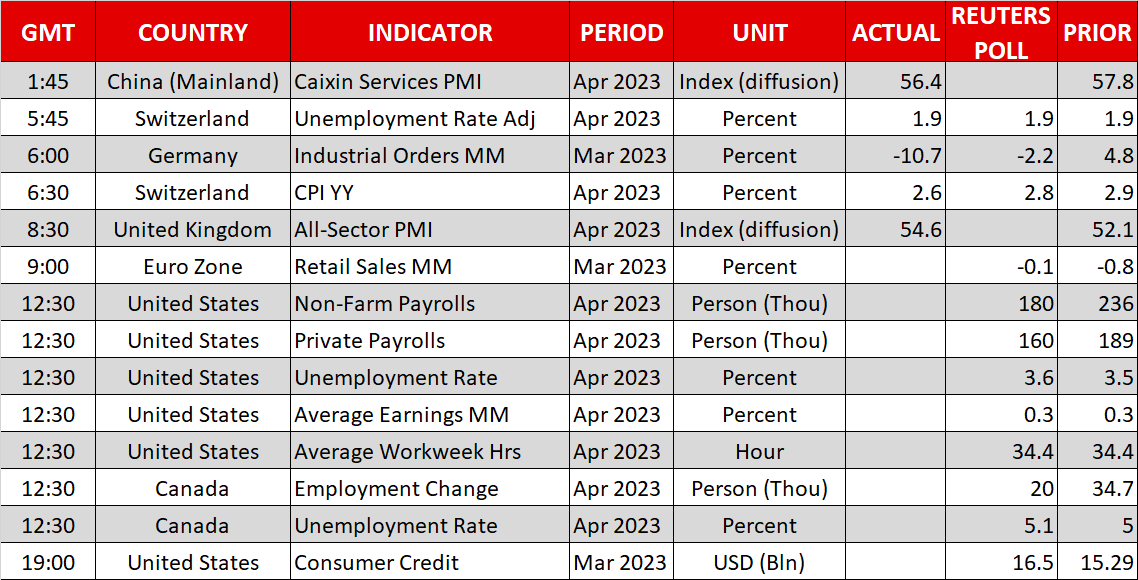

A tempestuous week for global markets will come to a crescendo today with the latest round of US employment data. Another solid report is anticipated, with nonfarm payrolls expected to clock in at 180k in April, less than the 236k in March but still a healthy number overall. The unemployment rate is seen ticking up, albeit from historically low levels, while wage growth is projected to hold steady.

By most indications, the US labor market remains exceptionally tight. Business surveys by S&P Global pointed to an acceleration in employment growth and the ADP employment report added validity to this notion. However, applications for unemployment benefits spiked higher from last month, which suggests that layoffs are on the rise, countering some of the optimism from other indicators.

With the markets now pricing in almost even chances for the Fed to cut rates in July, the stakes are high. While this gloomy pricing is likely a reflection of the renewed turbulence in the banking system, it still implies that investors anticipate a deterioration in the economic data pulse that gives the Fed cover to slash rates, sooner rather than later.

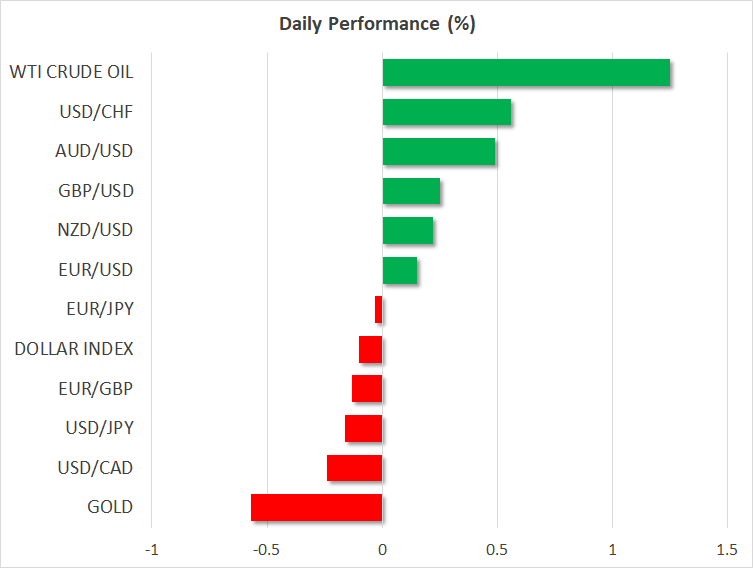

As for the dollar, its reaction function in recent months has been asymmetric, unable to benefit much from strong US releases but losing ground on any negative data. It will be interesting to see whether this dynamic is still in play and whether the jobs report can help euro/dollar break out of its recent trading range between 1.0940 and 1.1095.

Euro slides on ECB decision

It was a rocky session for the euro on Thursday. The single currency came under pressure after the ECB rolled out a 25bps rate increase, disappointing those betting on a bigger move. Traders saw that as a hint the ECB is near the end of its tightening cycle, and proceeded to recalibrate the terminal rate lower.

A relatively hawkish tone by President Lagarde and a surprise announcement that the reinvestments under the APP program will come to a halt by July didn’t do much to turn the tide in the euro, although the currency managed to recover some ground early on Friday.

In the grand scheme of things, the euro is one of the best-performing currencies this year as most of the negative forces that haunted it last year have faded. Europe got through the winter without suffering a recession, energy prices have fallen sharply, China’s reopening has helped boost demand for European exports, and rate differentials have compressed to the euro’s benefit as the ECB hit the gas on rate increases.

Still, a break above the 1.1095 region in euro/dollar is required to signal a trend continuation.

Cable, gold, and Apple earnings

Under the radar, it is the British pound that’s performed the best so far this year, with the Swiss franc being a close second. It’s difficult to pin this outperformance on domestic UK developments, as the BoE has been reluctant to raise rates despite double-digit inflation. Instead, sterling seems to have benefited mostly from the rally in equity markets and the dollar’s softness.

Gold came within touching distance of new record highs this week, boosted by safe-haven demand as fears around the regional US banking system flared up again, hammering Treasury yields down. Meanwhile, central banks spearheaded by China continued to raise their gold reserves in the first quarter, most likely as a diversification strategy against geopolitical tensions.

Finally, Apple reported earnings that exceeded analyst forecasts overnight, propelling its share price higher by 2% in after-hours trading. Lost in the excitement was the fact that revenue declined from last year while earnings were flat, making it difficult to justify the stock’s premium valuation at 28 times forward earnings.