Investing.com’s stocks of the week

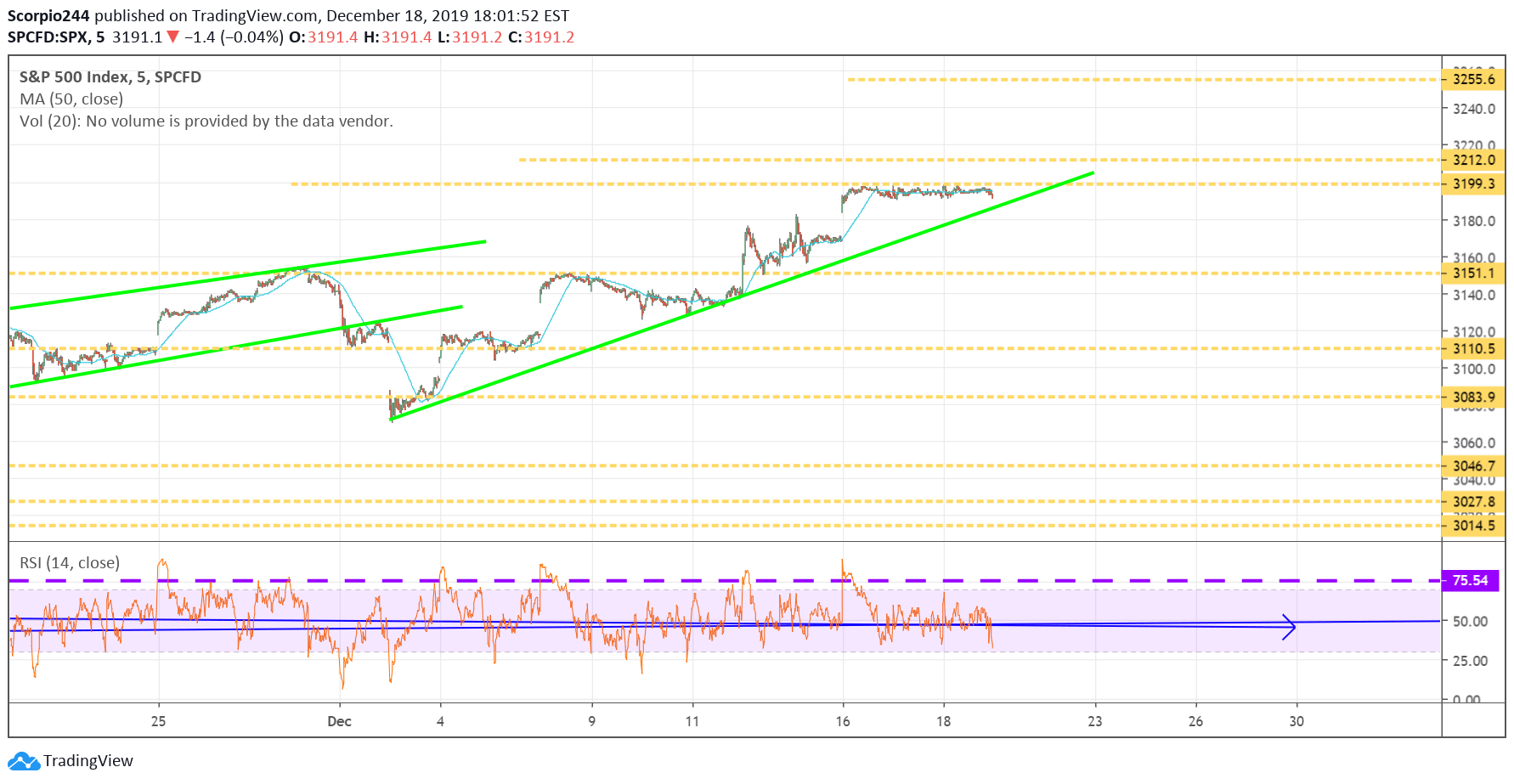

S&P 500 (SPY)

It was a dull day on the surface yesterday, but there was plenty of underlying action. The S&P 500 finished flat at 3,192

The pattern this week is nearly identical to the one last week. With the S&P 500 gapping higher on December 6, followed by sideways trading until December 12, of course, there was a weekend in between. This time we gapped higher on December 16 and based on the chart either late tomorrow or Friday should be a move higher.

Either way, it may not matter. We will run into the uptrend at some point, and then something will give. Right now, the path of least resistance continues to be higher.

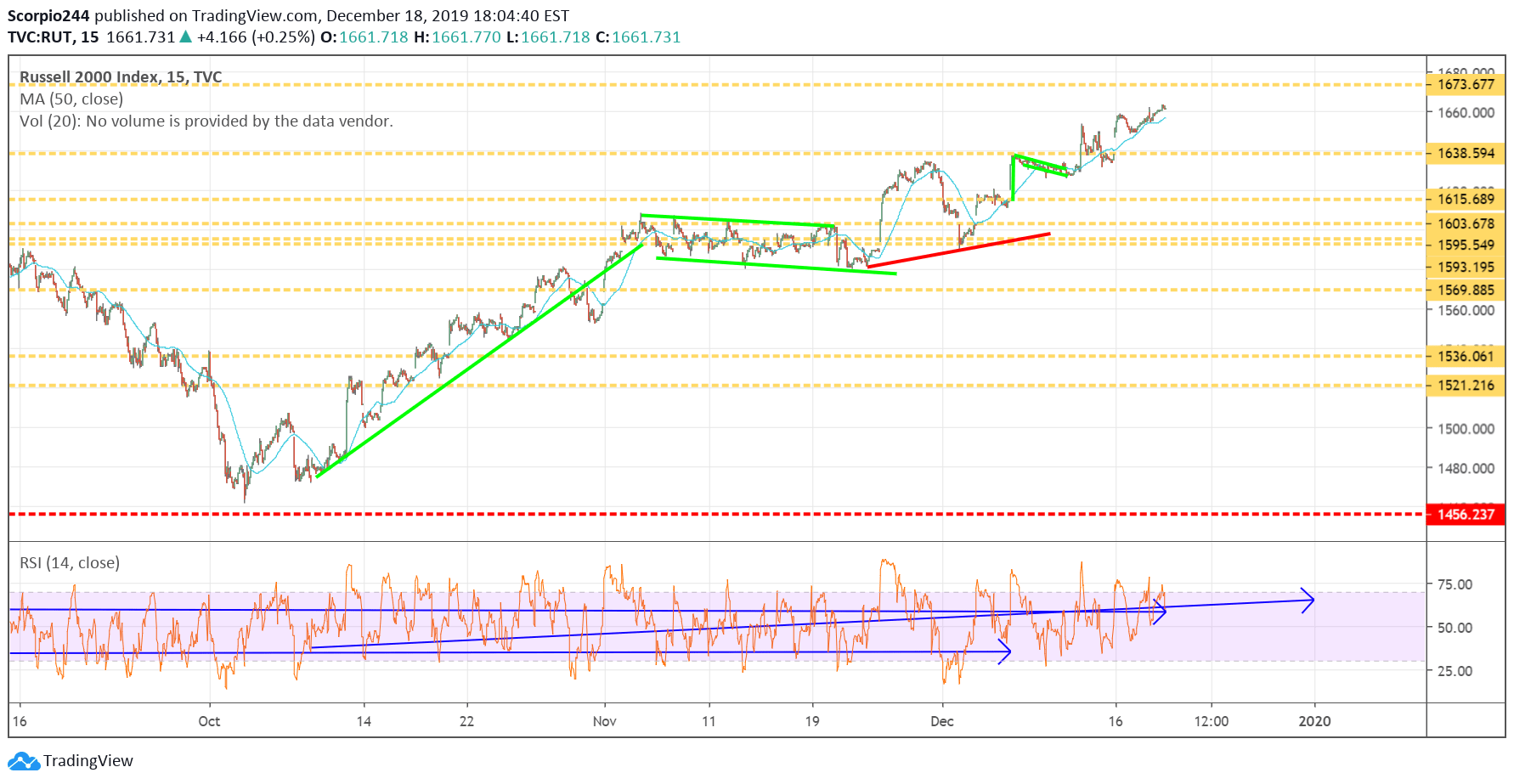

Russell (IWM)

The Russell had a better day and it seems to still be on path to 1,673.

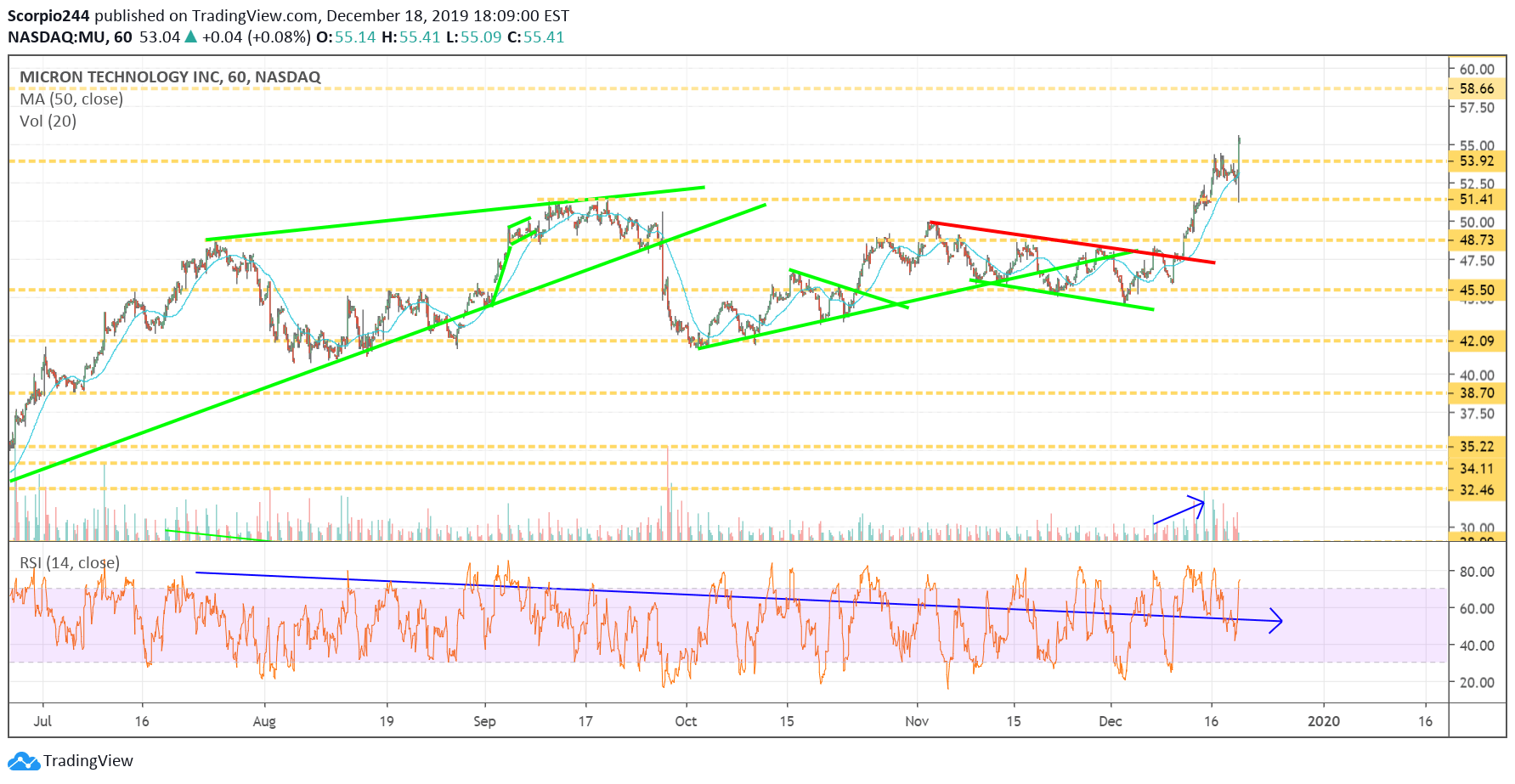

Micron (MU)

Micron (NASDAQ:MU) is rising after reporting results, with guidance that looked ok. Regardless, the stock is rising after hours, and the option traders did it again. The stock is rising above my initial target of $55.20, and now it could be on to my second target of roughly $58.

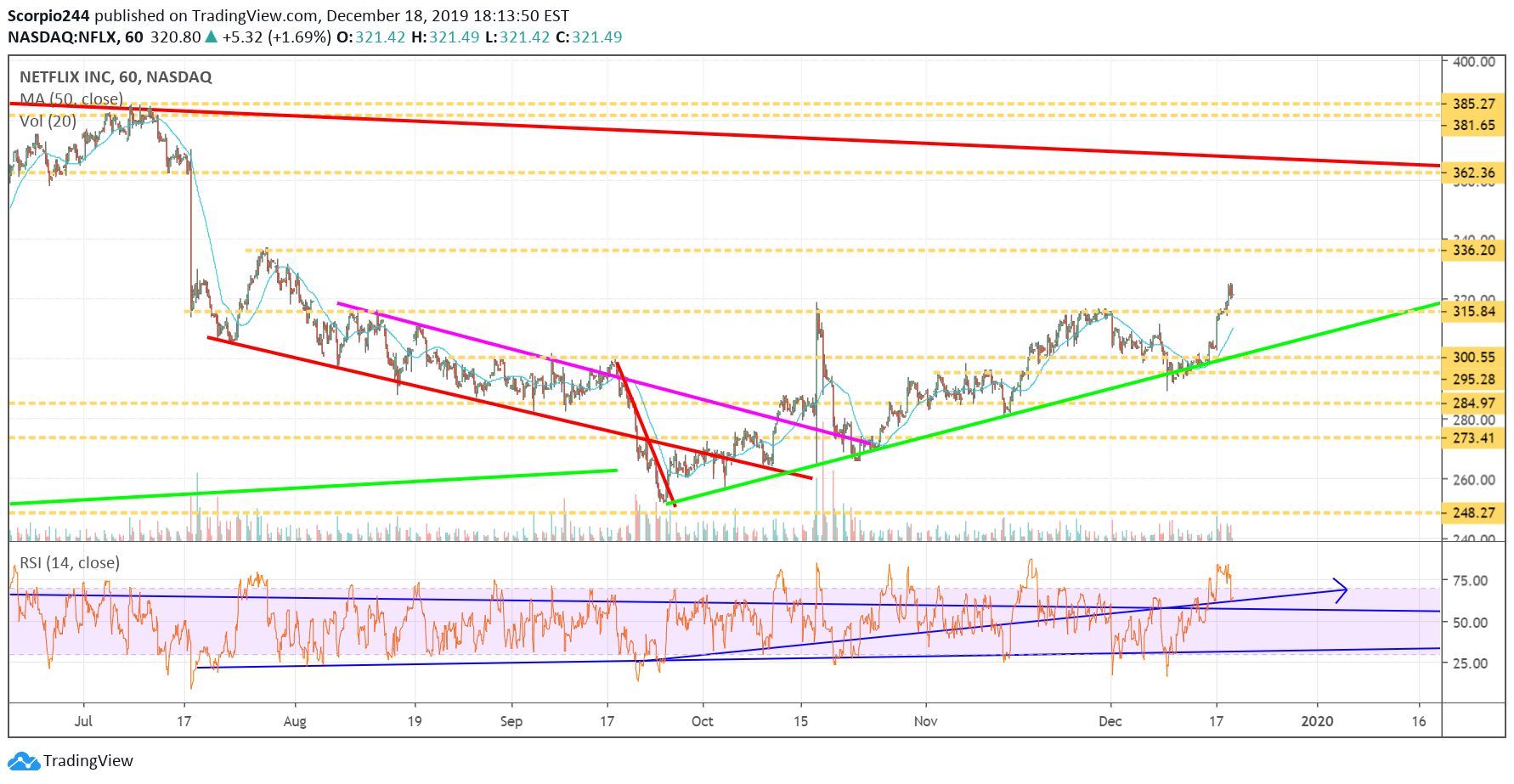

Netflix (NFLX)

Netflix (NASDAQ:NFLX) had a good yesterday day too. It seems competition isn’t hurting them too much.

$315 will now become support, with the next level of resistance likely coming around $335.

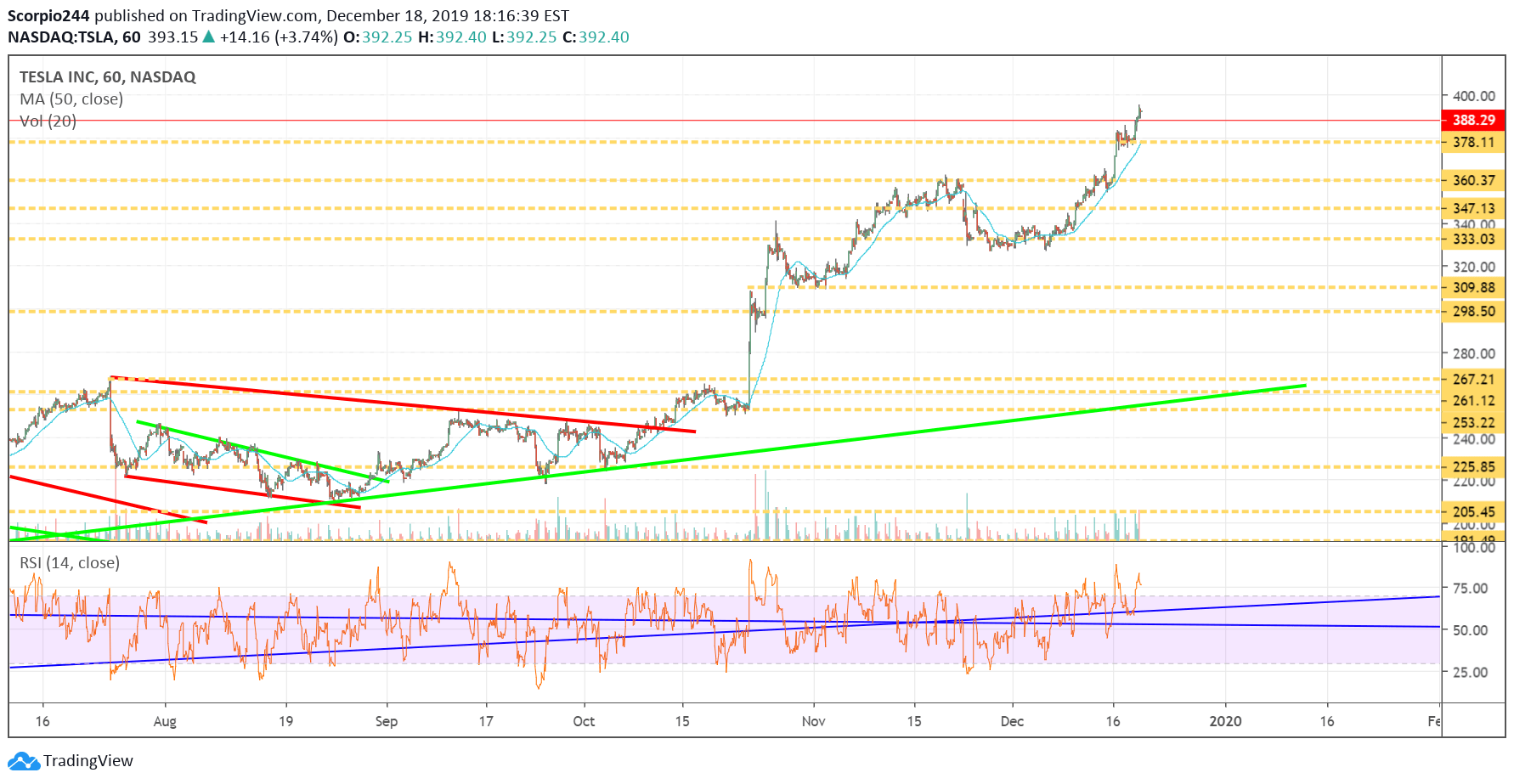

Tesla (TSLA)

Six months ago, the bears had everyone convinced nobody wanted a Tesla (NASDAQ:TSLA). Yesterday the stock hit an all-time high. I still think this one is going higher too.

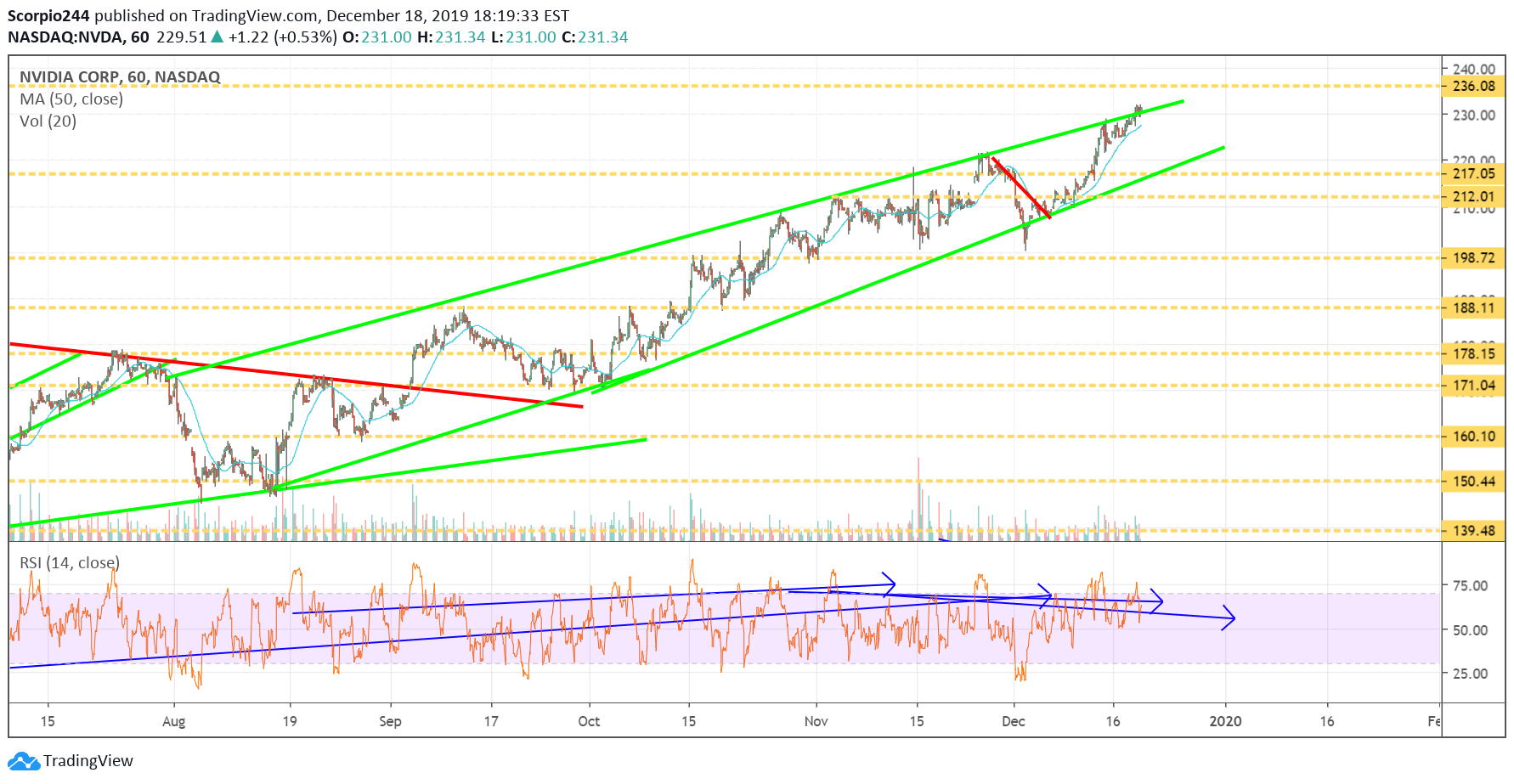

NVIDIA (NVDA)

I guess NVIDIA (NASDAQ:NVDA) is just going to keep trending higher to $236. I was wrong, thinking it would fall to $198.

Facebook (FB)

Of course, only I can write a story saying Facebook’s stock is going to fall, and then it goes up. I hate it when that happens. But there is still a chance I can be proven right. The stock failed today at resistance at $203. As long as it stays below $203, I have a chance.