- Knowing when the U.S. economy is heading for recession is paramount to successful investment decisions.

- Our weekly Business Cycle Index would have provided early reliable warnings for the past seven recessions.

- The BCI at 249.0 is above last week's level and no recession is signaled.

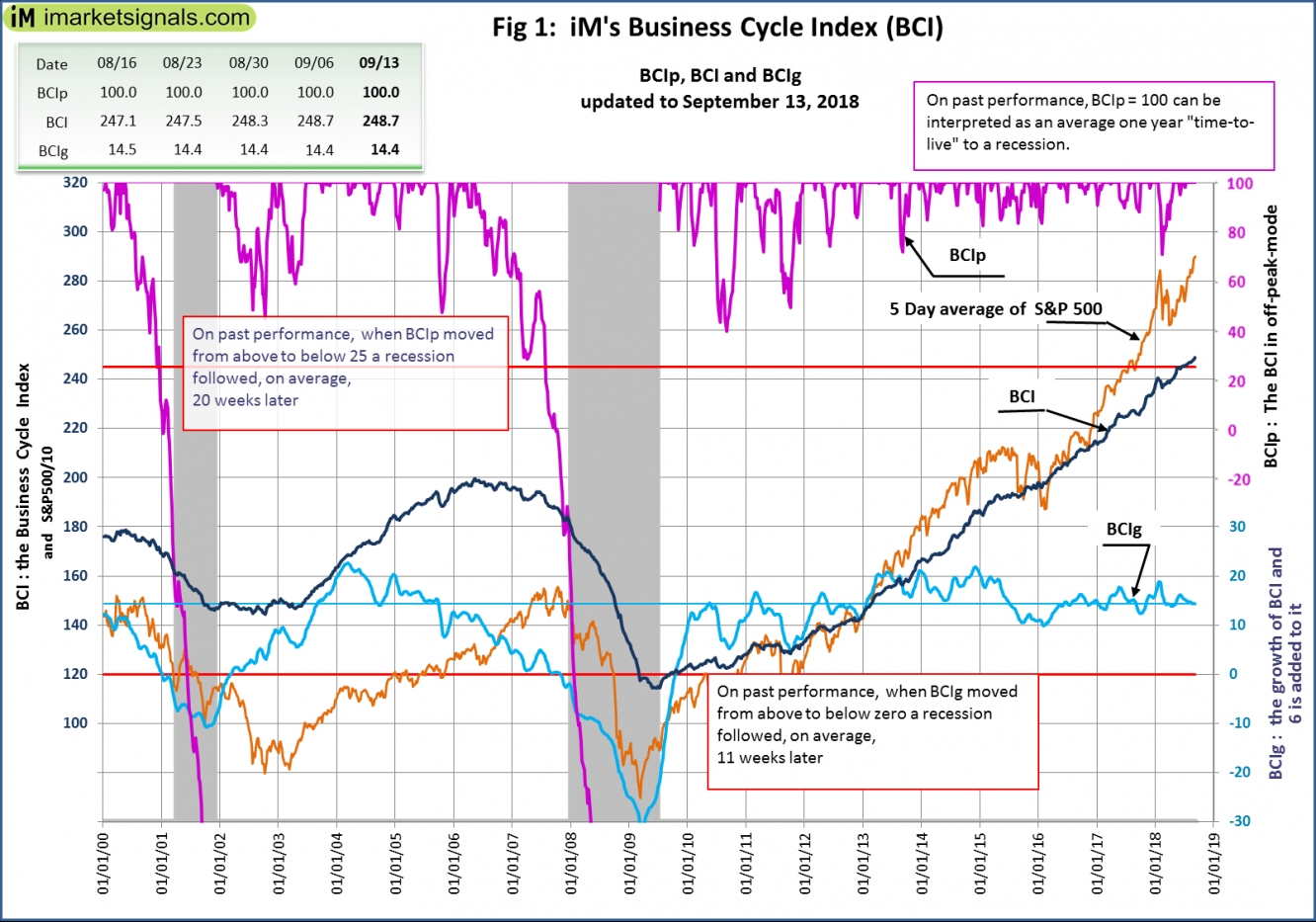

The BCI at 249.0 is above last week's downward revised level of 248.7, and formed a new high for this business cycle indicated by the BCIp of 100. However, the 6-month smoothed annualized growth BCIg remained at 14.4 for the third consecutive week. Both BCIp and BCIg do not signaling a recession. (BCIp needs to drop below 25, or BCIg needs to drop to below zero).

Figure 1 plots BCIp, BCI, BCIg and the S&P 500 together with the thresholds (red lines) that need to be crossed to be able to call a recession.

The BCI was designed for a timely signal before the beginning of a recession and could be used as a sell signal for ETFs that track the markets, like SPY (NYSE:SPY), IWV, VTI, etc., and switch into Treasury bond ETFs, like IEF, TIP, BND, etc. (see our article).

The BCI uses the below-listed economic data and combines the components for the index in "real time," i.e., the data is only incorporated into the index at its publication date:

1. 10-year Treasury yield (daily)

2. Three-month Treasury bill yield (daily)

3. S&P 500 (daily)

4. Continued Claims Seasonally Adjusted (weekly)

5. All Employees: Total Private Industries (monthly)

6. New houses for sale (monthly)

7. New houses sold (monthly)

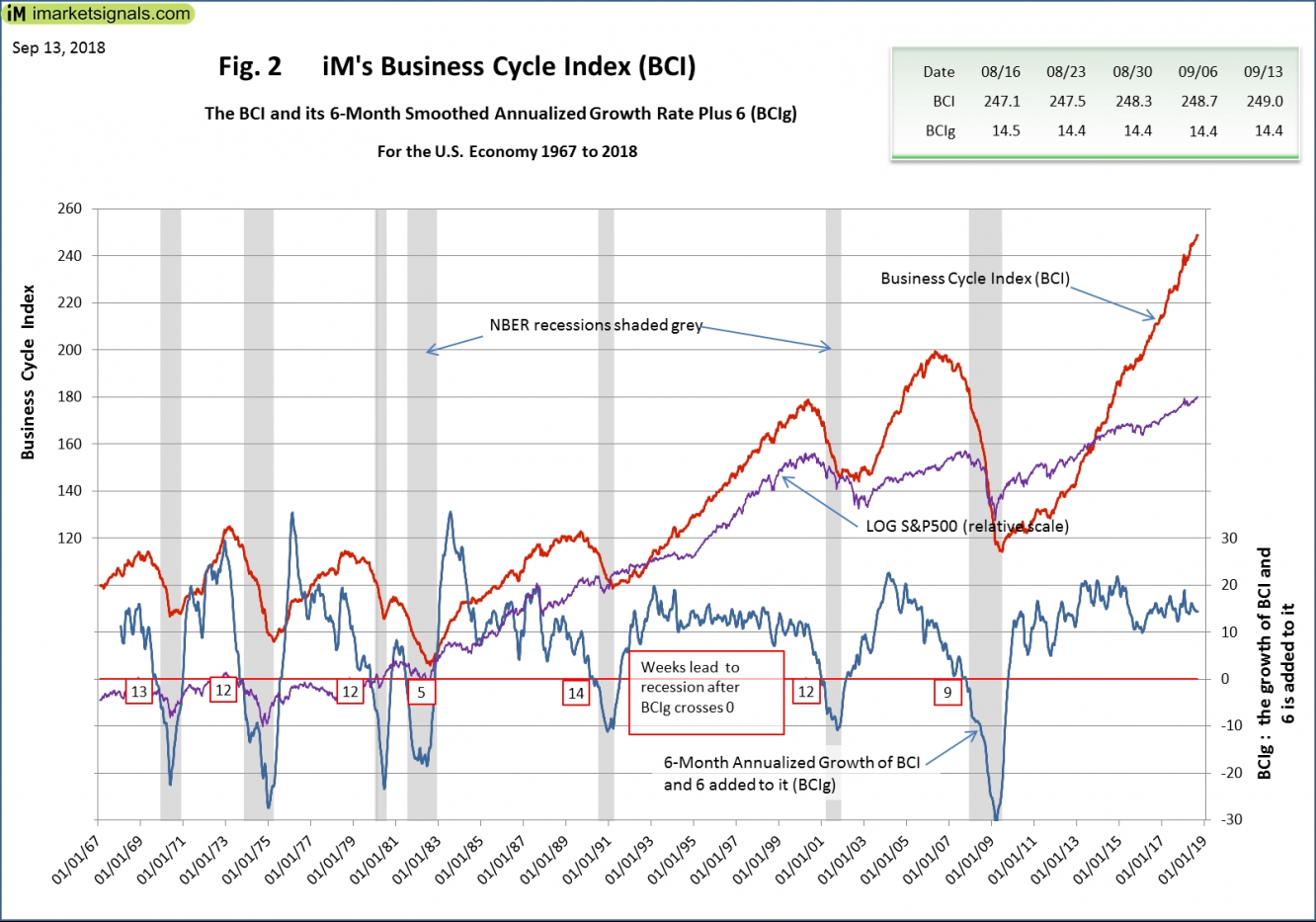

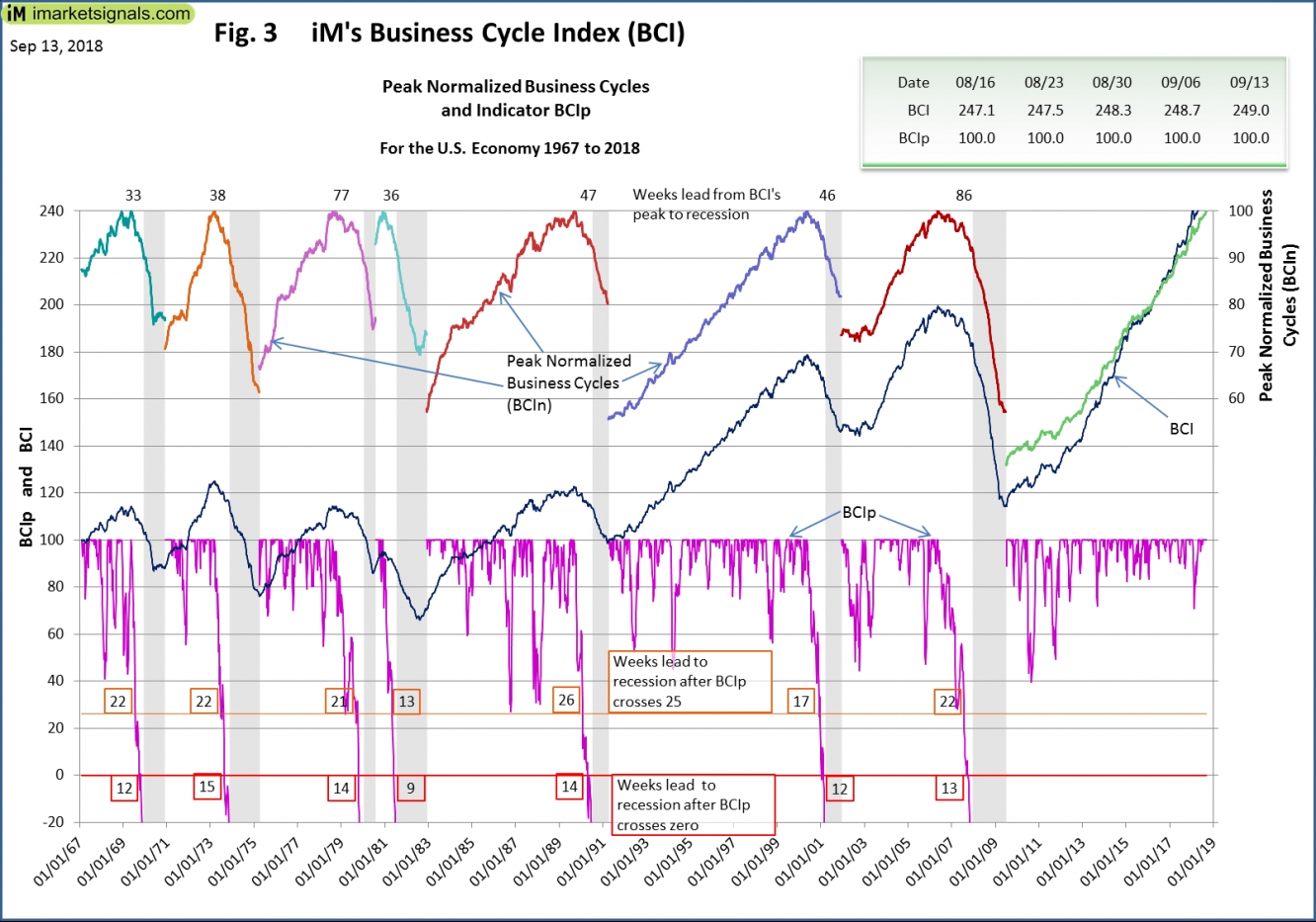

The six-month smoothed annualized growth rate of the series is a well-established method to extract an indicator from the series. We use this method to obtain BCIg, i.e., the calculated growth rate with 6.0 added to it, which generates, on past performance, an average 11-week leading recession signal when BCIg falls below zero. Further, the index BCI retreats from its cyclical peak prior to a recession in a well-defined manner, allowing the extraction of the alternate indicator, BCIp (and its variant, BCIw), from which, on average, the 20-week leading recession signal is generated when BCIp falls below 25.

A more detailed explanation/description can be found here. Also, the historical values can be downloaded from iMarketSignals as an MS Excel sheet.

Figure 2 plots the history of BCI, BCIg and the LOG (S&P 500) since July 1967, and Figure 3 plots the history of BCIp, i.e., 46 years of history, which includes seven recessions, each of which the BCIg and BCIp managed to indicate timely; the weeks leading to a recession are indicated on the plots.