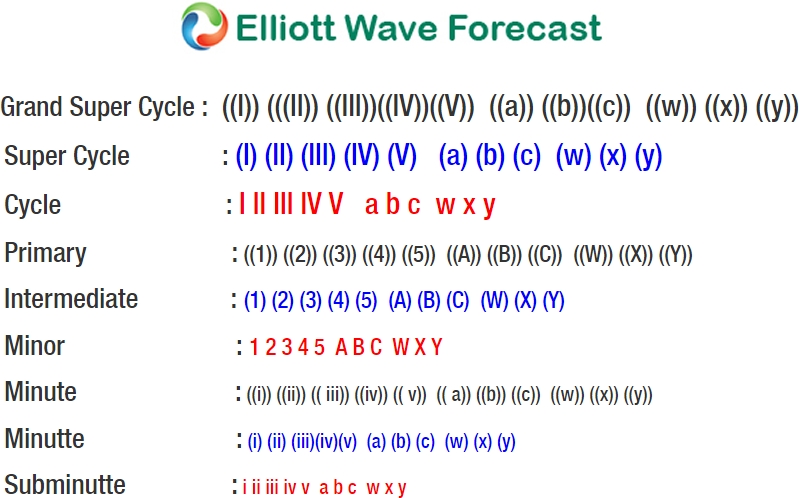

Nikkei short-term Elliott Wave view suggests that the index is correcting the cycle from 3/23/2018 low (20190) in 3, 7 or 11 swings. Rally to 23005 high ended Minor wave X of a possible double correction lower. Down from there, Minor wave Y remains in progress with lesser degree cycle showing another double correction structure.

Below from 23005 high, the decline to 22270 low ended Minute wave ((w)) as Elliott Wave Zigzag structure. The internals of that decline ended Minutte wave (a) at 22585 low, Minutte wave (b) ended at 22710 high and Minutte wave (c) of ((w)) ended at 22105. Up from there, Minute wave ((x)) ended as double three at 22769 high. The internals of that bounce ended Minutte degree wave (w) at 22585. Minutte degree wave (x) ended at 22390 low and Minutte wave (y) of ((x)) ended at 22769 high. Down from there, Minute wave ((y)) is taking place with another double correction lower. The internals of that decline ended Minutte wave (w) at 22025 low and bounce to 22405 high ended Minutte wave (x).

Near-term, while rally stays below 22405 high, and more importantly the pivot at 22769 high stays intact, index is expected to turn lower 1 more time within Minutte wave (y) of ((y)) of Y lower approximately towards 21537 – 21811, which is the 100%-123.6% Fibonacci extension area of Minute wave ((w))-((x)). Afterwards, expect Index to resume higher or or bounce in 3 waves at least. We don’t like selling it and expect buyers to appear in 21537 – 21811 area above.

Nikkei Elliott Wave 1 Hour Chart