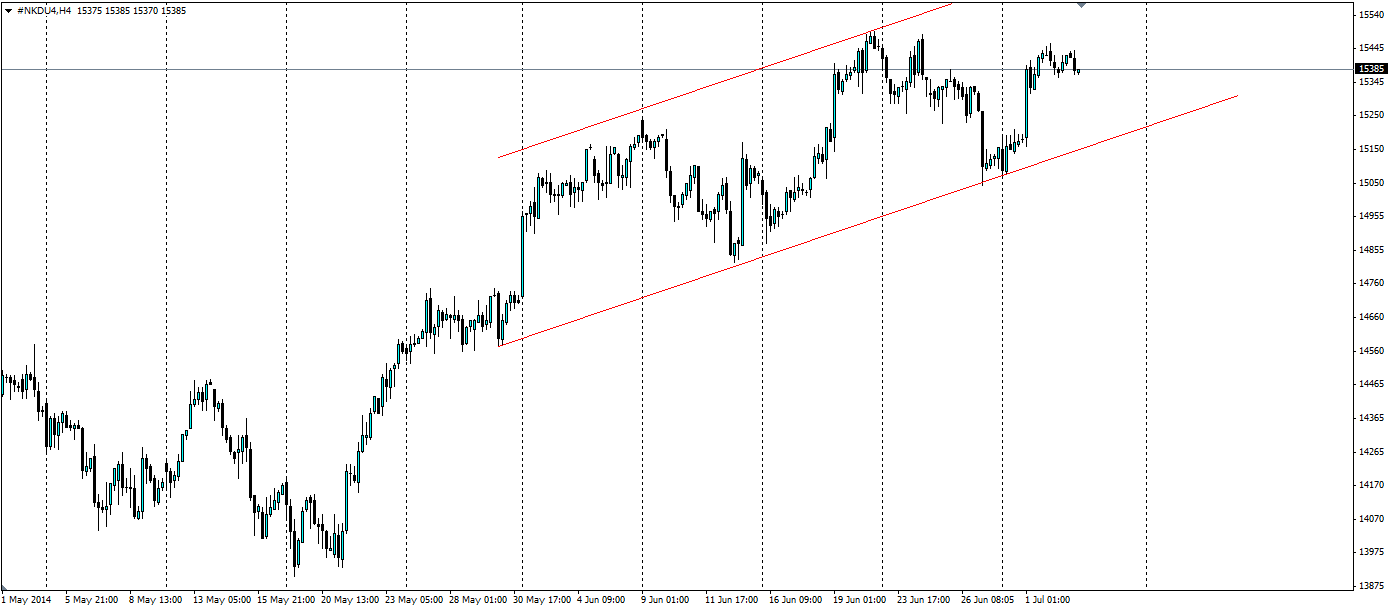

The Nikkei 225 index is following a decent channel upwards on the H4 chart. The current uptrend has formed a head and shoulders pattern that could signal a reversal.

The current situation in Japan is one of improving inflation, and optimism that the policies of Abenomics may be working their magic. The latest inflation figures put CPI at 3.7% year on year, well above the Bank of Japan’s 2% target. This could be the movement away from deflation that the stimulus policies were designed to achieve, but time will tell.

The optimism has spilled into equity markets and the Nikkei 225 index is knocking on the door of year to date highs. It has been following a nice channel for the past month and we can see the lower level has been tested on a couple of occasions.

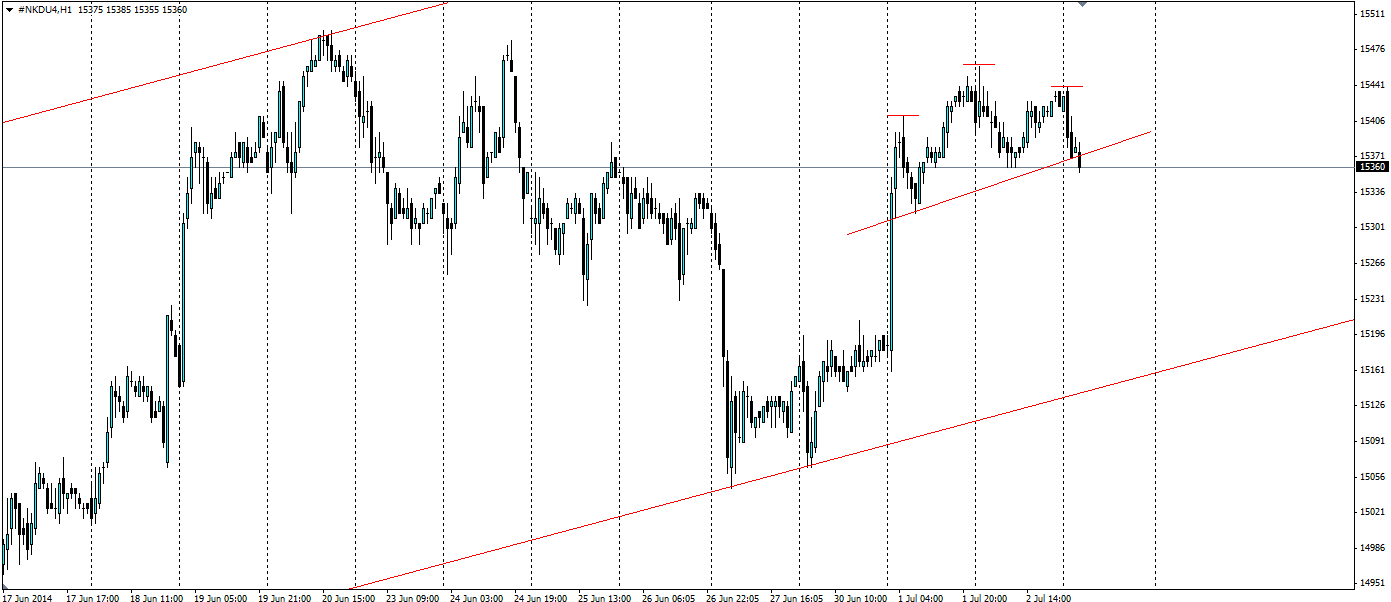

The index has found a bit of resistance on the current upward movement and a head and shoulders pattern looks to have formed. This signals a reversal back down to the trend line where it is likely to bounce off again.

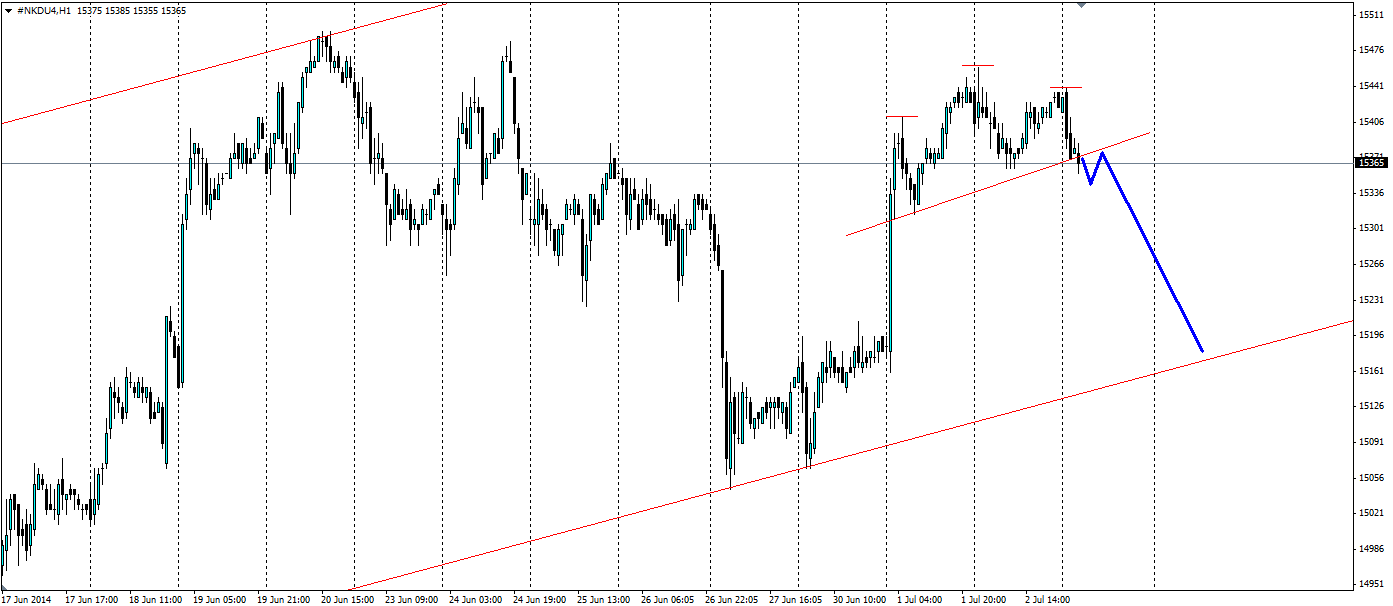

The price has just broken through the neck line of the current set up, the head and shoulders pattern is confirmed, which signals the bearish reversal. To take advantage of this we could look for a pull back to the neckline, where a short entry position can be placed before the price bounces back down to the bullish trend line. The blue line indicates the likely pattern the price will follow now that it has broken the resistance.

An obvious target for this short term play is the bullish trend line at the bottom of the channel. Be wary of support levels at 15283 and 15228 as the price moves down. Ensure a stop loss is set back above the neckline to ensure losses are mitigated in case the price breaks over it.

The Nikkei has formed a head and shoulders pattern that signals a short term reversal back down to the bottom of the bullish channel.