Nikkei 225 DAILY

The index is currently testing some major resistance levels - two-year falling trendline, descending triangle resistance and rising wedge upper boundary.

I expect a bounce lower and a possible move towards the triangle's support around 15,000.

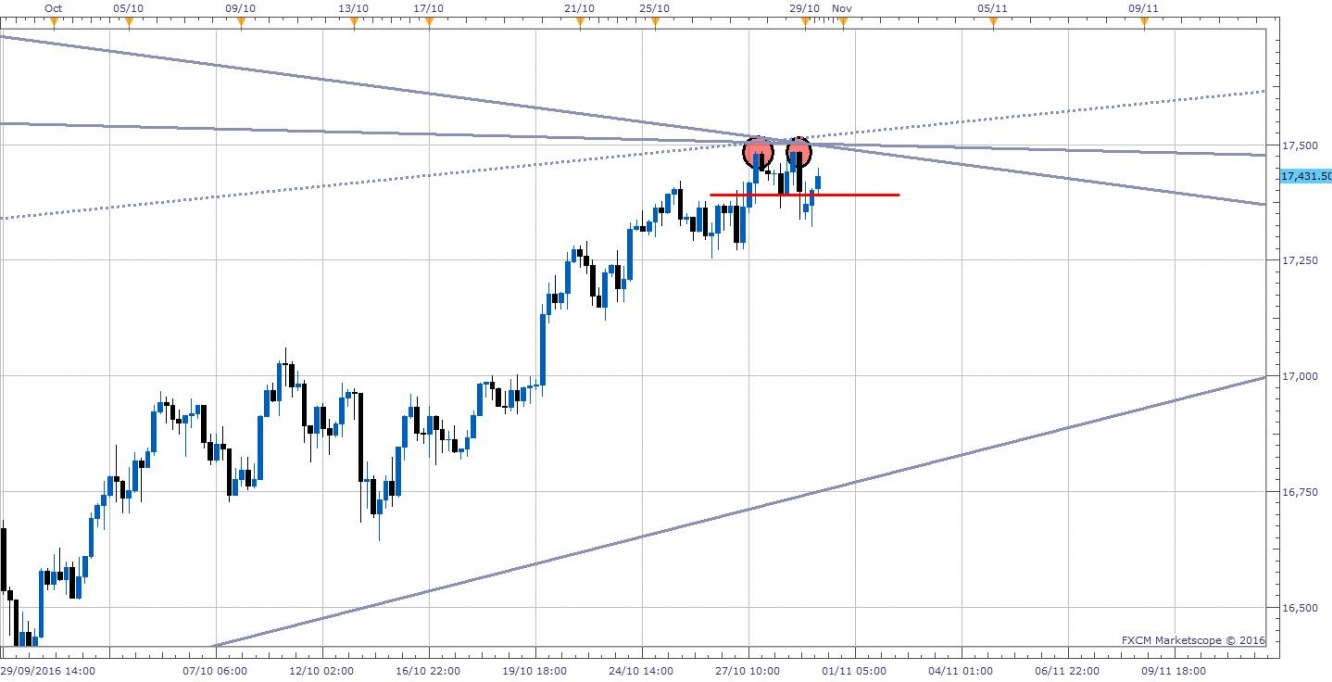

NIKKEI 225 H4

On the 4H chart, the price had formed a double top formation right at the 3-resistance lines confluence point before the the week opened with a large breakaway gap below the neckline at 17,390.

At the moment, it has already filled the gap but today's closing price is the most important as it needs to close back below the neckline to fully trigger the double top downside continuation.

In such case I will take a bearish stance on yen crosses. At the moment the most favorable are the AUD/JPY (has broken the monthly trendline) or GBP/JPY (bear flag/pennant formation)